June 2015, Vol. 242, No. 6

Features

PGC Report Shows Record-High Resource Evaluation of US Natural Gas

The United States possesses a large and growing domestic abundance of natural gas. The biennial report, Potential Supply of Natural Gas in the United States, developed by the Potential Gas Committee (PGC), details the nation’s total technically recoverable resource base of natural gas, which provides the foundation for stable prices, customer savings, energy security and more.

The PGC’s 50th Anniversary year-end 2014 report, released April 8, 2015, found that the United States has a technically recoverable natural gas resource potential of 2,515 Tcf. This is the highest resource evaluation in the PGC’s 50-year history, and exceeds the previous record-high assessment from year-end 2012 by more than 5%.

When the PGC’s results are combined with the U.S. Department of Energy’s latest available determination of proved dry-gas reserves – 338 Tcf as of year-end 2013 – the United States has a total available future supply that now exceeds 2,850 Tcf.

“These numbers underscore the fact that our nation can rely on domestic natural gas for our energy needs for years to come,” said Dave McCurdy, president and CEO of AGA.

John B. Curtis, professor emeritus of Geology and Geological Engineering at the Colorado School of Mines and Director of its Potential Gas Agency, which provides guidance and technical assistance to the PGC said, the year-end 2014 assessment reaffirms the committee’s conviction that abundant, recoverable natural gas resources exist within our borders, both onshore and offshore, and in all types of reservoirs – from conventional, tight sands and shales, to coals.

2014 Resource Assessments

This shows the greatest increase in the current assessment arose from re-evaluation of producing and developing shale-gas plays in the Appalachian basin of the Atlantic Area but also from important new contributions of shale gas in the Gulf Coast (East Texas and Gulf Cost basins), Mid-Continent (Fort Worth) and Rocky Mountain (Piceance basin) areas and conventional/tight gas in the Mid-Continent area (Permian basin).

Ultimate Recoverable Reserves

In the review of natural gas supply and ultimate recoverable reserves, the figures show future gas supply jumped from 2,692 Tcf in 2013 (revised from the previous report using the actual EIA number for 2012 released subsequently to the PGC’s report) to 2,853 Tcf in 2014, an increase of 161 Tcf (6%). Adding future gas supply to cumulative production; which includes successive record-high annual marketed-gas production in 2013-2014, 52.9 Tcf total, estimated by EIA boosts the URR to 4,132 Tcf, an increase of 214 Tcf (5.5%) from 2012.

Other finding show shale gas resources in the area assessments but are still treated as a subset of traditional resources. For year-end 2014, the “most likely” shale gas value is 1,253 Tcf and represents a 180 Tcf (16.8%) increase over that for year-end 2012.

The report notes that since 2009, annual marked-gas production has reached levels not seen since the 1970s. Output achieved even higher gains during the previous assessment period, reaching 27.5 Tcf (74 Bcf/d) in 2014. These increases in production have been driven by an attendant rise in consumption since 2009, thanks to a recovering industrial sector and, in particular, the expanding use of natural gas for power generation, displacing coal.

Also noteworthy is the expansion of the country’s proved reserves base since 2004. The EIA’s year-end 2013 tally of 338 Tcf of dry-gas reserves (estimated from wet-gas reserves) is the highest yet recorded in EIA’s historical tracing beginning in 1997, exceeding the previous record reported for 2011 (334 Tcf), as well as the earlier historical high of 293 Tcf reported by the American Petroleum Institute in 1967. Such unprecedented levels are credited to industry’s ability to consistently prove up new gas reserves from the discovered resource base far in excess of the now higher volumes that are produced annually.

In the potential resource assessments, considerably more variations from year to year are shown. This expected variability is noted as a direct re?ection of the highly dynamic spectrum of drilling and appraisal through which PGC members reevaluate, reclassify and reallocate categories of potential resources. Such changes are particularly well exempli?ed by the consecutive “spikes” in assessments since 2006 – attributable almost entirely to reevaluations of shale-gas resources.

The report finds the results of this analysis demonstrates an exceptionally strong and optimistic gas supply picture for the nation, with:

- Industry increasing domestic production, processing and storage levels to satisfy demand

- Producers offsetting production depletion by consistently proving up higher volumes of reserves through new ?eld discoveries, ?eld extensions and new pool discoveries in known ?elds

- Industry aggressively pursuing new domestic markets and expanding existing markets, particularly natural gas for power generation and transportation fuel

- Industry investing billions of dollars to construct liquefaction facility to supply overseas markets with domestically produced LNG

Regional Resources Assessments

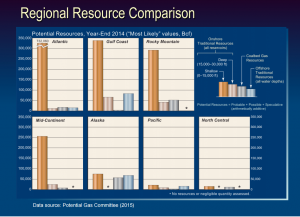

The breakdown of the year-end 2014 mean values of traditional resources by category and drilling theater for each of the PGC’s seven assessment areas used in the report.

Following are synopses of the changes in PGC’s regional assessments from 2012 to 2014 of the seven assessment areas. As a result of the current assessment, the Atlantic area continues to rank first as the county’s richest resource area with about 35% of total traditional resources, followed by the Gulf of Mexico, including offshore Gulf of Mexico, with 23%, Rocky Mountain area with 18% and the Mid-Continent area with 12.5%.

Atlantic Area – All of the 92,030 Bcf (mean value) increase in the Atlantic area’s assessment for 2014 arose from ongoing evaluation of Appalachian basin shales, predominantly the proli?c Marcellus. Total Marcellus gas production topped 16 Bcf/d in 2014.

Besides other Devonian Shales, the basin’s shale gas assessment includes a growing component re?ecting rising liquids and gas production from the Utica Shale in eastern Ohio, where that state has now issued more than 1,800 horizontal well permits, and 818 completed wells are producing. PGC’s evaluation also includes a ?rst-time assessment of the Rogersville Shale, based on an embryonic play taking shape in eastern Kentucky and southwestern West Virginia.

North Central Area – No changes were made in the area’s assessment for 2014. For the Michigan basin the lack of expansion of the state’s principal source of natural gas, the Antrim Shale, beyond the producing fairway has factored into continued declining levels of production as well as proved reserves.

New well permitting also is off as some operators are looking elsewhere for liquids-rich plays. Although potentially recoverable gas in the New Albany Shale has constituted PGC’s total assessment for the Illinois basin for many years, the cessation of historical New Albany gas production from the legacy ?elds and the diminished level of recent gas exploration did not warrant any changes.

Gulf Coast Area – Increases in assessments for three of the Gulf Coast’s four onshore basins arose overwhelmingly as a result of shale gas reevaluations. Contributing to the net 3% increase in the area’s resource base were gains primarily for the Eagle Ford Shale in the Texas Gulf Coast Basin.

Expansion of the Eagle Ford play, where drillers are targeting the lucrative light-oil and wet-gas/condensate windows, has bene?ted from use of longer lateral wells, tighter fracturing-stage spacing and closer well spacing. Results for the Haynesville and Bossier Shales were mixed – a slightly higher assessment for the East Texas basin and a slightly lower assessment for the play’s continuation into northern Louisiana.

Similar adjustments were made to re?ect expanded horizontal-well development in the Cotton Valley sands (conventional/tight reservoirs) in these two provinces. Lastly the PGC provided a ?rst-time assessment of potential gas resources in the oil-prone Upper Cretaceous Tuscaloosa Marine Shale, a possible Eagle Ford equivalent or analog in the Louisiana Gulf Coast Basin.

Mid-Continent Area – Substantially higher assessments (40+%) for the Barnett Shale in the Fort Worth basin and for shallow conventional/tight reservoirs in the Permian basin, more than offset declines in the Arkoma and Anadarko basins’ assessments to yield a 10% overall increase in total traditional resources for the area for 2014.

Improved horizontal-well completion techniques and higher per-well EURs indicate that the Barnett play has many years of sustained production remaining. In the Permian basin, technology-enhanced horizontal drilling in liquids-rich, stacked pay zones in the Bone Spring and Wolfcamp intervals has helped spur a resurgence of ?eld development and production. For the Arkoma and Anadarko basins, ongoing re-analyses of EUR data and re?ned estimates of proved reserves led to transfers and other downward revisions for shallow (less than 15,000 eeft) conventional/tight resources.

Rocky Mountain Area – This total assessment increased about 3% as a net result of upward and downward revisions in four producing basins. Development of oil and associated gas via horizontal drilling in naturally fractured carbonates of the Cretaceous Niobrara Formation of the Denver basin continues at a robust pace, primarily in the proli?c Wattenberg ?eld area, resulting in higher assessments in all three resource categories. In western Colorado the equivalent Niobrara interval is predominantly shale. Horizontal drilling on small multiple-well pads has helped bring this horizon into commercial production in the Piceance basin.

The greater data availability has enabled addition of Probable (discovered) resources and reallocations among possible and speculative resources, for a more than twofold increase in the basin’s shale-gas assessment. Reevaluations of production and EUR data were responsible for the lower assessments of Cretaceous tight-sand resources in the western Greater Green River basin, including the Pinedale Anticline and Jonah ?elds, and in the San Juan basin.

Paci?c Area – The new assessment re?ects both upward and downward revisions among shallow and deep traditional resources in the area’s two principal producing provinces and in three nonproducing provinces, resulting in an overall slight net decline in total assessed resources. On the down side, declining production due to lack of new ?eld development/extensions, depressed prices and a drop off in gas-directed exploration combined for a lower assessment of the gas-producing Sacramento basin.

For San Joaquin basin, in contrast, assessed resources were bolstered by increased development of gas and condensate at Elk Hills ?eld and by other exploration in the basin. Assessments were lowered in the Paci?c Northwest provinces in light of diminishing prospects for any sustained exploration efforts.

The targeted areas pose complex geology, dif?cult drilling conditions and regulatory drawbacks. However, renewed interest in developing oil, liquids and gas potential in eastern Nevada and the pending start of two new pilot drilling programs there, which will test shales and conventional reservoirs, have prompted ?rst-time assessments of probable and possible resources in the Great Basin province.

Alaska Area – All onshore and offshore resource assessments remained unchanged for 2014. No revisions were warranted based on the limited number of recent exploration and development wells drilled in the state’s four oil-producing provinces – Cook Inlet (onshore and offshore); North Slope, including NPR-A; and shallow, state-administered waters of the nearshore Beaufort Sea Shelf. Alaska’s regulators and oil producers are optimistic that an in-state gas pipeline will be built to ?nally allow commercial sales of some of the North Slope’s vast gas reserves.

The bulk of the associated gas presently withdrawn with the oil is reinjected for reservoir pressure maintenance and enhanced oil recovery. Not only will the pipeline deliver gas to south-central Alaska for export as LNG, it will also supply some of the state’s interior communities with more affordable energy. The sales gas offtake from the Prudhoe Bay ?elds eventually will effect adjustments in the PGC’s assessment of probable resources.

In discussing the recent report, McCurdy noted that the nation’s abundance of natural gas supports affordable prices for customers, bolsters U.S. energy security and provides efficiency and environmental solutions.

“Every day, America’s natural gas utilities deliver energy solutions to more than 68 million residential, commercial and industrial natural gas customers,” he said. “By enhancing safety and expanding service, we stand ready to deliver this abundant resource and support the nation’s economic, efficiency, environmental and security goals. We appreciate and welcome the sound scientific work that the PGC and its members have put into developing this valuable report.”

Footnote: PGC’s assessments in the report are baseline estimates in that they attempt to provide a reasonable appraisal of volumes of natural gas that the Potential Gas Committee deems to exist and considered technically recoverable. They assume neither a time schedule nor a specific market price for the recovery and production of future gas supply. The PGC’s technical recoverable reserves are also separate from and do not include proved reserves, which are reported annually by the Energy Information Administration.

Comments