January 2022, Vol. 249, No. 1

Global News

Global News January 2022

US Oil Pipelines at Half-Capacity: Wood Mackenzie

Overall U.S. pipeline capacity utilization entered 2022 at around 50%, compared with a range of 60% to 70% headed into early 2020 before the coronavirus pandemic hit, according to consultancy Wood Mackenzie.

U.S. oil production, which surged to 13 MMbpd in early 2020 to make the United States the top oil producer, has averaged 11 MMbpd in 2021.

Numerous crude oil pipelines were built to increase takeaway capacity from the Permian Basin – the largest U.S. oilfield – when production surged between 2017 and 2020. Generally, basins that are overbuilt, like the Permian, have lower uncommitted shipping rates than before the pandemic, but basins with less pipeline capacity have managed to raise rates, because there are fewer shipping options, said Ryan Saxton, head of oil data at Wood Mackenzie.

During the pandemic, companies began offering discounted rates to committed shippers as an incentive, said Jesse Mercer, senior director of oil markets at Enverus. As production continues to return, companies are likely to wind down those offers, he said.

North Dakota’s Bakken production is lagging pre-pandemic levels, and Energy Transfer LP’s Dakota Access Pipeline, which can carry about 570,000 bpd out of the region, is at about 77% of utilization, compared with nearly full utilization before the pandemic, Saxton said.

However, Dakota Access’ uncommitted tariff rate finished 2021 above its pre-pandemic rate, due to fewer pipelines out of the Bakken, Saxton said.

In its third quarter earnings, Phillips 66 noted its midstream transportation pre-tax income rose $30 million from the second quarter, in part due to Gray Oak, one of the largest oil pipelines from the Permian Basin with a capacity of 900,000 bpd.

BridgeTex, a joint venture from Magellan Midstream Partners LP, is at around 70% utilization, Saxton said. The 440,000-bpd line delivers crude to Magellan’s terminal in East Houston.

BridgeTex volumes in the third quarter 2021 fell to just over 315,000 bpd, about 5% below volumes in 2020, due to a decrease in uncommitted shipments in the quarter and unfavorable pricing differentials, Magellan said in its most recent earnings call. The company’s crude transportation and terminals revenue decreased $38 million in the third quarter.

US Natural Gas Production to Increase in 2022: EIA

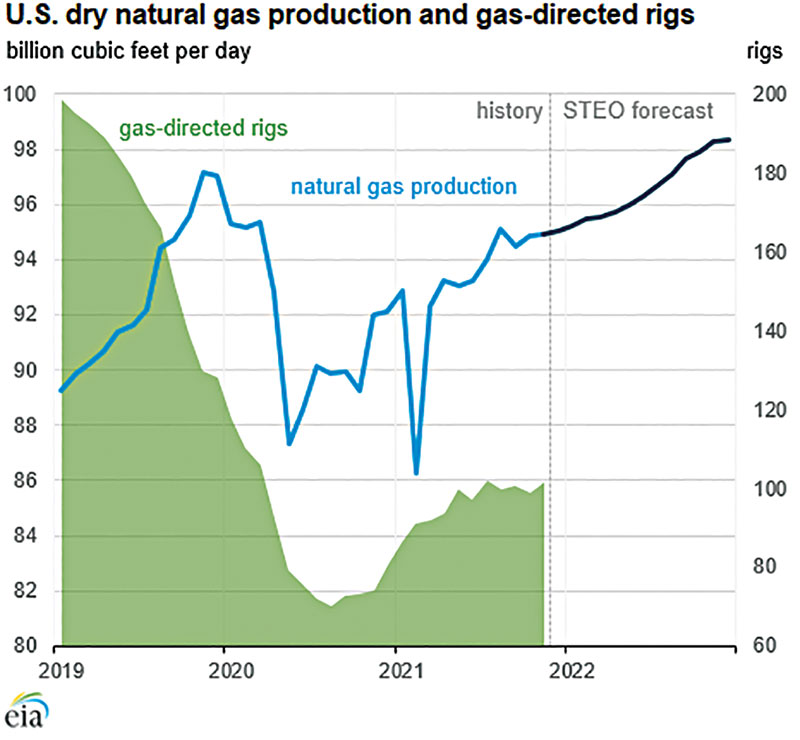

U.S. Dry natural gas production will increase from 95.1 Bcf/d in October 2021 to 97.5 Bcf/d by December 2022, an increase of 2.4 Bcf/d (2.5%), according to the Energy Information Administration’s updated forecast.

If realized, the December 2022 forecast production level will exceed the previous record of 97.2 Bcf/d, which was set in November 2019. The November 2019 record was set before COVID-19 was declared a pandemic, and before the COVID-19-associated declines in demand resulted in production declines to a low of 87.3 Bcf/d in May 2020.

Dry natural gas production has generally risen since October 2020. Natural gas production remained above 92.0 Bcf/d in 2021, except in February, when a winter storm substantially affected oil and natural gas production in Texas.

“In both the Haynesville region and the Appalachian Basin, according to our Drilling Productivity Report, we expect dry natural gas production will set new highs this December as a result of both increased drilling activity and output per well,” the EIA said in its December Short-Term Energy Outlook. “Associated natural gas production also increased, because producers have been completing wells from their inventories of drilled but uncompleted (DUC) wells, which peaked in June 2020.”

Osaka Gas Plans to Enter India’s City Market

Osaka Gas said in December it plans to enter India’s city gas market “in the near future” as a part of an effort boost profits through overseas expansion.

“We want to be the first Japanese company to enter the Indian city gas market as a joint venture with a foreign partner with expertise in city gas infrastructure,” a spokesperson said.

The Indian government is promoting the use of natural gas and grants operators exclusive marketing rights and infrastructure ownership for a certain period, they said.

The Japanese city gas supplier aims to supply natural gas to vehicles, homes and industries in India, using trucks and pipelines, as natural gas vehicles account for the majority of city gas demand in India, they added.

Federal Grand Jury Indicts Amplify Energy in California Spill

A U.S. grand jury has indicted Amplify Energy Corp. and two of its subsidiaries on charges of illegally and negligently discharging oil during a pipeline break in California in October and failing to respond to alarms.

The Department of Justice said the indictment alleges that the companies, which own and operate the 17-mile (27 km) San Pedro Bay Pipeline, failed to properly respond to eight alarms over more than 13 hours on Oct. 1-2.

Prosecutors accuse Amplify and its Beta Operating Co. and San Pedro Bay Pipeline Co. subsidiaries of shutting and restarting the pipeline five times after the first five alarms were triggered, sending oil flowing through the damaged pipeline for more than three hours.

Amplify investigated the pipeline, but its leak detection system was malfunctioning, it said in a statement, “wrongly signaling a potential leak at the platform where no leak could be detected by the platform personnel and where no leak was actually occurring.”

New York City Bans Natural Gas in New Buildings

The New York City Council voted in December to ban the use of natural gas in new buildings, following in the footsteps of dozens of smaller U.S. cities seeking to shift from fossil fuels to cleaner forms of energy.

The law would apply to new buildings under seven stories high at the end of 2023 and those over seven stories in 2027. There are exceptions for new buildings used for certain activities, including manufacturing, hospitals, commercial kitchens and laundromats.

Previously, the most populated U.S. city that has banned gas in new buildings is San Jose in California with about 1 million residents.

In 2020, the pandemic lockdown year, U.S. carbon emissions from fossil fuels fell to their lowest since 1983 but were predicted to rise about 7% in 2021. That’s partly because power providers were burning more coal to generate electricity due to a sharp increase in gas costs.

Brazil’s Petrobras Expects to Sell TBG Pipeline Unit in 2022

Brazilian state-run oil company Petroleo Brasileiro SA expects to sign a deal to sell its TBG natural gas pipeline unit next year, Chief Strategy Officer Rafael Chaves said during a presentation to a Rio de Janeiro industry group.

In August, Reuters reported U.S. private equity firm EIG Global Energy Partners made a binding offer worth several hundred million dollars for the asset.

Regulator: Canadian Oil Output to Peak Sooner Than Expected

Oil output in Canada, the world’s fourth-largest producer, will climb over the next decade and peak at 5.8 MMbpd in 2032, seven years sooner than previously forecast, the Canada Energy Regulator (CER) said.

The CER said a rebound in oil prices after the 2020 pandemic-related crash meant more near-term investment would help production grow quicker than previously anticipated, before it starts to slowly decline to 4.8 million bpd by 2050. The level of anticipated peak production is unchanged from last year’s projection. Canada’s current production is 5 million bpd.

The CER said oil production is likely to remain resilient over the next three decades, despite relatively low oil prices and steadily more ambitious climate policies, thanks to northern Alberta’s vast oil sands deposits, which account for nearly two-thirds of Canadian production.

“The resilience is really owing to the unique nature of the oil sands. Once they are built, they are very long-lived and operating costs are quite low,” Darren Christie, the CER’s chief economist.

Aramco Signs Gas Pipelines Deal with BlackRock, Hassana

Saudi Aramco said it signed a $15.5 billion lease-and-leaseback deal for its gas pipeline network with a consortium led by BlackRock Real Assets and state-backed Hassana Investment Co.

Gulf oil producers are looking at sales of stakes in energy assets and raising cash through long-term leases, capitalizing on a rebound in crude prices to attract foreign investors. Earlier this year Aramco sold a 49% stake in its oil pipelines to a consortium led by U.S.-based EIG under a similar structure for $12.4 billion.

As part of the latest transaction, a newly formed subsidiary, Aramco Gas Pipelines Co, will lease usage rights in the state energy firm’s gas pipelines network and lease them back to Aramco for a 20-year period, it said. In return, Aramco Gas Pipelines Co will receive a tariff payable by Aramco for the gas products that will flow through the network, backed by minimum commitments on throughput.

Aramco will hold a 51% majority stake and sell a 49% stake to investors led by BlackRock and Hassana, the asset management arm of the General Organization for Social Insurance (GOSI).

Blast-Damaged Part of Arizona Pipeline Out for Months

Kinder Morgan said it expects part of its El Paso natural gas pipeline to remain out of service for “several months” following a blast in Arizona that killed two people.

The company told customers on Nov. 30 that activities were underway to return a portion of the blast-damaged El Paso Line 2000 for limited operation at reduced operating pressure for the sole purpose of conducting an inspection on the line, including recently installed pipe. The reduction has limited flows to California as the state was using more natural gas for power generation.

The National Transportation Safety Board said the damaged pipe was installed in 1985 and previously transported crude oil. It was converted to gas service about 20 years ago and was acquired by Kinder Morgan in 2012.

Key Ecuador Crude Oil Pipeline Ruptures While Halted by Erosion

Erosion in the Amazon region ruptured Ecuador’s state-owned pipeline SOTE in December, the same problem that led to its shutdown during the previous week, the Energy Ministry said.

The collapse in the pipeline’s tubing did not cause any environmental damage given it was empty following its suspension, along with the privately-owned OCP pipeline, last week, the ministry said.

Earlier in the same day of the rupture, President Guillermo Lasso had said that operations would begin to normalize in the next 17 days, weather permitting. Petroecuador has built six detours for the SOTE and is working on a seventh, while OCP has eight temporary and two permanent detours.

Before Ecuador’s government declared force majeure over its oil exports and production contracts due to the pipeline closures, the country’s crude production averaged 485,000 bpd. By mid-December, it had fallen to about 220,000 bpd, according to government data.

Comments