February 2021, Vol. 248, No. 2

Projects

Projects February 2021

Waha Hub Prices Rise with Permian Highway Pipeline In Service

The Permian Basin basis to the Henry Hub briefly went positive as the Permian Highway pipeline entered service, the U.S. Energy Information Administration’s said.

The price at the Waha Hub in West Texas, near Permian Basin production activities, averaged $2.42/MMBtu on Dec. 30, which is 3 cents/MMBtu above the Henry Hub price. As of Wednesday, the price averaged a weekly high of $2.52/MMBtu, 18 cents/MMBtu below the Henry Hub price, according to the EIA report.

Kinder Morgan’s Permian Highway pipeline began commercial in-service on Jan. 1, which adds 2.1 Bcf/d of takeaway capacity out of the Permian Basin to Katy, Texas, with connections to the U.S. Gulf Coast and Mexico markets.

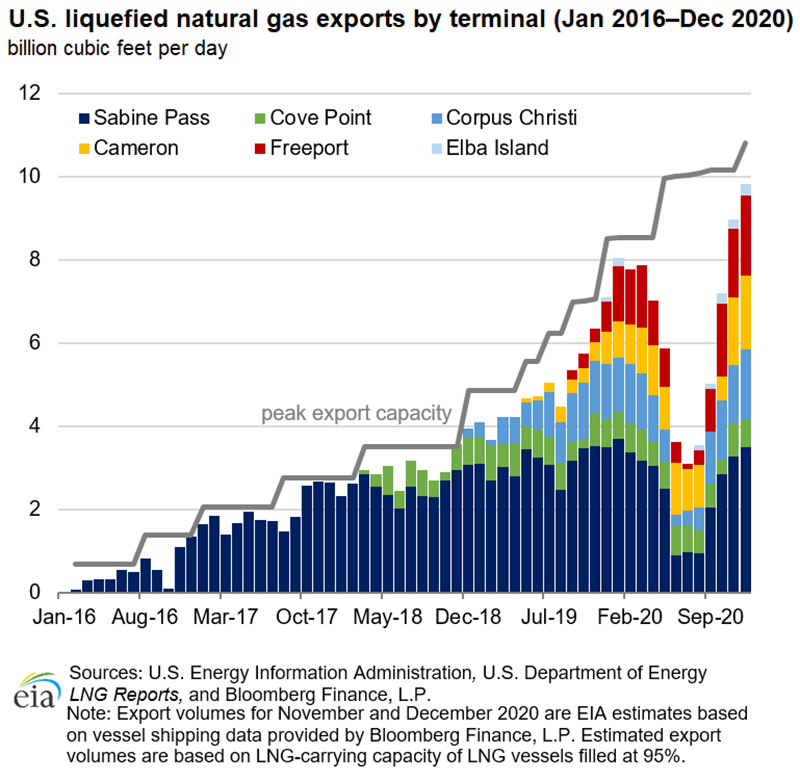

This report accompanied news that U.S. LNG exports had another record-breaking month in December. The exports averaged 9.8 Bcf/d, EIA estimates show, based on Bloomberg Finance shipping data.

This follows a November that was also record breaking and makes December’s exports more than three times higher than the export levels from summer 2020, the EIA report states.

Factors to the higher levels of U.S. LNG exports include colder-than-normal winter temperatures in key Asian LNG-consuming markets and unplanned outages at LNG export facilities in Australia, Malaysia, Qatar, Norway, Nigeria and Trinidad and Tobago.

These outages increased natural gas and LNG prices in Asia and Europe, attracting higher volumes of flexible LNG supplies from the U.S., according to the EIA report.

The total U.S. consumption of natural gas fell, though, by 2.9% compared to the previous report, according to data from HIS Markit.

Natural gas deliveries to U.S. LNG export facilities, or LNG pipeline receipts, remained about the same, averaging 11 Bcf/d, according to the report that reflects data from Dec. 31 through Jan. 6.

Maddy McCarty, Digital Editor

Nord Stream 2 Construction more than 90% Complete

The Gazprom-led Nord Stream 2 consortium is expected to start laying a remaining 100 km (62 mi) stretch in Danish waters from Jan. 15.

The final 1.6-mile (2.6-km) stretch in German waters has been finished, Refinitiv Eikon data tracking movements of pipe-laying ships indicated in December.

Double E Seeks Permits to Build Texas-New Mexico Natural Gas Pipeline

Double E Pipeline LLC has asked U.S. energy regulators for permission to start building its natural gas pipeline project in Texas and New Mexico, a filing shows.

According to its website, Double E is owned by units of Summit Midstream Partners LP, which has 70%, and Exxon Mobil Corp, which owns 30% of the company.

Double E wants to build a 135-mile (217-km) pipeline to transport about 1.35 Bcf/d of gas from the Delaware Basin in the Permian Shale in New Mexico and Texas to the Waha hub in West Texas.

Double E is one of several pipelines proposed to transport Permian gas and is expected to enter service in 2021.

The Permian is the biggest U.S. production area for crude oil and the second biggest for gas. Drillers there are mostly seeking oil, which comes out of the ground with a lot of associated gas.

Permian producers have burned record amounts of gas in recent years due to a lack of gas pipeline capacity. That lack of capacity caused gas prices at the Waha hub to turn negative several times in 2019 and 2020, which means some producers paid others to take their gas.

In addition to Double E, other gas pipes under construction or development in the Permian include WhiteWater Midstream and MPLX LP’s 1.8-bcf/d Agua Blanca project, which is expected to enter service in early 2021, and WhiteWater, MPLX, West Texas Gas Inc and Stonepeak Infrastructure Partners’ 2.0-bcfd Whistler project, expected in the second half of 2021.

Kinder Morgan Inc’s 2.1-Bcf/d Permian Highway pipe, meanwhile, entered service on Jan. 1.

New US Army Corps’ Stream-Crossing Rules Could Hurt Pipelines

The U.S. Army Corps of Engineers completed changes to its Nationwide Permits, a program for utility stream crossings, criticized by environmentalists, which analysts say could cause problems for oil and natural gas pipelines.

In recent years, state governments, Native American tribes and environmental groups have successfully challenged the Army Corps’ use of the Nationwide Permit Program to stop construction of several big oil and gas pipelines.

Those projects include TC Energy Corp’s Keystone XL crude pipe and Equitrans Midstream Corp’s Mountain Valley gas pipe.

The revisions, which make it easier for companies to receive Nationwide Permits, also create three categories of linear utility infrastructure: oil and gas pipes, water and sewer pipes, and power and telecommunications lines.

“Because these changes lack scientific or legal justification and threaten important waterways, we hope and expect the Biden administration will move quickly to undo them,” said Jon Devine, the director of federal water policy at the Natural Resources Defense Council.

Administration to exclude oil and natural gas pipelines from the program.

Currently, utilities and energy companies can seek a Nationwide Permit that allows their projects to cross several streams.

But without access to Nationwide Permits, oil and gas pipelines would have to seek individual stream-crossing permits.

German State Creating Foundation to Back Nord Stream 2

The German state of Mecklenburg-Vorpommern plans to set up a foundation to facilitate the completion of the Nord Stream 2 (NS2) pipeline to bring Russian gas to Germany and to fend off the threat of increased U.S. sanctions that halted work last year.

The $11 billion pipeline would double the existing Nord Stream pipeline’s capacity and has become a focal point of Russia’s confrontation with the West.

The United States has said Europe is undermining its energy security by increasing its reliance on Russian gas, while Russia says the United States is using sanctions to block the pipeline and protect its own natural gas industry.

A spokesman for the state premier’s office in Schwerin confirmed media reports that the local coalition, made up of Chancellor Angela Merkel’s conservatives and Social Democrats, aimed to launch a public sector foundation.

Public sector broadcaster NDR said earlier the body would boost the role of renewables and gas as a bridging technology toward cleaner fuels and shield the companies involved from U.S. sanctions.

Details of the body’s wider objectives would emerge later, but a contribution to finishing NS2 was included in its agenda, he said, adding approval by the state parliament was needed because public sector capital is involved.

It would be far harder for the United States to target a state-backed foundation with measures such as freezing funds, than private companies.

Pembina Pipeline Launches Open Season on Cochin Pipeline

Pembina Pipeline Corporation announced that PKM Cochin and Pembina Cochin have launched an open season to obtain binding commitments for the transport of light condensate on the Cochin Pipeline.

The Cochin Pipeline currently transports light condensate from receiving points at Kankakee County, Illinois; Clinton, Iowa; and Maxbass, North Dakota to Fort Saskatchewan, Alberta, Canada.

Through the open season, Cochin Canada will make available up to 14,000 bpd of committed capacity on the Canadian Segment of the Cochin Pipeline, subject to execution by an interested shipper of a transportation services agreement for requested capacity.

Throughput and deficiency incentive rate service for transportation of light condensate on the U.S. Segment of the Cochin Pipeline from receiving points at Kankakee County, Illinois or Kankakee County, Illinois and Clinton, Iowa will also be made available by Cochin U.S., subject to execution by the interested shipper of a throughput and deficiency agreement.

Cochin anticipates that the committed capacity that is the subject of the open season will be made available as early as April 1 and service under the T&D Agreements would be available for commencement at the same time. The open season closes Feb. 18.

Two-Year Plan Proposed to Undo Work on Atlantic Coast Pipeline

The developers of the now-canceled Atlantic Coast Pipeline have laid out plans for how they want to go about unwinding the work that was done for the multistate natural gas project and restoring disturbed land.

In a filing with federal regulators, the company proposed a two-year timeline for efforts across West Virginia, Virginia and North Carolina, where progress on the project ranged from uninitiated to essentially complete.

The plan outlines where the company wants to clean up felled trees and where it plans to leave them behind, and it proposes abandoning the 31 miles (50 km) of pipe that was installed in place.

“We spent the last several months working really closely with landowners and agencies to develop the most responsible approach for closing out the project,” said Aaron Ruby, lead developer of Dominion Energy. “And ultimately our primary goal is to complete the project as efficiently as possible, and with minimal environmental disturbance.”

Ruby also confirmed for the first time that the company does not intend to voluntarily release the easement agreements it secured on landowners’ properties.

In most cases, the legal agreements were obtained through negotiations with landowners, who were paid and who the company has previously said will keep their compensation. But in other cases, in which sometimes vociferously opposed landowners fought the project, the easements were obtained through eminent domain proceedings.

Asked if there are any plans to sell the easement agreements to a third party such as another pipeline or infrastructure project, Ruby said, “We have no plans to do so at this time.”

Ruby also said the company has no plans to voluntarily compensate landowners who are still in court fighting over the legal fees and other costs they incurred related to the project. On Dec. 18, a federal judge in North Carolina awarded one group of defendant landowners just over $20,000 in fees and costs.

Plans for the 600-mile (965-kilometer) Atlantic Coast Pipeline were first announced with great fanfare in 2014, but it was running years behind schedule. Legal challenges brought by environmental groups prompted the dismissal or suspension of numerous permits and led to delays in construction and ballooning costs that brought the estimated price tag to $8 billion.

Building the project was to involve tree removal and blasting and leveling some ridgetops as the pipe, 42 inches (1 meter) in diameter for much of its path, crossed mountains, hundreds of water bodies and other sensitive terrain and burrowed underneath the Appalachian Trail.

Comments