April 2013, Vol. 240 No. 4

Features

EIAs Short-Term Look At Crude Oil Pipeline Infrastructure

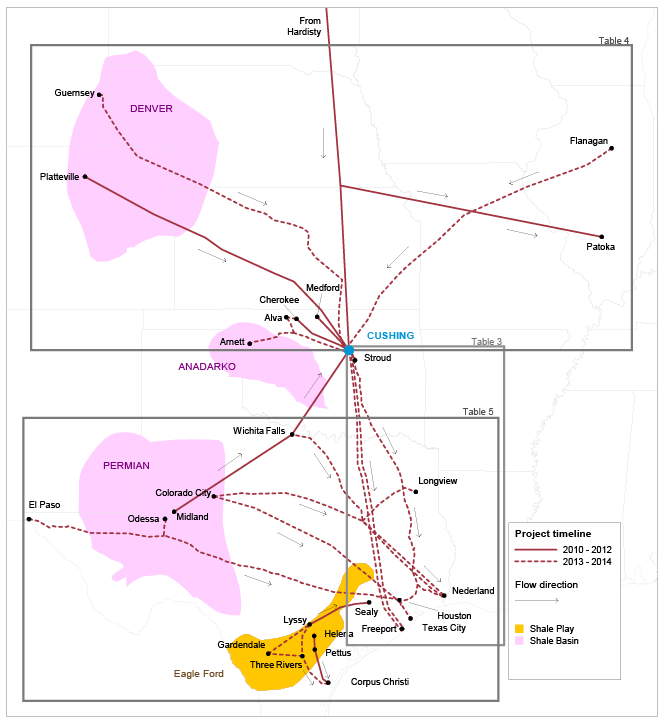

The rapid growth of production from tight oil plays in the U.S. mid?continent, as well as the development of oil sands in Canada, have dramatically changed the balance of flows at Cushing, OK, which was historically the distribution hub of imported and West Texas produced crude oil for Gulf Coast refineries.

During the last three years, pipeline capacity for delivering crude oil to Cushing increased by about 815,000 bbl/d (solid lines on Figure 5). The key development was the construction of the 590,000 bbl/d TransCanada Keystone pipeline that originates in Hardisty, Alberta, Canada. Phase 1 of the Keystone pipeline, which runs from Hardisty to Steele City, Nebraska, and on to Patoka, Illinois, was completed in June 2010. Phase 2 of the Keystone pipeline, which extended the pipeline from Steele City to Cushing, was completed in February 2011.

Until mid?2012, there was only one pipeline that could deliver crude oil from the Midwest to the Gulf Coast. The 96,000?bbl/d ExxonMobil Pegasus pipeline between Patoka, Illinois and Nederland, Texas originally shipped crude oil northward. The pipeline was reversed in 2006 in order to ship Canadian heavy oil to the Gulf Coast. The growing supply of crude oil into Cushing quickly exceeded the capacity of Midwest refineries to process it.

As a result, the 150,000?bbl/d Seaway pipeline carrying imported crude oil from the Gulf Coast to Cushing was reversed in May 2012. Because it takes four years or longer to plan, obtain permits, and build new interstate pipelines, major expansion of new pipeline capacity to deliver the fast?growing mid?continent crude oil production to the Gulf Coast is just now nearing completion.

The Enbridge/Enterprise Seaway Expansion brought 250,000 bb/d of new capacity into service on Jan. 11, 2013. A new pipeline with 700,000 bbl/d of capacity is expected to be completed in the fourth quarter of 2013 and an additional 450,000 bbl/d of capacity is expected to be added in 2014 (Table 3).

In anticipation of the new pipeline take?away capacity from Cushing, 1,225,000 to 1,315,000 bbl/d of new pipeline capacity to deliver crude oil into the Cushing hub is also planned (Table 4).

Crude oil production in the Permian Basin faces the same transportation constraints as Canadian imports and producers in the mid?continent. Two pipelines currently transport crude oil from the Permian Basin to Cushing: the Plains All American Basin pipeline, which was expanded from 400,000 to 450,000 bbl/d in early 2012; and the 175,000 bbl/d Oxy Centurion pipeline. A third pipeline, the Sunoco Logistics West Texas Gulf pipeline, has the capacity to transport 300,000 bbl/d from the Permian Basin to Longview, Texas, where it connects with the Mid?Valley pipeline to Samaria, Michigan.

Because the existing pipelines are nearly fully utilized and deliver crude into the over?supplied Midwest market, six pipeline projects that include pipeline reversals, expansion, and new lines would provide 355,000 bbl/d of new capacity to move crude oil from the Permian Basin to the Gulf Coast in 2013, and 478,000 bbl/d of new capacity in 2014 (Table 5).

Over the past three years, almost 815,000 bbl/d of new pipeline capacity delivering crude oil to Cushing was added. Over the same period, only 400,000 bbl/d of new pipeline take?away capacity was added. During the next two years an additional 1,190,000 bbl/d of pipeline capacity for delivering crude oil from Canada and the mid?continent to Cushing is planned, but this is balanced by 1,150,000 bbl/d of planned pipeline capacity additions to deliver crude oil from Cushing to the Gulf Coast. In addition, about 830,000 bbl/d of new pipeline capacity is planned to move crude oil from the Permian Basin to the Gulf Coast (Figure 5).

Comments