February 2014, Vol. 241 No. 2

Features

The Name Of The Game Is Still Pipelines

Tonight I’d like to cover several topics important to all of us. Projections for increased production of natural gas and crude oil, transportation of said commodities to the marketplace, climate change and politics.

So let’s start with Keystone XL. Apparently the State Department’s study has come down in favor of the pipeline, that it will not oppose a serious threat to the environment. Of course, this had to come down after the president’s state of the union speech. Before his reelection I put the odds on President Obama approving Keystone at 25-1. Has anyone checked with their bookie lately? Last year the odds were 3-1 against it.

Forget the talk about all of the jobs that are supposed to be created and the concept of energy independence. That’s no more real than Keystone will cause global contamination. If Obama approves it, he loses some of his base but gains nothing from those who advocate the project other than “what took you so long?”

If he doesn’t approve it, he earns the wrath of unions, Democratic senators in those states the pipeline would run, Canada because we would literally be declaring economic war against them, and those who would build future pipelines and infrastructure, because this will only embolden the opposition to block new projects, making them a lot more expensive and time-consuming. With rail looking over our shoulder, it’s not a good feeling.

I think Obama will say yes because the positives far outweigh the negatives. If not, it won’t have anything to do with climate control but indicative of the divide between his administration and Big Oil.

The Rail Conundrum

Rail is probably the biggest threat for future pipeline construction because for the most part it’s already there and the president can’t veto it. Producers want to get their oil to the refineries as quickly and cheaply as possible. Rail infrastruture is cheaper and faster to build; rail cars can transport products in both directions and reach their destinations a lot faster. Contractual obligations are generally 1 to 4 years long, compared to 10-20 year commitments for pipelines.

Because the rail infrastructure is pretty much already in place and can go anywhere, all you really to build to transport crude are loading and unloading terminals. The biggest problem has been securing enough tanker cars; there’s a 2½ year backlog.

This obviously has been the biggest problem with the Bakken. Because of the lack of pipelines 70% of Bakken crude rides on rail. In 2012 Oneok canceled a $2 billion proposed pipeline and last month Koch killed a plan to pipe Bakken oil into Illinois and last year Kinder Morgan killed a pipeline planned from to take oil from Texas to California. Keystone was thought likely pick up some of that oil the producers aren’t going to wait 2 or 3 years until it’s even built. That’s also causing producers in Colorado and Wyoming to turn to trains. Now even the operators are investing in rail.

About 235,000 carloads of crude went by rail in 2012 to refineries, up from 9,500 in 2008. More than 10% of our crude was transported by rail last year. And now as we shift from coal to natural gas, the railroads are going to be even more aggressive going after crude oil.

The producers never gave much thought to safety issues. Since March there have been 10 large crude spills in the U.S. and Canada because of rail accidents. Last year in the U.S. 1.15 million gallons of spilled from rail, far more than the 800,000 spilled from 1975-2012. And that doesn’t include the Casselton, ND spill late last year, estimated at 400,000 gallons.

We haven’t even discussed the the Quebec explosion last July that killed 47 people and destroyed a town, raising questions about safety on both sides of the border and putting pressure on regulators to take a much closer look at this industry that literally was reborn overnight.

The trains won’t go away. There’ll be increased regulations of the rail industry, more improved tank cars built. The stakes are too high. And besides all that, the producers really like rail.

Oil Production Keeps Rising Beyond the Forecasts

The International Energy Agency now says the U.S. will surpass Russia and Saudi Arabia to become the world’s largest oil producer in 2015. However, they also say the Middle East will become the dominant source of global oil supply by 2025.

Now let’s get on to more mundane topics. Our oil production rose by a record 992,000 bpd in 2013. As someone with the International Energy Administration said last week, “We keep raising our forecasts, and we keep underestimating production.”

That exceeded the increase of 836,000 bpd in 2012, a 15% jump that is the highest annual surge for any country in over 20 years. The largest increase before that, of 751,000 barrels, was in 1951. Our production averaged 7.5 million bpd with November and in December exceeded 8 million bpd. Our consumption of oil also rose by 2% to 18.9 million bpd.

Although our production is the highest since 1989, its still far below the the 1970 record of 9.6 million bpd. They’re forecasting that American production will add 782,000 barrels, to 8.3 million bpd, the first time in 25 years its hit 8 million.

If that’s accurate, and I think it’s on the low side, our oil production will have increased 46% over the three years from 2011-2014. There hasn’t been anything like that in 90 years. By 2035, the IEA projects that North America’s need for oil imports will all but disappear.

Just to show you how important our production is, demand in China and Brazil is up more than 30% since 2007, and India is 17% higher.

The IEA also warns that regulatory constraints and lack of infrastructure could soon squeeze our production, perhaps even causing slowdowns. This is LNG exports are important as is Keystone.

Natural Gas Prices

Shale production will keep natural gas prices in North America in the range of $4-5 per through 2035, according to IHS CERA. They predict that even at market prices of $4 or less, about 900 Tcf of unconventional gas resources can be produced economically. That’s more than 30 years of U.S. consumption and a third of North America’s total recoverable resources. Natural gas prices will fluctuate in coming years but will maintain a steep discount to oil.

Gas production is forecast by the EIA to hit a fifth consecutive annual record high in 2015 while net imports of gas next year will fall to their lowest in 30 years. Natural gas production this year is expected to rise 1.5 Bcf/d or 2% from 2013’s record high level of 71.6 Bcf/d. Production next year should rise another 1.3% next year to 72.6 Bcf/d. Imports from Canada are about 7.5 Bcf/d, half of what they were just a few years ago. EIA projects imports of 3 Bcf/d this year, falling to 2.5 Bcf/d next year, the lowest level since 1986.

Would exports affect that? IHS CERA doesn’t think so and predicts we’ll become a net natural gas exporter by 2019. The study said that over 15 years, an average residence that uses natural gas for heat will save $5,731 compared to an all-electric home.

Some facts and figures looking ahead to 2040:

While domestic crude production is expected to level off and then slowly decline after 2020, natural gas production grows steadily, with a 56% increase between 2012-2040 when production reaches 37.6 Tcf.

Industrial shipments grow at a 3% annual rate over the first 10 years of the projection and then slow to 1.6% annual growth for the rest of the projection.

In 2040, natural gas accounts for 35% of total electricity generation while coal accounts for 32%. Generation from renewable fuels, unlike coal and nuclear power, is higher in 2014 than in 2013.

U.S. exports of LNG rise to 3.5 Tcf in 2029 and stay there through 2040. Pipeline exports to Mexico will grow by 6% per year, from 0.6 Tcf in 2012 to 3.1 Tcf in 2040, and exports to Canada grow by 1.2% per year, from 1 Tcf in 2012 to 1.4 Tcf in 2040. Over the same period, U.S. pipeline imports from Canada fall by 30%, from 3 Tcf in 2012 to 2.1 Tcf in 2040.

Domestic energy production increases from 79 quadrillion Btu in 2012 to 102 quadrillion Btu in 2040, net use of imported energy sources, 30% in 2005, falls from 16% of total consumption in 2012 to 4% in 2040.

Improved efficiency of energy use in the residential and transportation sectors and a shift away from carbon-intensive fuels for electricity generation keep U.S. energy-related carbon dioxide.

The cold wave in the Northeast finally did manage to push natural gas prices above the $5 range. Prices on Jan. 24 traded between $10 and $25, according to ICE, which tracks prices in the New York City area. Some spot prices spiked past the previous record of $90 set on Jan.6. The onshore production also created a problem because normally most of our gas production came from the GoM where you might have shutdowns in the fall because of weather conditions. The producing wells up north don’t do well in freezing weather.

This underscores the need for more pipelines to transport natural gas from the Marcellus into densely populated regions in New York and New England. We have a transportation and storage issue. We don’t have gas where we need it right this second. How much are we getting from the Marcellus (show slide)? In December it provided 14 Bcf/d and 18% of U.S. production, and it’s only to grow.

NGVs

We heard the president discuss the prospect for natural gas vehicles in his speech. This is not a market to ignore anymore. Global natural gas demand in transportation will grow from 40 bcm in 2012 to over 160 bcm in 2030, increasing from 1.2% to some 3.4% of global gas demand. Growth of LNG demand associated with the transport sector is even more dramatic, going from less than 5 bcm in 2012 to over 80 bcm in 2030, increasing from less than 1% to some 10% of global LNG demand. Heavy Duty trucking fleets will be the greatest driver of NGV gas demand – nearly 45 bcm by 2030 and LNG will be preferred over CNG, with its storage restrictions.

Proposed Projects

Last year the industry spent about $4.3 billion building new onshore pipelines, down from previous years. A report from Douglas-Westwood estimates that $22 billion will be spent to build more than 23,000 miles of new pipeline between now and 2020. Obviously this is being driven by shale. They expect more than 1,100 miles of transmission to carry Permian crude this year. More than 1,000 miles of pipeline are planned for the Bakken crude by 2016.

WBI Energy Inc. just announced plans for a 375-mile gas pipeline from western North Dakota to northwestern Minnesota. Dakota Pipeline is been designed to transport 400 MMcf/d of natural gas and can be expanded to 500 MMcf/d. It will comprise 24-inch pipeline and includes two new compressor stations. Construction could begin in 2016 with completion in 2017.

Kinder Morgan wants to build the Utica Marcellus Texas Pipeline to carry gas liquids from the Utica and Marcellus shales to the Texas Gulf Coast. The project would convert 1,000 miles of 24- and 26-inch Tennessee Gas Pipeline system from Mercer, PA to Natchitoches, LA and 220 miles of new pipeline, including a 22-mile lateral from Harrison County, OH to Natchitoches. They have a joint venture fractionation facility with Targa which has facilities at Mont Belvieu.

TransCanada’s proposed $11.3 billion Energy East project will convert 3,000 km of natural gas pipeline to crude oil service and include 1,460 km of new pipeline for a total length of 4,460 km. This includes new pipeline segments within Manitoba and Saskatchewan to connect the Mainline to crude oil produced from the Bakken and construction of 68 pumping stations along with storage tanks. The project will link western Canadian oil production to eastern Canadian refineries and international markets. It will have capacity of 1 million bpd. Deliveries to Quebec are should be in service in 2017 with deliveries to New Brunswick in 2018.

Spectra Energy plans to build the $3 billion Sabal Trail Pipeline from Alabama into Central Florida. The 465-mile line is a joint venture of Spectra and NextEra Energy they were awarded by Florida Power & Light. This marks the third interstate natural gas pipeline into Florida and will carry more than 1 Bcf/d from Tallapoosa County, AL extending into Georgia and ending at a hub near Orlando.

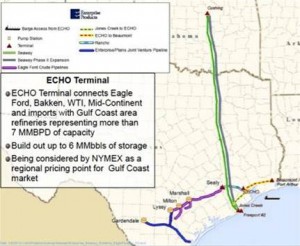

Enterprise Products Partners plans to expand its crude oil storage and distribution infrastructure to serve the Southeast Texas refinery market. Final completion is expected later this year and will include an additional 4 MMbbls of new crude oil storage capacity at Enterprise’s ECHO and Bertron facilities and 55 miles of 24-inch and 36-inch pipeline to directly connect ECHO with the refineries.

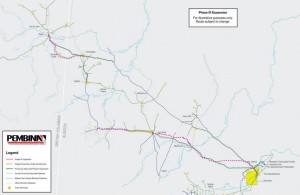

As part of its $2 billion expansion program, Pembina Pipeline is getting ready to start work on its Phase III Expansion which is expected to be in service in 3 years. The 336-mile project will connect the company’s existing pipeline systems from Taylor, British Columbia southeast to Edmonton, Alberta, eliminating bottlenecking.

They’ll build a 168-mile, 24-inch pipeline from Fox Creek, Alberta, to the Edmonton area, with initial capacity of 320,000 bpd which can be increased to 500,000 bpd. With its 2 existing pipelines and current expansions, Pembina’s three pipelines will have capacity to transport up to 885,000 bpd if fully expanded.

Pilgrim Pipeline wants to build a 150-mile, 16-inch pipeline from Linden, NJ to Albany, NY. Linden is the Northeast hub for refined products and the pipeline is expected to be built in 2 years.

Rockford Corp. won a contract from Crestwood Midstream Partners and Mountaineer Keystone to build the 42-mile, 16-or 20-inch Tygart Valley Pipeline natural gas gathering system to serve Mountaineer’s Marcellus development in northeast West Virginia. The pipeline will interconnect with Columbia Gas Transmission’s pipeline have total capacity of 200 MMcf/d which can be expanded to 300 MMcf/d with compression.

As part of its extensive and ongoing pipeline integrity program, Enbridge is undertaking an expanded maintenance and rehabilitation effort along portions of its Line 6B Pipeline. Line 6B originates in Griffith, IN and crosses southeastern Michigan. Enbridge plans to replace 75 miles of Line 6B, 10 miles in Indiana and 65 miles in Michigan.

Pennant Midstream LLC is building a $60 million 38-mile, 12-inch NGL pipeline connecting a processing plant in New Middletown, OH to a facility near Kensington, Columbiana County. The line will have capacity to deliver 90,000 bpd and be a vital part of a full-service solution for providers in the northern Utica. The line should be completed by July.

VECTRON Corp. plans to replace more than 1,000 miles of underground and old natural gas pipeline across 50 Indiana cities. They’ll remove bare steel and cast iron distribution mains and replacing them with new pipes, mostly plastic.

Comments