October 2023, Vol. 250, No. 10

Features

Williams’ DJ Basin Move May Signal New Investments

By Richard Nemec, Contributing Editor, P&GJ North America

(P&GJ) — Early in 2023, Tulsa-based energy infrastructure giant Williams wasted no time in announcing that it had acquired MountainWest Pipelines Holding Company (MountainWest) from Southwest Gas Holdings, in a transaction that included $1.07 billion in cash and $430 million in assumed debt, for an enterprise value of $1.5 billion.

MountainWest comprises roughly 2,000 miles of interstate natural gas pipeline systems primarily located across Utah, Wyoming and Colorado, totaling approximately 8 Bcf/d of transmission capacity, and it also operates 56 Bcf of total storage capacity, including the Clay Basin underground storage reservoir serving western markets in the Rockies and elsewhere.

Williams’ officials confirm that they expect new investment opportunities to flow from the acquisition. Also, they say the prospect for technological advances and system enhancements is present in the Rockies as it is throughout their midstream portfolio.

“We continue to invest in our modernization and emission reduction programs across our entire U.S. footprint, including the Rockies,” said Candyce Fly Lee, Williams vice president and general manager of MountainWest.

More recently in mid-2023, Colorado state energy officials were moving ahead with implementing stricter regulations involving the use of produced water in the oil and natural gas industry, something that could impact Williams’ newly acquired assets.

Colorado’s Department of Natural Resources Executive Director Dan Gibbs appointed a governing body of the Colorado Produced Water Consortium, a recent creation of the state legislature to help reduce the consumption of freshwater within oil and gas operations.

In early July, the state added 22 additional technical members, representing government and private sector experts, as well as research, environmental and oil and gas industry institutions.

In 2019, legislation changed the mission of the Colorado Oil and Gas Conservation Commission (COGCC) from promoting the efficient development of oil and gas resources to protecting public welfare, health, safety and the environment and wildlife in the development of oil and gas operations.

Consequently, in the following years oil and gas and air quality regulators adopted various regulations for the industry. Earlier in 2023, analyst calls with oil and gas CEOs have increasingly been peppered with questions about the regulatory impacts on oil and gas operations in the state.

“We certainly support the energy industry’s efforts to be good environmental stewards and work with the state, but Williams is not in the upstream sector and so we wouldn’t want to speak to the specifics of new policies and regulations on the upstream side,” Lee said.

Pipeline holding company Tallgrass Energy Corp. in mid-year said it will convert a natural gas pipeline into carbon dioxide (CO2) service and ship CO2 from an Archer-Daniels-Midland Co. corn-processing plant in Nebraska to a permanent underground storage hub in Wyoming.

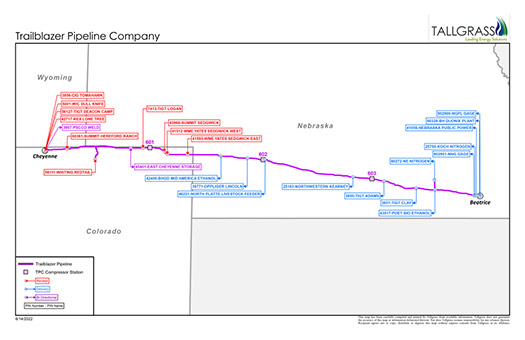

As the Rockies Express (REX) pipeline owner/operator, Tallgrass wants to convert its Trailblazer natural gas pipeline, which runs through Nebraska, Colorado and Wyoming, into a 400-mile carbon dioxide system capable of transporting over 10 mtpa of CO2. The pipeline will connect to Tallgrass’s recently announced CO2 sequestration hub in eastern Wyoming. That facility is anticipated to start service in 2024. Tallgrass plans to lease capacity from REX to replicate the existing gas transportation service for shippers.

Tallgrass’s Trailblazer and REX pipelines filed the application for a certificate and abandonment with the Federal Energy Regulatory Commission (FERC) in late May, stating the proposal would result in more efficient use of existing facilities and minimize construction of new pipelines to serve CO2 transportation needs.

Earlier in 2023, Houston-based natural gas transporter Ruby Pipeline LLC, a Kinder Morgan Inc. and Pembina Pipeline Corp. unit, received U.S. bankruptcy court approval for a Chapter 11 plan built around a $282 million sale of its assets to Tallgrass, allowing the Blackstone unit to acquire the 680-mile pipeline that moves Rockies gas to Northern California and the Pacific Northwest.

In late May, Fitch Ratings affirmed REX’s long-term issuer default rating (IDR) at ‘BB+’ and senior unsecured debt rating at ‘BB+’/’RR4’ with a “stable” overall ratings outlook, noting that this reflects REX’s “highly contracted revenue profile.” Fitch noted that long-term take-or-pay contracts drive more than 95% of the company’s cash flows. Those contracts also offer high-capacity utilization with the daily average at more than 90% of its Clarington-to-Mississippi River pipeline segment which accounts for more than 70% of its EBITDA.

According to Fitch, this demonstrates “demand for the pipeline; intact and stable credit quality of its top customers which drive more than 60% of the EBITDA; and the company’s efforts in growing its demand-pull volumes.”

However, Fitch noted that what it called “the contract cliff in 2024” is a concern, when REX’s most remunerative contract along with some smaller contracts expire. It said this is somewhat offset by the company’s “demonstrated ability to obtain new contracts for the expiring capacity, and potential growth initiatives.”

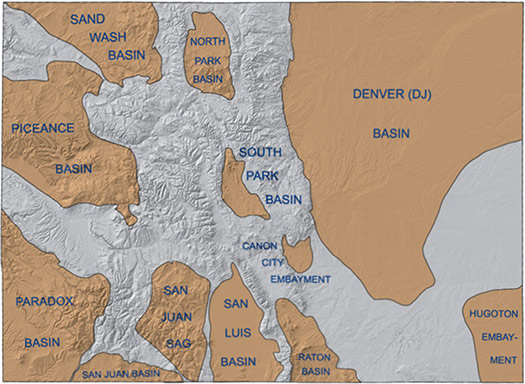

These developments arose in a longer term, wider context in which natural resources-rich Colorado has been working for a number of years to strengthen its oversight of both the environment and its historically robust energy production, particularly in the Denver-Julesburg (DJ) and Piceance Basins in Colorado and Wyoming.

A state report filed in the aftermath of a 2020 gas pipeline explosion which caused the death of a 49-year-old Gypsum, Colorado, mother, noted that from 2017 to 2022, 94% of the alleged 5,643 safety noncompliance identified by state safety officials received no enforcement actions.

This included accidents that caused at least two deaths, more than a dozen injuries and millions of dollars in property damage. “When verbal warnings were given, the program did not always follow up to ensure the safety issues were fixed,” state auditors found.

Despite the Williams acquisition and a $7.6 billion purchase of PDC Energy in 2022 by a unit of Chevron Corp., the region-wide energy sector tenor is cautious with the outlook subdued. Consolidation has continued to mark the Rockies, particularly in the DJ Basin. The PDC Energy purchase will boost Chevron’s cash flow by $1 billion and create $400 million in efficiencies, Chevron CEO Mike Wirth told analysts following the announcement of the deal.

“This seems like a testament to the idea that the DJ can be a core U.S. position even for a company as large as CVX,” according to Brad Handler, a researcher at the Colorado School of Mines’ Payne Institute for Public Policy, who was quoted in a report in the Colorado Daily Sun.

Over the past five years, Colorado oil and gas sector consolidations have proliferated, led by the 2019 $55 billion purchase of Anadarko Petroleum Corp. by Occidental Petroleum Corp. A year later Chevron took over Noble Energy in a $13 billion deal.

In 2021, Civitas Resources was created by merger of three midsized operators – Extraction Oil and Gas, Bonanza Creek Energy and Crestone. Earlier, Bonanza had purchased bankrupt Highpoint Resources.

Earlier still, PDC Energy was in competition for acquisitions, purchasing SCR Energy in 2019 for $1.7 billion and Great Western Petroleum for $543 million in 2022.

While there have continued to be asset sales, such as the 680-mile Ruby gas pipeline from the Rockies to California/Pacific Northwest markets, new infrastructure projects are scarce. In fact, in the past year the U.S. Energy Information Administration’s (EIA) annual energy outlook has looked at a scenario in which no new gas infrastructure is constructed from 2024 through 2050 with resulting slightly lower (Henry Hub) prices and smaller supplies for natural gas.

Restricting interstate natural gas pipeline construction results in an interregional capacity of 163 Bcf/d in 2050, which is 7.4 Bcf/d less than EIA’s Reference case projection. Between 1990 and 2020, U.S. interstate gas pipeline capacity grew considerably, increasing by nearly an estimated 300 Bcf/d over that period, according to EIA’s state-by-state energy tracking system.

Generally, the more recent increases in natural gas pipeline capacity have “accommodated and prompted growth in natural gas production, allowing additional natural gas volumes to reach sectors with growing natural gas consumption, such as natural gas exports and natural gas-fired electric power generation,” both of which would be dampened by no new interstate infrastructure, according to EIA.

The Rockies’ largest gas distribution company, Minneapolis-based Xcel Energy Inc., obtains more than half of its natural gas supplies from the DJ Basin.

“While we don’t plan to participate in any new interstate transmission line projects, we do have a number of capacity reinforcement and expansion [safety] projects in certain parts of our system,” said Xcel spokesperson Tyler Bryant. “As you know, most interstate transmission projects are not typically built by distribution companies, like Xcel Energy, but by production and interstate pipeline companies.”

In May Xcel submitted its first-ever gas infrastructure plan for Colorado state regulators detailing proposed infrastructure investment projects that the eight-state utility holding company considers critical to ensuring that it continues to safely serve its customers in the Rockies.

Spread over mostly the first three of the next six years (2023-28), Xcel plans to spend more than $50 million for pipeline replacements, regulator upgrades, and replacements of obsolete equipment, along with regulator station and pipeline renewals.

“The projects in the plan build a foundation to modernize the system as heating and other energy technologies evolve over the next few years,” Bryant said. “The plan is also a complement to our Clean Heat Plan, which we will be filing [later in 2023] as a roadmap to further reduce greenhouse gas [GHG] emissions and achieving the 2050 net-zero vision for the heating and energy service we provide to customers.”

Meanwhile, officials at the Colorado Oil and Gas Association (COGA), which includes the largest DJ Basin producers, told P&GJ in June that a group of COGA midstream companies this year indicated they are not planning any major projects on the horizon. COGA’s Christy Woodward, senior regulatory director, thinks 2023 may see a low-level of activity in terms of midstream infrastructure work in the Rockies.

Williams’ MountainWest acquisition added roughly 2,000 miles of gathering and interstate systems across the Rockies (Utah, Wyoming and Colorado), with multi-Bcf/d of transmission capacity and the largest gas storage field in the Rockies.

“MountainWest fits squarely within our existing footprint of upstream, midstream and downstream pipeline and storage infrastructure, creating a critical gateway between markets,” Lee said, noting in June that Williams had already identified several expansion opportunities from its newly acquired assets. “Storage will be one of the most critical assets in tightly balanced markets as demand for energy continues to rise in the West.”

The venerable midstream operators at Williams this year are taking a contrarian view of the DJ and the broader Rockies following the MountainWest purchase.

“The Rockies have traditionally been a wet gas play, but we see future opportunities for dry gas production in areas like the Niobrara [Shale in the DJ],” said Williams spokesperson.

Williams focuses on infrastructure to move natural gas from supply centers to demand centers – period.

“Our extensive gathering, processing and transportation in the Rockies is well-placed as a bridge between tight supplies in the Rockies, low storage inventories in the West, and high demand in California and the Pacific Northwest,” the spokesperson said.

Executives at Williams told P&GJ within months of their purchase they have identified “several expansion opportunities” across the MountainWest assets. The company already had announced in the spring a successful open season for what is called the Westbound Compression Project designed to provide up to 325 MMcf/d of incremental firm transportation on Overthrust Pipeline.

In addition, there are several opportunities related to coal-to-gas switching in the area and a lack of gas takeaway capacity out of the Uinta that they think Williams can address. “We will continue to leverage our operational expertise and footprint to drive additional growth projects in the area,” Williams spokesperson said.

“Additionally, we continue to look for opportunities in the clean energy space to support carbon capture and sequestration and hydrogen production across our western footprint from southwest Wyoming south across Utah, Colorado and New Mexico.”

A Baltimore-based company earlier this year filed for developing a geothermal project in the middle of the DJ Basin, to service the oil and gas industry’s future power needs in an environmentally clean fashion. Geothermal Technologies, Inc. (GTI) filed for drilling permits with Colorado’s Division of Water Resources. GTI seeks to drill geothermal wells for the purpose of generating utility-scale electricity in Weld County.

“This is an important step forward in our plans to construct a first-of-its-kind geothermal power plant in the D-J using GTI’s proprietary suite of technologies,” said GTI CEO J. Gary McDaniel. “We are excited about the potential that exists in Colorado for the development of advanced geothermal power.”

McDaniel indicates that GTI has calculated that the thermal prospect in the DJ Basin has over 5 GW of geothermal energy that can be harvested. GTI’s calculations indicate the company has the potential to install up to 400 MW of baseload electricity production.”

GTI’s proprietary GenaSys (Geothermal Energy Harvesting System) is billed as the latest generation of geothermal technologies. When coupled with advanced organic Rankine cycle (ORC) power-generation technology, GTI’s system enables the efficient extraction of geothermal energy in geographic regions that have been untapped using conventional approaches.

Although remaining agnostic toward midstream infrastructure – at least in the near-term – Chevron’s purchase of PDC changes the balance of power in the Rockies, making it the largest player, as research analyst Andrew Dittmar with Enverus Intelligence Research noted back in 2022.

“The deal makes Chevron an even more formidable operator in Colorado,” according to Dittmar, an Enverus director.

However, he did acknowledge that the added assets carry “some increased regulatory risk,” although a widespread concern several years ago that permitting might dry up has largely not come to pass in the state. Companies have successfully been able to secure years of drilling permits, Dittmar noted.

Analysts note that for years Kerr-McGee Oil & Gas Onshore, a subsidiary of Houston-based Occidental Petroleum Corp., was Colorado’s top oil and gas producer. It was followed by Chevron’s Noble Energy with PDC Energy ranking third or fourth place among producers.

In June, FERC approved Wyoming Interstate Company LLC’s (WIC) plans to abandon gas infrastructure in Uintah County, UT. It is WIC’s Diamond Mountain project, including a compressor station and associated facilities and equipment following a decline in gas production in the Uintah Basin.

FERC noted that WIC, a Kinder Morgan unit, will continue to operate the existing mainline block valve at the station site after the abandonment. The federal regulators concluded there will be no significant environmental impact with proposed mitigation measures submitted by WIC.

WIC’s system consists of 850 miles of pipelines with its mainline extending from western Wyoming to northeast Colorado (the Cheyenne Hub). It includes several lateral pipeline systems, running from various mainline interconnections in western Colorado, northeast Wyoming, and eastern Utah.

“WIC would complete all work within the existing gravel station yard and would access the station from the existing facility roads,” the company told FERC, adding that “no ground disturbing activities are proposed. WIC would remove and repurpose components of the abandoned facility for use at other Kinder Morgan affiliate pipelines.”

Richard Nemec is a long-time contributing editor based in Los Angeles. He can be reached at rnemec@ca.rr.com.

Comments