August 2022, Vol. 249, No. 8

Features

Liquid Fuels Production Expected to Grow in Brazil, Canada

By U.S. Energy Information Administration (EIA)

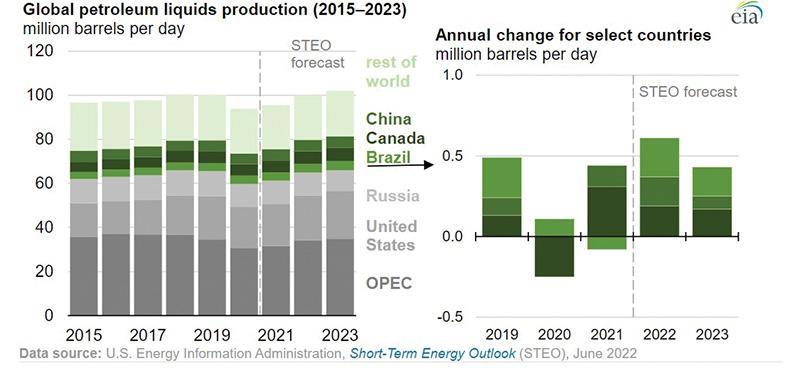

In the U.S. Energy Information Administration’s (EIA’s) Short-Term Energy Outlook (STEO), liquid fuels production in Brazil, Canada and China is forecast to increase this year and next, contributing to growth in overall non-OPEC (Organization of the Petroleum Exporting Countries) petroleum production.

EIA forecast that petroleum production in the combined non-OPEC countries, excluding the Unites States and Russia, will increase by 3%, or 900,000 bpd, in 2022 and by 2%, or 800,000 bpd, in 2023, compared with an increase of less than 1% (200,000 bpd in 2021).

The United States will account for about 60% of the growth in combined liquid fuels production in all non-OPEC countries, followed by Brazil and Canada. By the end of 2023, Brazil’s liquid fuels production will increase by 400,000 bpd, and Canada’s output will increase by nearly 400,000 bpd, to 5.9 MMbpd.

For Brazil, EIA assumed production from six new floating production storage and offloading (FPSO) units will ramp up through 2023 and continue to drive growth, notably at the Sepia, Mero and Buzios fields. Once at full capacity, the FPSOs will each produce between 70,000 bpd and 180,000 bpd of liquid fuels. Brazil’s production is expected to increase from 3.7 MMbpd in 2021 to 3.9 MMbpd in 2022 and to 4.1 million bpd in 2023.

Canada’s growth in crude oil and natural gas production during 2022 and 2023 is driven primarily by expanding oil sands and debottlenecking projects. Canada’s growth, in part, is from the Enbridge Line 3 crude oil pipeline expansion (760,000 bpd capacity), which became operational in October 2021.

The TransMountain pipeline expansion project (890,000 bpd capacity) is scheduled to enter service at the end of 2022. Additional Enbridge expansions and optimizations to its existing pipeline system, if completed, will add more than 400,000 bpd of export capacity through 2023.

As a result of the new pipeline capacity from Enbridge and other planned pipeline expansions, current constraints on oil exports from Canada are expected to lessen by the end of 2023 and drive increased production.

Comments