May 2021, Vol. 248, No. 5

Features

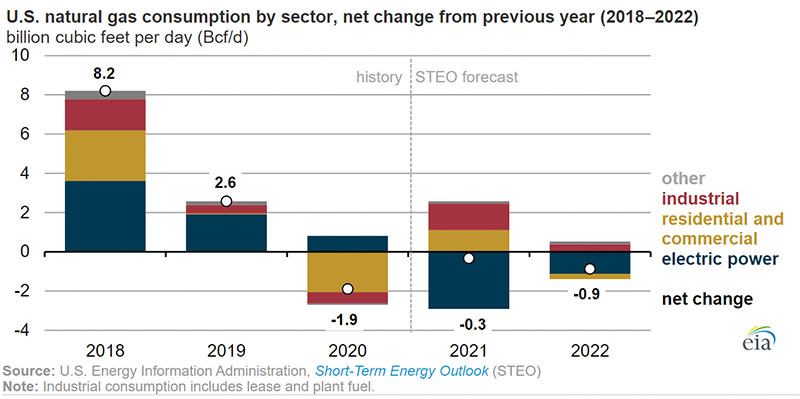

US Consumption to Continue Decreasing

By U.S. Energy Information Administration

EIA forecasts a decreased total U.S. natural gas consumption in 2021 and 2022, following a decline in 2020. Consumption in 2020 was 1.9 Bcf/d lower than the all-time high of 85.1 Bcf/d set in 2019.

Total consumption declined as a result of the economic slowdown associated with the COVID-19 pandemic and lower heating demand amid milder temperatures. Although we expect natural gas consumption to continue to fall in 2021 and 2022, changes in sector-level natural gas consumption show different trends than in 2020.

The STEO forecasts that electric power will be the only sector that will consume less natural gas in 2021 after being the only sector to increase its natural gas consumption in 2020.

Natural gas prices in 2019 and 2020 were historically low, making natural gas more competitive with coal for generating electric power. However, because forecast natural gas prices will be higher and more renewable capacity will come online in 2021 and 2022, we expect more electricity generation will come from coal and renewables and less from natural gas.

Residential and commercial natural gas consumption fell by a combined 2.1 Bcf/d from 2019 to 2020 primarily because of warmer weather and responses to the COVID-19 pandemic. The warmer weather, which resulted in 9% fewer heating degree days (HDDs) in 2020 than in 2019.

Based on forecasts by the National Oceanic and Atmospheric Administration, we expect HDDs will increase by 5% in 2021 and by 1% in 2022. We also expect residential and commercial natural gas consumption will increase in 2021 and then decrease slightly in 2022.

In the STEO forecast, industrial natural gas consumption will increase in 2021 and 2022 after decreasing by 600 MMcf/d in 2020. Although also affected by heating demand, industrial natural gas consumption is more affected by economic trends.

As a result of a weaker economy during the COVID-19 pandemic, industrial activity in April 2020, as measured by STEO’s natural gas-weighted industrial consumption index, was at its lowest level since the 2009 financial crisis. This index reflects the growth of manufacturing subsectors and their relative importance to total natural gas consumption. EIA expects the index to exceed 2019 levels on an annual basis in 2021 and 2022 as businesses resume operations.

We increased the natural gas-weighted industrial consumption index in 2021 and 2022 in our forecast to reflect expectations for economic activity based on IHS Markit forecasts.

Comments