June 2015, Vol. 242, No. 6

Features

Caspian Regions Newly Independent Nations Look for Higher Gas Profits

The Caspian region of Central Asia is one of the world’s most important oil and gas-producing regions. Until recently, Caspian gas traveled thousands of miles via largely Soviet-built pipelines to eastern Russia where a portion of it was re-exported to Europe at two and even three times the purchase price.

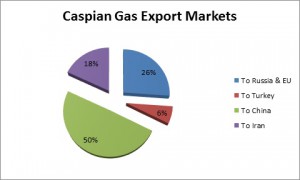

Since 2010, however, newly built pipelines have carried natural gas east to China, which receives about 50% of Caspian gas exports, surpassing Russia and Europe’s share 26% and Iran and Turkey take of 24%.

The newly independent governments of Azerbaijan, Kazakhstan, Turkmenistan and Uzbekistan have sought to capture and retain the higher profits from increasing their share of gas exports through newly constructed pipelines to China, Iran and Turkey, thereby reducing Moscow’s market and political influence over the region.

Completion of the Central Asia-China gas pipeline in 2009, with an annual capacity of 55 billion cubic meters (Bcm), has created a significant new market. Caspian gas now accounts for half of China’s gas imports and a third of its total gas consumption. Similarly, the opening of the Dauletabad Khangiran gas pipeline to Iran in 2010 has increased pipeline capacity by a third, making Iran a more significant market than before.

Exports to Europe, Russia

Gazprom continues to dominate the transit of Caspian gas destined for Russia and European markets through its control of the 30-year-old Central Asian Centre Pipeline network with its capacity of 195 Bcm/year (Table 2 and Figure 2).

In 2007 Gazprom purchased 60.7 Bcm of Caspian gas. By 2013 purchases had halved, according to Gazprom, along with its discounts, owing to both the declining EU and Russian demand.

As Howard Rogers, senior research fellow at Oxford Institute for Energy Studies (OEIS) pointed out, “Russia already has a surplus of production capacity in the general West Siberia region to supply its markets.”

In February, Interfax reported Russian plans to more than cut in half its gas imports from Turkmenistan, to just 4 Bcm.

Designed to bypass Russia and Gazprom’s control of European destined gas, is the much talked about Southern Gas Corridor (SGC) pipeline project, which aims to link Azeri gas fields with Europe via the 2007 completed South Caucasus Pipeline (SCP), the currently being built Trans-Anatolian Natural Gas Pipeline (TANAP) and the Trans Adriatic Pipeline (TAP).

The SCP pipeline has delivered about 6.6 Bcm from the megafields of Shah Deniz to Turkey. On completion in 2018, the Southern Gas corridor pipelines will transmit 16 Bcm/y of gas production, of which, Turkey will retain 6 Bcm, with 10 Bcm being sent on to Europe.

The ambitious plan to upgrade and extend the SGC underneath the Caspian Sea to Tashkent through construction of the Trans-Caspian Gas Pipeline (TCP) linking the Baku end of the SCP with Turkmenistan by a subsea pipeline has received a lukewarm reception. As Jonathan Stern, senior research fellow as Oxford Institute for Energy Studies predicts, this proposal is unlikely to come to fruition “due to lack of markets in Europe and opposition from both Russia and Iran.”

OIES’ Howard Rogers pointed to another equally important obstacle. “Turkmenistan appears to have a policy of pipeline gas sales at its border. The expectation is that the buyer will build a pipeline to its border from the market and resolve all related issues.”

Gas Exporting Pipelines to South Asia

Although Iran has the world’s second-largest gas reserves after Russia, it has been forced, through Western sanctions and economic mismanagement, to import piped gas to top-up winter supplies to its northern provinces.

It imports about 10 Bcm/y from Turkmenistan, making it the second-biggest market after China. Iranian gas imports could increase, too. Plans to pipe Turkmenistan gas to Pakistan and India via Afghanistan received short shrift from Stern who said, “I strongly doubt it both on security (Afghanistan), but also commercial grounds.”

Additionally, Pakistan will receive its first LNG this year, which will reduce the need for pipeline gas (Figure 4).

Exporting to China

Turkmenistan, Caspian’s leading gas exporter sends over half its exports to China, with Russia and Iran its other major markets. It exports 30%, or 20 Bcm, of its annual production, to China via the Turkmenistan-China gas pipeline (TCGP) completed in 2009.

The pipeline collects gas from Turkmenistan’s eastern gas fields, including the Galkynysh and the Bagtyyarlyk field group, before crossing Uzbekistan where it enters southern Kazakhstan heading north to the Chinese border at Khorgos, connecting to the West-East Gas Pipeline.

In order to increase contracted exports to China to 65 Bcm/year, Turkmenistan wants to increase production to 95-100 Bcm by 2016. In Kazakhstan, the TCGP’s partner, Trans-Azia Gas Pipeline Company Limited, is completing a 10-Bcm capacity spur, to be ready at the end of 2015. It will enable Kazakhstan’s western Tengiz and Kashagan gas fields to supply additional gas to China.

As for the future

How much more pipeline capacity will be built to transport increasing Caspian gas exports to China will depend on a number of factors, most notably price and government energy policy.

As Howard noted, given the distance between Caspian gas fields and Shanghai, “It’s not particularly cheap, and so much depends on China’s future growth and energy mix policy.”

Nevertheless, Chinese demand for Caspian pipeline gas could grow as the power sector switches away from coal and shale gas production disappoints. As for the prospect of new pipeline capacity to Europe via Turkey, history suggests progress at a snail’s pace – especially if Iranian and Iraqi gas becomes available.

CIS Statistical Report 2013, Gazprom, Sinopec

Central Asian Centre pipeline. Gazprom map

Comments