November 2023, Vol. 250, No. 11

Global News

Global News November 2023

Global News November 2023

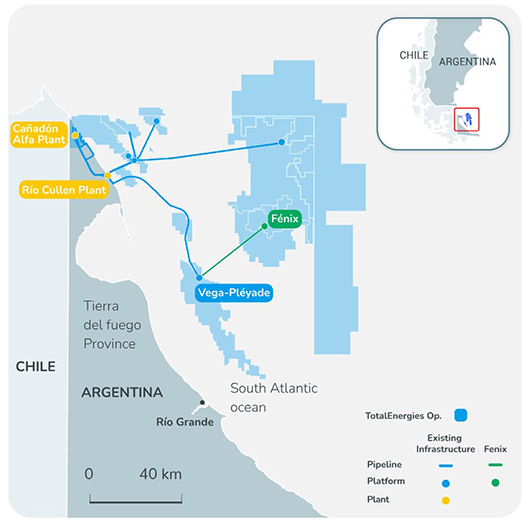

TotalEnergies Starting Production at Fenix Field in 2024

TotalEnergies will begin drilling at the Fenix field, off the southern Argentine province of Tierra del Fuego in March 2024, according to company Vice President Catherine Remy, who spoke at Argentina’s Oil & Gas Exhibition.

The $700 million project will produce 353 MMcf/d (10 MMcm/d) of natural gas, which equates to 8% of the country’s total production. Production by the French company is expected to begin in November 2024, she said

Increased domestic energy production can help the Argentina cut into its trade deficit of $4.5 billion, which was accumulated in 2022. TotalEnergies said in September 2022 that it had made the final investment decision to start work on the Fenix project.

Argentina is expected by analysts to achieve a positive trade balance of $100 million this year. This boost comes as the country attempts to protect the central bank’s limited foreign exchange reserves.

TotalEnergies has a 37.5% stake in the Fenix project, which it operates, in partnership with WintershallDea, also with 37.5%, and Pan American Energy with 25%.

Chevron Acquiring Hess in All-Stock Transaction

Chevron Corporation entered into a definitive agreement with Hess to buy all of the outstanding shares of Hess in an all-stock transaction valued at $53 billion, gaining a 30% stake in Exxon’s massive discoveries in Guyana.

The Stabroek block in Guyana is an “extraordinary asset,” Chevron said, in a release to the media. Chevron already operates in neighboring Venezuela and Suriname.

Additionally, Hess’ Bakken assets add another leading U.S. shale position to Chevron’s DJ and Permian basin operations and further strengthen domestic energy security.

Under the terms of the agreement, Hess shareholders will receive 1.0250 shares of Chevron for each Hess share. The total enterprise value, including debt, of the transaction is $60 billion.

“This combination positions Chevron to strengthen our long-term performance and further enhance our advantaged portfolio by adding world-class assets,” said Chevron Chairman and CEO Mike Wirth. “Importantly, our two companies have similar values and cultures.”

Chevron recently acquired U.S. companies PDC Energy and Noble Energy, bringing its total oil and gas output, along with Hess, to about 3.7 MMbpd, boosting the company’s shale output to 40%.

Civitas to Buy Permian Oil Assets for $2.1 Billion

Civitas Resources entered into an agreement with Vencer Energy, a Vitol investment, to acquire oil-producing assets in the Midland Basin of West Texas for about $2.1 billion.

The move will increase Civitas’ portfolio with an estimated 400 gross development locations, primarily located in the Spraberry and Wolfcamp formations. About 40% of these new locations boast an estimated IRR of over 40% at $70 per barrel WTI. With this acquisition,

Civitas will accumulate more than 1,200 high-quality oil development locations in the Permian Basin.

With operations spanning three productive basins, Civitas will have the flexibility to allocate capital investments and activity levels across assets, thereby optimizing returns and mitigating potential operational and timing risks.

This transaction is scheduled to close in January 2024.

DNO Makes Norway Gas Condensate Discovery

Norway’s DNO said it has uncovered gas condensate at its Norma location in the North Sea and will continue to explore nearby areas.

Early analysis shows gross recoverable resources of 25MMboe to130 MMboe. A spokesman for the company told Reuters a “best-guess estimate” for the find is 70 MMboe.

Unfortunately, from DNO’s perspective, Norma is situated in an area with extensive infrastructure already in its central portion, making development options limited.

This year, DNO has made four discoveries off Norway, including the largest find since 2013 – the 120-230 MMboe Carmen.

LM Energy Sells 130 Miles of Pipelines of Oil Gathering Assets

LM Energy Holdings entered into definitive agreements to sell assets related to its Touchdown Crude Oil Gathering System in Eddy and Lea counties, New Mexico. The transaction is expected to close during the fourth quarter of 2023.

LM began the development of its crude oil gathering business in 2019 and has constructed over 130 miles of pipelines, two terminals with 136,000 barrels of combined storage capacity, and grew volumes from zero to approximately 75,000 bpd on a 100% greenfield basis.

“This transaction positions LM as a stronger and even better capitalized company that is focused on our gas business,” said Elliot Gerson, CEO at LM Energy.

LM has continued expanding its gas gathering systems in the two counties, and currently provide low-pressure gathering, dehydration, compression, liquids handling and high-pressure gathering services.

The company has constructed over 70 miles of pipelines to-date and will commission its sixth compressor station during the fourth quarter of 2023.

Irish Planning Body Nixes Large LNG Terminal over Climate

Plans for a huge LNG terminal in Ireland have been shot down by the country’s top planning body, which cited the government’s greenhouse gas reduction targets.

The decision quite possibly sounded the death for the project described by supporters as essential to the country’s energy security.

An Bord Pleanála, the planning appeals body, said it had refused permission for a terminal with regasification capacity of 798.11 cf/d (22.6 MMcm/d) and a storage capacity of 6.36 Bcf (180,000 MMcm) in Kerry County, located on the west coast.

Allowing the development at this time “would be contrary to current government policy,” said the decision, which could potentially be challenged in court.

“Further fossil fuel generation risks a failure to meet 2050 targets, would create a lock-in effect, delaying transition to a zero carbon economy and displacing investment in clean energy,” the decision said.

Ireland produces some gas but is becoming increasingly dependent on gas import pipelines.

Chevron Acquires Majority Stake in Utah Hydrogen Storage Project

Chevron bought a majority stake in what would be world’s largest proposed storage facility for hydrogen from renewable energy, if it reaches completion. The financial terms of the deal were not disclosed.

The proposed facility, ACES Delta, was purchased from private equity Haddington Ventures as part of a plan to develop “a large-scale, hydrogen platform that provides affordable, reliable, ever-cleaner energy,” according to Austin Knight, vice president of hydrogen, Chevron New Energies.

The facility will use electrolysis, powered by wind and solar to produce hydrogen, which will be stored in salt caverns. Last year, the Delta, Utah project received the first U.S. Department of Energy loan for clean energy in nearly a decade, of $504 million.

It is the first project for the acquisition, designed to convert and store up to 100 metric tons per day of hydrogen, is under construction and is expected to enter commercial-scale operations in mid-2025, Chevron said.

ACES Delta is the joint venture of Mitsubishi Power Americas and Magnum Development.

‘Outside Activity’ Likely Damaged Gas Pipeline, Finland Says

A subsea gas pipeline connecting Finland and Estonia under the Baltic Sea has been damaged in what appears to be a deliberate act, the Finnish government said.

NATO Secretary General Jens Stoltenberg said NATO was sharing its information over the damage and stands ready to support the allies concerned, according to Reuters.

The Balticconnector gas pipeline was shut down Oct. 8 over concerns about a gas leak in the 48 miles (77-km) pipeline. Finnish operator Gasgrid said it could take months or more to repair.

“It is likely that damage to both the gas pipeline and the communication cable is the result of outside activity,” Finnish President Sauli Niinistö said, according to Reuters. “The cause of the damage is not yet clear. The investigation continues in cooperation between Finland and Estonia.”

The pipeline between Inkoo in Finland and Paldiski in Estonia crosses the Gulf of Finland, an arm of the Baltic Sea that stretches east into Russian waters, terminating at St Petersburg.

“The fall in pipeline pressure was quite fast, which would indicate it's not a minor breach. But the cause of it remains unclear,” said a Baltic energy official with knowledge of the situation, who spoke to Reuters on condition of anonymity.

Comments