January 2018, Vol. 245, No. 1

Features

READY OR NOT, Here Comes New U.S. Pipeline Infrastructure

Within the span of less than three days in early November, the construction of the much-embattled Williams Partners LP’s Atlantic Sunrise natural gas pipeline project was halted and then restored by an appellate court in Washington, D.C.

It is an all-too-familiar part of the developing short history of this 1.7 Bcf/d project. Williams’ Transcontinental Gas Pipe Line Co. (Transco) has been bidding for some time to move Marcellus Shale supplies in Pennsylvania to the Gulf Coast, running through Maryland and Virginia on the way to the Gulf.

The U.S. Court of Appeals for the D.C. Circuit finally lifted an administrative stay that had been placed on the Atlantic Sunrise project two days earlier, deciding that the pipeline opponents had come up short in demonstrating the stringent legal requirements for halting construction on an approved pipeline infrastructure project.

But this kind of legal tug-of-war that unfolded is becoming common in regard to pipeline projects that have drawn the active opposition of environmental groups, and the Northeast has been a particularly attractive target.

On the industry’s side, organizations like the American Petroleum Institute (API) and companies like Williams and Energy Transfer Partners (ETP) are dedicated to persevering in their quest to build energy pipeline infrastructure that they argue is good for consumers, workers and ultimately the environment. As a result of the shale revolution, the United States is now the world’s top oil and gas producer, and to take advantage of that world-leading position the nation’s infrastructure must be constantly upgraded and expanded.

While there is a long list of major projects totaling billions of dollars and carrying additional billions of dollars of economic stimulus, several critical projects in the Northeast have struggled in the face of over-zealous environmental pushback and misguided NIMBYism, according to API’s Robin Rorick, group director for mainstream operations, who wrote a recent opinion essay articulating the stakes in these pending projects.

Rorick cites a study from the New England Coalition for Affordable Energy that makes the case the region’s energy costs are going to skyrocket if needed energy infrastructure doesn’t get built. She and the study see the stakes as high.

“Unless the region invests in energy infrastructure to connect it to nearby energy supplies, the region’s households and businesses could see an estimated $5.4 billion in higher energy costs by 2020,” Rorick wrote. “When you peel away the politics and focus on the facts, pipelines are a win for jobs, consumer savings and energy reliability.”

While there is an abundance of individual pipeline projects nationally with a concentration east of the Mississippi River, in New Mexico-Texas, and in the Upper Midwest, the macro-economic story is more compelling as told by Rorick and her colleagues at API. “Beyond keeping affordable energy moving to homes, schools, hospitals and manufacturers, energy infrastructure plays an integral role in job creation, economic growth, and the reliability of the electric grid,” Rorick wrote in her essay.

According to API’s analysis, the additional pipeline infrastructure envisioned over the years leading up to 2035 could support over 1 million jobs annually on average. In its 2017 natural gas industry report, Strategic Directions, Black & Veatch (B&V), the global engineering consultant, spelled out how supply reliability ultimately depends on infrastructure investments. “Oil and gas leaders must look beyond the next few years and plan for decades to come,” B&V’s Hoe Wai Cheong, president of its oil/gas business, wrote in the annual gas report.

“In the United States, build-out of new pipeline capacity necessary to keep pace with increases in production volume continues to be a challenge,” Cheong writes.

There is a global side to all of this, too, as Cheong’s B&V colleague John Chevrette, president of B&V’s consulting business, wrote in the gas industry report, noting that in today’s oversupplied liquefied natural gas (LNG) global market, “producers and traders are increasingly stepping in, helping to finance and build onshore infrastructure, or floating terminals, that bring natural gas to international markets where funding for such projects may be lacking.”

The Federal Energy Regulatory Commission (FERC), which oversees all interstate gas pipelines built and operated in the nation, does not maintain lists of the major pending projects, but it does keep track of those projects for which it has issued a final environmental impact statement (FEIS) or a final environmental assessment (EA). Those two categories include the projects nearest to breaking ground, according to a FERC spokesperson following natural gas matters in Washington, D.C. She noted that FERC also publishes a monthly infrastructure report “Natural Gas Highlights.”

Thus, at the end of 2017, two related projects by units of Columbia Gas Transmission LLC (part of TransCanada Corp.), Mountaineer Xpress and Gulf Xpress, were granted FERC’s final EIS for moving gas from West Virginia westerly. They were authorized to start construction on what amounts to 170.5 miles of 36-inch and 24-inch pipe, 10 compressor stations, two regulating stations, upgrades of two existing compressor stations, and various short-distance piping jobs between West Virginia and Mississippi.

Similarly sitting with a FEIS was the Atlantic Coast Pipeline (ACP) and Supply Headers Project sponsored by Dominion Energy Transmission Inc., Duke Energy, Piedmont Natural Gas, and Southern Company Gas. They propose to build over 600 miles of pipeline, most of it a 333.4-mile, 42-inch pipeline and 186 miles of 36-inch pipe. Atlantic Coast is proposing to deliver upward of 1.5 Bcf/d to customers in Virginia and North Carolina.

Before the end of 2017, FERC approved the project, which includes three compressor stations in Pennsylvania and West Virginia, nine meter and regulating stations, 11 pig launchers, and 41 valves in West Virginia and Virginia.

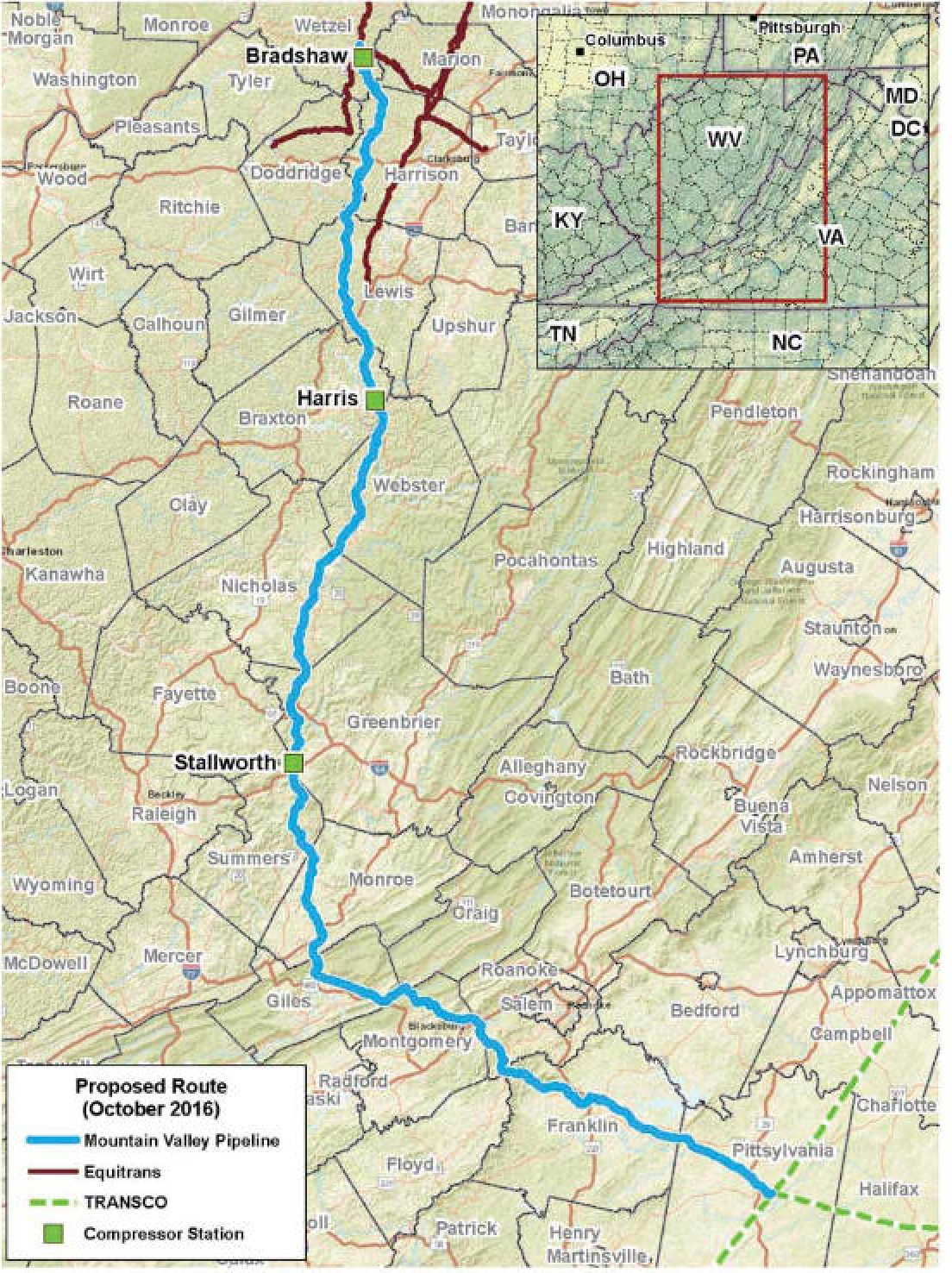

At the same time, FERC greenlighted another Northeast gas infrastructure project, Mountain Valley Pipeline (MVP). In a rare split decision, the regulators issued a certificate authorizing the 303-mile, 2 MMDth/d MVP to move forward, the culmination of a multi-year review process that officially kicked off when both projects (ACP and MVP) applied at FERC in fall 2015.

Both MVP and ACP are designed to deliver Marcellus and Utica shale gas into Southeast markets. Each greenfield pipeline will start in West Virginia before crossing into Virginia to interconnect with Transco. ACP would also extend south into North Carolina.

Another effort on the verge of a final FERC approval at year-end 2017, the PennEast Pipeline project expects soon to be building its 120-mile, 1.1 Bcf/d gas delivery pipeline in Pennsylvania and New Jersey for moving Marcellus supplies. The mostly 36-inch pipeline will originate in Luzerne County in the northeastern part of the state and terminate at the Transco pipeline interconnection near Pennington, NJ.

Momentum was returning to various projects in late 2017 as a reinvigorated FERC and the courts were giving life to previously stalled projects. (KM Louisiana Pipeline LLC for the Sabine Pass LNG expansion, and the Sierra Club dropping a court challenge to the Nexus Pipeline project now seeing light at the end of a long permitting tunnel are examples.)

Even the poster child for debated, high-profile infrastructure projects, TransCanada’s Keystone XL oil pipeline, obtained its last state approval (Nebraska) for its U.S. route only to have to re-apply to the state asking for changes in a state-mandated alternative routing for the long-envisioned pipeline link between western Canadian producers and U.S. refineries.

In late 2017, the Permian Basin was capturing prime time attention for its spike in production and for the infrastructure wish list that the production surge created. At the outset of the New Year, it was clear that 2018 would likely be make-or-break for satisfying most of the wishes of producers worrying about having to shut in wells for lack of takeaway capacity.

U.S. crude production hit an all-time high of 9.64 MMbpd the week of Nov. 10, according to the U.S. Energy Information Administration (EIA). It was led by the Permian where production was up 21% from July 2016 to August 2017. In the last quarter of the year, EIA noted that the general increase in gas production nationally had constrained takeaway capacity again, and it predicted that with ramp-ups such as Rover Pipeline, the opening of the Cove Point (MD) LNG facility for exports, and the Nexus gas transmission project converging at the end of 2017 and early in the 2018, there should be a combined 5.5 Bcf/d of added takeaway capacity.

As a result, B&V’s Denny Yeung, a principal consultant in its Houston office, sees a lot of sizable, mostly intrastate (Texas) projects being completed in that state, given that it has one of the nation’s most favorable regulatory climates for new infrastructure projects. Yeung thinks most of the Permian projects have a high likelihood of being built in the time frames now outlined. Three of those projects include:

- Kinder Morgan’s Gulf Coast Express project

- Boardwalk Inc.’s Permian to Katy project

- Enterprise Partners’ Permian to Gulf Coast project

Yeung thinks two of the three could be built in 2018. “A lot of supply in the Permian is associated gas and we have seen a resurgence of Permian production, going from 4 to 6.5 Bcf/d,” he said. “Potentially, the 6.5 Bcf/d could grow more rapidly if more takeaway capacity gets built.”

At the Permian Basin Petroleum Association (PBPA), there was much discussion among industry players at the end of 2017 about various interconnections leading to a more complexJanuary network that will link the Permian’s various sub-basins to the Texas Gulf Coast and elsewhere.

Midland-based Oryx Midstream Services CEO Brett Wiggs talked with local news media about plans for a 400,000-bpd pipeline from the Permian’s Delaware sub-basin as being part of larger efforts that eventually will build a “natural header system” with which to develop new Permian export projects that “create significant marketing and economic benefits through an integrated solution from wellhead to the Gulf Coast.”

Oryx in late 2017 was starting construction on a 220-mile oil pipeline from southeastern New Mexico into Texas and up to Midland with segments varying from 16-24-inch diameters. It will be constructed in phases during 2018 and completed by year end,” a PBPA official told P&GJ.

Another liquids pipeline now being built, starting in southeast New Mexico, is the Epic Y Grade Pipeline LP natural gas liquids (NGL) line. Destinations for the 650-mile, 375,000-bpd pipeline include Orla, Benedum and Corpus Christi where an Epic affiliate plans to build a fractionation complex that will accommodate the line’s volumes. Epic officials were promoting the project as a “NGL superhighway” providing a link from the Permian to Corpus Christi.

Also in the Delaware sub-basin, Magellan Midstream Partners LP is building a 60-mile, 24-inch pipeline to move 250,000 bpd of crude oil and condensate from Wink to Crane, TX. The new line will have the ability to expand up to 600,000 bpd if future demand supports those volumes. It will include a new terminal at Wink, offering what Magellan calls “broad inbound and outbound pipeline access” to parties connecting to the new facility when it is operational.

“All of these projects are either under construction or are highly likely to be constructed,” PBPA Executive Vice President Stephen Robertson told P&GJ in late 2017.

Amid this momentum there remain projects stalled or shelved by legal and social activist efforts. Another hurdle comes in the form of marketing and financing challenges for some of these infrastructure projects, according to Matt Hong, director of Research, Power and Gas at Morningstar Commodities Research in Chicago. The engineering aspects of these projects are often the easiest part, given the social, legal and financial requirements that ultimately need to be addressed, he said.

“As we moved into the current environment where gas prices are on the low side, the big energy sector challenge in the last two years has been getting access to financing,” Hong said. “Especially looking out to 2018-19, there doesn’t appear to be a huge carryover in the market right now. The other piece is the marketing of the capacity to ensure you have the cash flow from these assets at a level where banks are comfortable lending the money.”

In 2018-19, Hong said the industry is looking at an added 19 Bcf/d of pipeline capacity, and longer term, up to 65.9 Bcf/d of new capacity is in the works; 12.7 Bcf/d is under construction. It is concentrated in the Northeast, upper Midwest and Permian (New Mexico/Texas) with just a handful of smaller projects in the West. Built into these plans is the realization among companies that court challenges will be part of the design, permitting and construction phases. It is part of the infrastructure buildout business today.

Hong’s view near the end of 2017 was that FERC will continue to approve the new pipelines, but some states, such as New York in particular, could slow the completion of permitting as has happened in three cases he cited – Millennium Pipeline Company LLC’s Valley Lateral (New York), Constitution Pipeline (Pennsylvania and New York), and National Fuel Gas Supply Corp.’s Northern Access Pipeline (New York).

In all three projects, state agencies have undermined FERC’s approvals. For Northern Access, the New York environmental department refused to issue a water certificate, preventing construction from starting after a Pennsylvania state agency had issued a similar permit for the project. This project and the Constitution Pipeline are involved in court cases in the U.S. Court of Appeals for the 2nd Circuit.

Citing recent responses from industry players, Hong said they are seeking assistance from the U.S. Army Corps of Engineers “looking at ways to change the Clean Water Act. Either way, there is a lot more that is needed to be fleshed out, and how the court and FERC act going forward will determine how fast these projects can be completed.”

Regarding marketing/financing hurdles, Hong cited the longstanding Jordan Cove LNG export project and 232-mile Pacific Connector transmission pipeline as the poster child for this obstacle to build. After being denied a FERC permit in 2016 at least partially because of a perceived lack of market support for the project and/or its connecting transmission pipeline from the Oregon-California-Nevada border to the coast, sponsors have a new application in play at the start of 2018.

Having acquired Jordan Cove’s original sponsor, Calgary, Alberta-based Veresen Inc., Pembina Pipeline Corp. in late 2017 became the project backer, strengthening the financing picture as a result, Hong pointed out. “Several LNG projects in Texas have been delayed final investment decisions for what I can assume are questions around global demand,” he said. “We have seen this in other industries as well, especially with respect to export markets. Projects typically need capacity commitments in order to convince financiers that a project is viable. It also seems to play a role in the approval process with federal and state regulators.”

Hong said it should be interesting to see how state regulators react to some of these projects if FERC approves them. Regardless, for the Texas Gulf region nothing seems to be in place that will hold back its continued growth as a strong U.S. energy demand center.

“The Texas Gulf Coast is a strong demand center, and given where we are in terms of LNG exports and exports to Mexico, moving the Permian gas to the Gulf is a logical step for producers to monetize the gas,” said B&V’s Yeung, who thinks at least three new pipeline proposals will have a “sizable impact” on future markets, aside from several new liquids pipeline projects to the Gulf.

Whether at FERC or in Texas, projects are going to take longer and cost more, but industry analysts like Yeung see them eventually succeeding.

The paths to success will be bumpy from both an adversarial point of view and an economic focus. Satisfying seemingly never-ending environmental concerns and finding the right counterparties to make projects financially viable will continue to be difficult. The end of 2017 marked a global glut of oil and natural gas, which could impact the next generation of U.S. infrastructure projects in the early 2020s.

A key factor, experts say, is to demonstrate that a project is needed, and that it has significant benefits to the community with no significant environmental impacts that can’t be mitigated. The pipeline industry now understands that increased public scrutiny is going to continue, they agree.

Natural Gas Highlights

- Transco received authorization to place into service Phase 1 of its Garden State Expansion Project in Burlington and Mercer counties, NJ.

- Dominion received authorization to place into service its Leidy South Project that will transport 155 MMcf/d of capacity from Clinton, PA to points in Loudoun, VA.

- Northern received authorization to construct the Bakersfield Compressor Station Project, including 11,152 hp of compression and 1.45 miles of pipeline with a 200 MMcf/d capacity in Pecos County, TX.

- Columbia received authorization to construct and operate its Central Virginia Connector Project which would provide 45 MMcf/d of capacity on its existing system in Goochland and Louisa counties, VA.

- National Fuel received authorization to construct and operate its Line QP Project and to abandon by sale its Queen Storage Field and related facilities, all located in Forest and Warren counties, PA.

- Delfin LNG received authorization to construct and operate certain onshore facilities in Cameron Parish, LA to transport natural gas to Delfin LNG’s planned LNG deepwater port export facility.

- Tennessee received authorization to construct and operate its Abandonment and Capacity Restoration Project, which would abandon pipeline facilities from Station 40 in Natchitoches Parish, LA to Station 216 in Columbiana County, OH and construct replacement facilities in OH and KY.

- National Fuel received authorization to abandon Colden Well 0925-I at its Colden Storage Field in Erie County, NY. This will not affect the capacity or deliverability of the field.

- Tres Palacios Gas Storage received partial authorization to amend the certificated working gas volume at its Tres Palacios Gas Storage Facility located in Matagorda, Colorado and Wharton counties, TX with requirements to conduct additional tests of cavern integrity.

- Columbia received authorization to construct and operate Wellington Storage Wells 12599 and 12600 at its Wellington Storage Field in Lorain and Medina counties, OH. The new wells will not change the certificated physical parameters of the field.

- National Fuel received authorization to abandon Henderson Well 3168 at its Henderson Storage Field in Venango County, PA. This will not affect the capacity or deliverability of the field.

- EcoElectrica received authorization to place into service its LNG Terminal Sendout Project, which will use an existing spare LNG vaporizer unit at its import terminal in Peñuelas, Puerto Rico, to increase deliverability by 93 MMcf/d for a total sendout of 279 MMcf/d.

- Texas Gas requests authorization to plug and abandon Well 17378 and associated lateral line and equipment at its Midland Storage Field in Muhlenberg County, KY.

- CIG requests authorization to abandon its Rawlins Processing Plant in Carbon County, WY. This includes abandonment by sale of related gas liquids assets to Sinclair Wyoming Refining Co.

- Texas Eastern requests authorization to offset and replace a 1,250-foot section of 20-inch pipeline beneath the Rahway River in Linden and Woodbridge, NJ.

- Jordan Cove requests authorization to site, construct, and operate its LNG Terminal on the North Spit of Coos Bay, OR. The terminal is designed to receive 1.17 Bcf/d of natural gas and produce approximately 1 Bcf/d of LNG for export.

- Pacific Connector requests authorization to construct a 1.2 Bcf/d pipeline to provide feedgas to the Jordan Cove LNG terminal. The pipeline would extend 229 miles from the interconnect with the Ruby and GTN pipelines in Klamath County, OR to Coos County, OR.

Richard Nemec can be reached at: rnemec@ca.rr.com.

Comments