April 2016, Vol. 243, No. 4

Web Exclusive

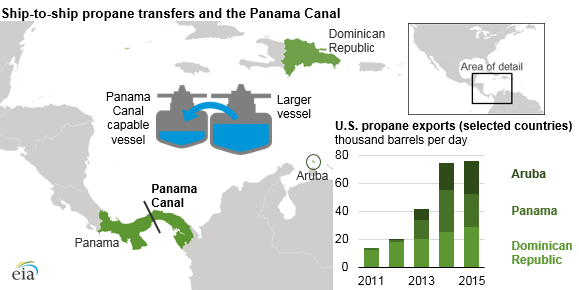

Logistical Challenges Result in Ship-to-Ship transfers of US Propane Exports

U.S. propane exports have increased significantly over the past three years, but only after market participants worked to overcome several challenges in transporting propane to export customers. After largely overcoming the first challenge of building sufficient export capacity, the next challenge involves economically transporting large quantities of propane over long distances. The current, although likely temporary, solution has resulted in import and export data abnormalities affecting U.S. propane exports to Asian countries.

Asia, the largest regional destination for U.S. propane, imported 220,000 barrels per day (b/d) of U.S. propane in 2015, or slightly more than one-third of total U.S. propane exports. Most of these exports originated from the U.S. Gulf Coast and traveled through the Panama Canal on longer, more expensive routes that go across the Atlantic Ocean and then through the Suez Canal or around Africa’s southern tip to destinations in Asia.

Transporting large quantities of propane over long distances requires specifically designed refrigerated ships. The largest, most economical class of these ships are very large gas carriers (VLGC). Only a limited number of VLGCs with narrower, more upright hull designs are able to pass through the current Panama Canal lock dimensions. This situation will change when a new, larger set of Panama Canal locks opens. The Panama Canal Authority recently announced that the Panama Canal Expansion will be inaugurated on June 26.

One method used to cut voyage times and costs within the constraints imposed by the existing Panama Canal locks involves a ship-to-ship transfer, where the propane cargo of a larger vessel is transferred to a smaller ship that can transit the canal. Once through the canal, the smaller ship will either continue on to Asia or transfer the cargo back to a larger ship. The additional cost associated with using multiple vessels is mitigated by cost and time savings from transiting the canal rather than taking longer alternative routes that avoid the canal.

This cargo transfer activity is likely affecting trade data. Much of EIA’s energy export data is based on information from U.S. Customs and Border Patrol, which collects the final destination of an export, if known. Despite this requirement, some of the propane cargoes exported from the United States that undergo a ship-to-ship transfer will cite the jurisdiction of the transfer, not the cargo’s actual final destination. U.S. export data show increased propane exports to countries in the Caribbean and Central America where the ship-to-ship transfers are taking place, but these countries do not have sufficient domestic demand for—nor the infrastructure to store and distribute—such large quantities of propane.

For example, based on trade data, the United States exported 31,000 b/d and 23,000 b/d of propane to Panama in 2014 and 2015, respectively. However, the National Energy Secretariat of Panama reported total national propane consumption of only 1,671 b/d in 2014 and 1,736 b/d in 2015. Similarly, Aruba, an island nation of approximately 100,000 people and no major source of demand (such as a petrochemical facility or a propane-fired power plant), reported 23,000 b/d of propane imported from the United States in 2015.

This discrepancy is also affecting import data in Asian countries. Both China and Japan have begun to report propane imports from Panama, even though Panama does not produce any propane. These propane volumes were likely U.S.-sourced propane that underwent ship-to-ship transfers in Panamanian waters.

Not all cargoes that undergo ship-to-ship transfers are necessarily destined for Asia. The ports and territorial waters of Central American and Caribbean countries are also likely locations for large cargoes of propane to break-bulk, where large cargoes are divided into several smaller ones to better accommodate regional demand.

The new, larger Panama Canal locks will allow the majority of VLGCs to transit, which will likely reduce or end the practice of ship-to-ship transfers of U.S. propane destined for Asian markets. That outcome would reduce discrepancies between import and export statistics, providing greater clarity on the major markets for increasing U.S. propane exports.

Comments