April 2013, Vol. 240 No. 4

Features

Northwest Says Gas Outlook Has Bright Horizon

A rapid influx of natural gas supply coupled with an annual predicted growth rate of .9% in regional demand has revolutionized natural gas as a key player in strengthening North America’s economy, according to Northwest Gas Association’s recent “Gas Outlook” report.

Natural gas is coined as a “fundamental economic input” in the study due to its integral role as an industrial and commercial fuel for electricity generation. Because it is a cheaper option than gasoline or diesel for vehicle fueling and a medium for water heating in homes, the report says, demand expansion will largely be contingent upon the recovery of the economy and is expected to grow 8.1% in the Pacific Northwest by 2021.

NWGA credits federal, state and provincial efforts to fully utilize the plentiful resource, through job development and energy independence advancement, as another prime influence in future demand.

Demand is split into four sectors of variability: residential, commercial, industrial, and generation.

Residential demand is slated for an annual growth rate of 1.1%, according to NWGA. This slothful rate is due to the decline in new housing construction in the Pacific Northwest paired with consumers utilizing greener appliances, weatherizing their homes and being more aware of their thermostat, the report says. Homes are changing with more environmentally-friendly technology, ultimately allowing consumers to reduce their natural gas usage.

NWGA says that commercial demand is foreseen to have an annual growth rate of 1% because the economy has not fully recuperated. The report estimates that major institutions and commercial consumers of natural gas will cut down usage and be hesitant about opening new branches.

Industrial demand is determined to have an annual growth rate of .6%, according to the study. Like commercial demand, industrial demand will rise as the economy improves. The report says that during 2013-2014 the economy is estimated to gain strength, therefore sparking an upsurge in industrial demand. NWGA attributes this future boost in demand to the industry renewing pre-recession production levels or switching to natural gas.

Generation demand is measured to have an annual growth rate of 1%, says NWGA. The report says that the Pacific Northwest is using more natural gas to generate electricity, which is estimated to continue.

The report says, “Natural gas use to generate electricity will grow over the next decade. How much, how quickly and the nature of the demand for natural gas as a generation fuel is the subject of an ongoing dialogue between regional industry stakeholders.”

Electricity generation is one of three variables that could drive or pacify demand. NWGA also lists the possibility of new industrial loads triggered by lower natural gas prices and potential fuel-switching by new industry and existing industry. The third factor that NWGA lists is the potential rise in natural gas usage as an alternative transportation fuel. All three of these variables could counteract any predictions and are not quantified, states the report.

Energy companies can play a heavy hand in demand as well by following carbon-reducing energy policy mandates, says the report. If energy companies are compliant and environmentally aware it could spur an uptick in midstream and downstream investment, such as added pipeline infrastructure and storage hubs, explains the study.

While natural gas demand waivers with the state of the economy, supply is solid. This gush of resources stems from the North America shale boom, which has fostered unprecedented production due to advancements in drilling and completion technologies. The Potential Gas Committee estimates that natural gas resources could sustain North America for over 100 years, according to the report. The study estimates that shale plays currently represent 20% of U.S. natural gas supply, and are foreseen to hit 50% by 2035.

Shale gas production has flourished, gas supply is on the rise and shale economics are progressing, says the report. NWGA points out that high oil prices are a major catalyst for drilling operations and that lease agreements tend to push for quick well development, which ultimately boosts natural gas production rates.

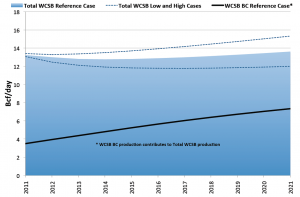

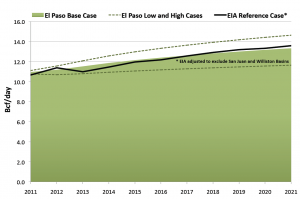

Two gas giants are right in North America’s backyard, the Western Canada Sedimentary Basin and the Rockies, together producing more than one third of the U.S. gas supply. In 2010 alone, the two regions produced an average of 27 Bcf/d of natural gas, which is expected to climb to 30 Bcf/d by 2012, says the report.

“We have seen unprecedented change in the natural gas industry over the past few years,” said Frank Morehouse, NWGA Board President. “One thing is certain: thanks to the vast shale gas reserves unlocked by breakthroughs in drilling technologies, natural gas resource available to serve our energy needs is abundant, secure and accessible across North America.”

Because of the natural gas supply surplus in North America, natural gas prices have been cut in half. According to the report, daily spot prices through 2011 were $4/MMBtu versus $9/MMBtu in 2008.

After inflation, economic recovery, and supply and demand are factored in, NWGA predicts that natural gas prices will fall between $4/MMBtu and $7/MMBtu through 2021.

The economy is benefitting from low natural gas prices. The report states, “The low price of North American natural gas is itself playing an important role in economic recovery by stimulating growth of industries that use natural gas and, because global prices are much higher, by bringing overseas manufacturing jobs back to North America.”

While natural gas prices are foreseen to stay modest in the near future, NWGA raises six factors that could incite future prices, including: a shift in funding from dry gas production to oil; additional regulations on production operations; the state of North America’s economy; the transformation of natural gas as a fuel for electricity generation and transportation; the inter-regional price effects of shifting gas production in North America; and the pros and cons of North America exporting natural gas overseas.

With the upcoming flood of supply and uptick in demand, midstream infrastructure is a prime concern. According to the report, future peak day demand could meet or surpass the Pacific Northwest’s current 48,000-mile network of transmission and distribution pipelines.

Currently, the regions’ pipeline network and peak storage facilities can support over 6.5 MMDth/d of natural gas. The report states that if the infrastructure is pushed to maximum capacity, the system could become stressed.

NWGA says that the states of Oregon and Washington will close down two coal plants in the region and replace the plant’s output with natural gas-fired generation. The reports points out that, “If these plants are built, they will represent significant gas volumes that would require capacity within the forecast period.”

Three key expansions have been proposed in the Pacific Northwest and deferred due to a decrease in estimated demand, said the report. The Sumas I-5 Expansion, proposed by Williams Northwest Pipeline, would increase transportation from Sumas, WA, to the I-5 corridor. The Blue Bridge/Palomar Expansion, proposed by Williams Northwest Pipeline, NW Natural and TransCanada GTN, would beef up capacity in the I-5 corridor by up to 750 MMcf/d. The FortisBC Kingsvale-Oliver Reinforcement Expansion, proposed by FortisBC and Spectra Energy, would expand capacity from Kingsvale to Oliver, BC, by up to 450 MMcf/d.

The report stresses that projects like these are still in their planning phases but will eventually come on stream, therefore the need for infrastructure expansion in order to efficiently handle future gas supply is inevitable. It is not about if, it is about when.

As supply and demand rise in tandem, North America will be forced to tailor to the natural gas gush, the report concludes.

During President Obama’s State of the Union speech, Feb. 12, 2013, he said, “The natural gas boom has led to cleaner power and greater energy independence. We need to encourage that. And that’s why my administration will keep cutting red tape and speeding up new oil and gas permits.”

For the full report, go to http://www.ingaa.org/Foundation/18003.aspx.

By Kate Permenter, Pipeline News Editor

Comments