January 2017, Vol. 244, No. 1

Features

Russia Shifts Eastward: China Gas Sales & Pipelines Construction

The Russian Federation (RF) stretches from Belarus in the West to Vladivostok on the Pacific Coast. The country is endowed with vast amounts of gas, oil and other natural resources. The RF’s entire population is about 144 million which is less than half of what it was under Soviet rule. After the disintegration of the Soviet Union, Moscow focused primarily on selling natural gas and crude oil to Western Europe. Energy prices were favorable which allowed Moscow to fund its newly created welfare state and the modernization of the country’s armed forces.

However, to guard against excess oil and gas price gyrations, the Kremlin failed to adopt or implement a diversified industrial development strategy. Thus, plummeting crude oil and gas prices put the Russian economy in a tail spin, from which it has not yet recovered. This development strategy is not unique to the RF and became the practice of many energy and other commodity producing nations. In times of steep price declines having betted on only one commodity usually take its toll on the economy and the population at large.

Facing worsening relations with the European Union (EU) and United States, President Vladimir Putin did not have much of a choice and was forced to deal with China. Given Russia’s geographic location and despite opposition among nationalists in the Duma, Russian government officials looking eastward remained the only logical alternative. Prospectively, of course, China would also be a much bigger energy market than Europe.

In 2014, Two Russia-Chinese Mega Deals

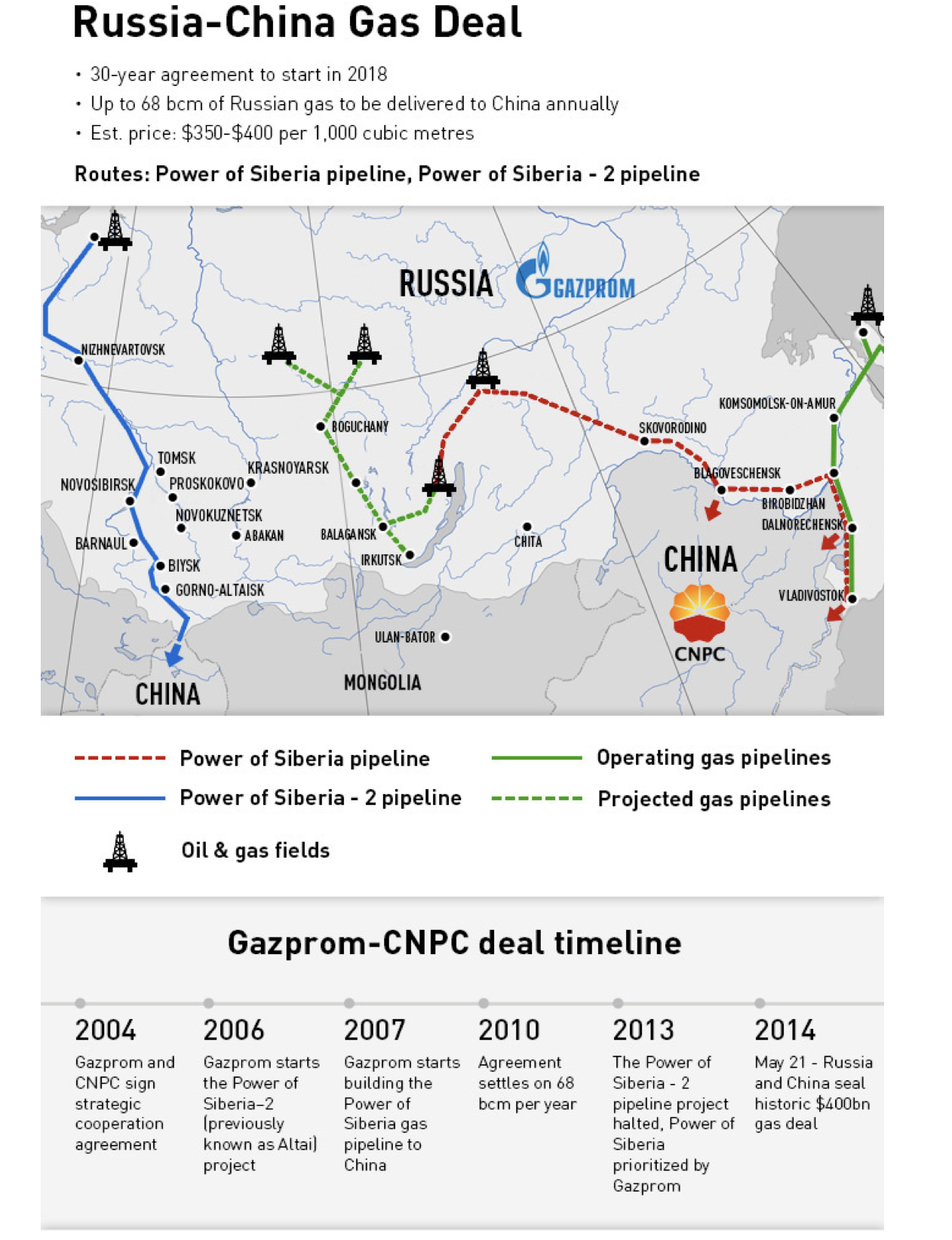

On May 21, 2014 the media reported that China and the RF reached a 30-year gas deal worth about $400 billion. Some sources said the deal had been in the making for about a decade. Apparently, Moscow was unwilling to agree on a pricing formula suggested by Beijing. So what had changed? Energy experts attribute Putin’s greater flexibility partly to Western sanctions and partly to competition from Turkmenistan, a country rich in natural gas reserves. Another factor has been Germany’s push for other sources of supply including renewables to reduce its dependency on Moscow.

After the Kremlin’s sponsored uprising in Eastern Ukraine and the annexation of Crimea, Germany’s NATO allies, particularly Poland, heavily criticized Berlin for its Russian dependency as a potential threat to European energy security. But actually, for Moscow to cut off gas supplies to Germany would have ruined the RF’s access to European markets for many years to come. Also, it would have deprived Russia of $18-23 billion of much-needed annual revenues.

On Nov. 10, 2014 China and the RF signed a second gas deal in which the RF would supply China with 30 Bcm of natural gas via the western route over 30 years. This would require construction of the pipeline Power Siberia-2. Gazprom signed the 30-year contract with China’s National Petroleum Corporation (CNPC).

The two combined natural gas deals between Russia and China would amount to about 68 Bcm which is considerably more than the 45 Bcm the RF provides Germany each year. The gas deals would make China Russia’s most important customer, second only to Germany.

Russia is Not Alone

To many political observers, the mega gas deal with the PRC was clearly a foreign policy coup for Putin. The message to the West was that Russia is not alone and does have allies. The price tag on this deal is enormous. First, there are the infrastructure requirements related to pipeline construction and related facilities. Second, there are significant financial obligations that further squeeze Moscow’s precarious federal budget.

Price Tag and Energy Prices

In 2014 the cost of Gazprom’s gas pipeline to China was estimated at between $60-70 billion. Reportedly, China had indicated it would advance $25 billion to begin construction; however, there is no indication that these funds were ever paid.

When the first mega deal was signed Moscow was clearly euphoric. Crude oil prices on the spot market were around $100/b (WTI). As oil prices and gas prices tend to run parallel, gas prices were high too. However, by the end of 2014 prices for crude had dropped sharply and oil sold slightly above $50/b. The mega deal that six month earlier had been valued at $400 billion was now worth a lot less. Especially since subsequent spot prices for crude on several occasions fell below $30.

Western trade sanctions and sharply falling energy prices wreaked havoc with the Russian currency, the ruble. Between 2014 and 2016 the ruble fell from 29 to 70 to the U.S. dollar, making imports or foreign purchases, including badly needed foodstuffs, prohibitively more expensive.

Construction Delays? “Power of Siberia”

In a meeting with Gazprom’s CEO Alexey Miller, Putin was informed that the route to supply gas to China via Western Siberia may be implemented more rapidly than the eastern route. The China-Russia Power Siberia-2 route connects gas deposits in Western Siberia and the northwestern part of China via Russia’s Altai region. Why the switch?

Plummeting crude and gas prices called into question the completion date of the project. There had been speculation that the funding of the Russia- China pipeline construction might be in jeopardy. In 2015 construction expenditure for “Power Siberia” was sharply curtailed falling from 31 billion rubles to 19 billion. Thus, CNPC feared the agreed-upon schedule would be in trouble.

According to Interfax.com, on June 13, 2016 Miller, assured the CNPC that the construction of “Power Siberia” would be completed as scheduled and would be put into operations in 2019. Whether a “two year option if the infrastructure is not ready” would still apply to the 2019 completion date is not clear. On June 24 at a meeting between Miller and CNPC Board Chairman Wang Yilin the parties discussed the gas supply project for the Eastern route and the project was deemed to be on schedule. The two sides also discussed in detail the gas supply project of the Western route which had long been part of the discussion between Gazprom and CNPC. It appears Chinese officials want the Eastern route to be finished first.

China’s Gas Situation

In 2014 the International Energy Agency (IEA) reported “that the Chinese power, industrial and transport sectors will drive gas demand to 315 Bcm by 2019.” Liquefied natural gas (LNG) is assumed to cover much of the demand along with new pipelines. Chinese domestic production is assumed to grow 65% from 117 Bcm to 193 Bcm by 2019. Private sector operators in Australia, Canada and the U.S. are leading the LNG trade which may grow to 450 Bcm by 2019.

Once the pipelines Power Siberia and Power Siberia-2 are completed and fully operational, they would add 68 Bcm to China’s natural gas supply. Let’s suppose by 2020 the RF- CNPC pipelines are operating at 100% capacity. The question then is whether the additional natural gas will replace coal and/or LNG. Clearly, PRC officials will evaluate the least-cost options in the short run and in the long. Each supply route entails certain risks: tundra vs. LNG supply vessels maneuvering the potentially treacherous waters of the South China Sea.

Of course, part of the Siberian gas might be allocated to meet increases in domestic demand. However, a large share would still compete with coal and LNG. Major LNG suppliers affected by the increased competition with Siberian gas would be Australia, Qatar and the U.S.

Every time oil prices go above a certain level, let’s say $50+, the supply increases again and prices return to their previous levels. With the U.S. involved in internationally markets, excess capacity seems infinite. Of course, it isn’t infinite, but are there limits? Unless producer nations exercise some constraints through mutual agreements this scenario might exist for quite some time. However, if some nations, including the U.S. take the position that oil and gas are just another geopolitical weapon, any international agreement would seem futile.

Depressed Oil Prices

Now let’s suppose the energy price volatility continues into the early 2020s. LNG will compete directly with Siberian gas flowing through the Russian-Chinese pipelines. Are the pipelines going to be viable at the current level of world market prices?

In this situation Gazprom’s Miller had proposed to use the Chinese domestic gas index as the basis for pricing, which reportedly was rejected by Beijing. The question becomes how much of a premium to market prices might China be willing to pay to ensure the gas will flow to power its economy. The premium would be more like insurance in the event Russia is in severe financial difficulties and is unable to keep the pipelines operating.

Finally, let’s suppose oil price recovery to a level of $70-80 or more: the Chinese may still have some room to negotiate to perhaps to something similar to the price level of 2014 when the original contracts with the RF were signed.

As always, the future is wrought with uncertainty and the next several years are most likely to offer a few more surprises.

Gazprom Says its Ready

Meanwhile, it was reported that Gazprom recently reviewed the readiness of its Unified Gas Supply System (UGSS) facilities to operate at peak loads during the coming winter and concluded reliable gas supplies can be provided to the Russian regions, as well as consumers abroad where contracts are in place.

Potential daily delivery from the system is expected to hit a record of 801.3 MMcm after comprehensive preparations at the UGSS facilities were made, including 16 sets of preventive maintenance and repair operations, all of which were completed.

Over the first nine months, the company overhauled about 660 km of gas pipelines and 262 gas distribution stations. Separately, 18,100 km of pipelines passed inline inspections, while 741 submerged crossings underwent repairs and checkups, respectively, the company said. In addition, 353 gas compressors were repaired and 53 km of process pipes at compressor stations were overhauled.

The company completed the process of stockpiling 72.098 Bcm of gas reserves in Russia-based UGS facilities. With the Armenian and Belarusian UGS facilities factored in, Gazprom’s gas reserves stand at about 73.3 Bcm.

Pipeline, Processing Plant Discussed

Gazprom’s Alexey Miller and Alexander Kozlov, governor of the Amur Region, met recently to discuss construction of the 875-km Power of Siberia Pipeline, which will run across the Amur Region and the Amur Gas Processing Plant (GPP). Under construction in the Amur Region, it was noted the projects were running on schedule. Specifically, preparations are underway for the construction of the cross-border Power of Siberia gas pipeline in Russia.

Also discussed was the Amur GPP site preparation work that is advancing along with the construction of access roads, a river wharf, railroad facilities, temporary buildings and installations, including a shift camp for builders.

Author: Hubert H. Reineberg holds a Master‘s Degree in Economics from Arizona State University. He is a former consultant at Ekonocom International and a full-time lecturer in the Department of Economics at ASU, in Tempe, AZ. As part of his consulting activities he worked with the Energy Group at the Institute of International Education in Washington, D.C. Reineberg is semi-retired and his focus includes gas, oil and pipelines, particularly geopolitical issues concerning the Russian Federation, Eastern Europe and Central Asia.

Comments