October 2023, Vol. 250, No. 10

Projects

Projects October 2023

DT Midstream Completes Phase 1 LEAP Expansion Early

DT Midstream Inc. has announced the early commissioning of its LEAP Phase 1 expansion, increasing capacity from 1 Bcf/d to 1.3 Bcf/d, surpassing its planned Q4 2023 in-service date and staying within budget.

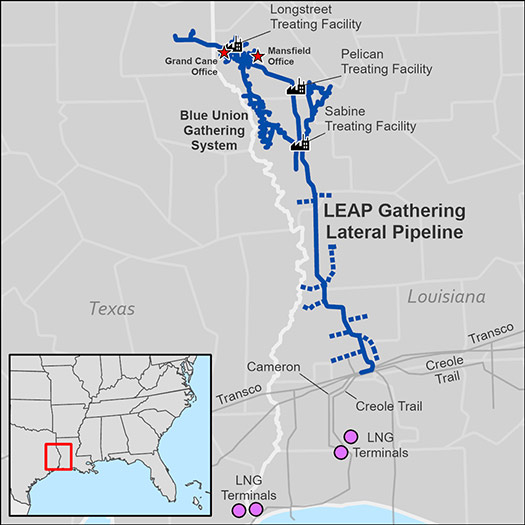

The LEAP Gathering Lateral Pipeline is a 155-mile high-pressure lateral pipeline that gathers gas along a spine-like system from Haynesville shale area producers and redelivers gas to interstate pipelines that provide access to petrochemical and refining facilities, power plants and LNG export facilities.

The pipeline's phase 2 and phase 3 expansions are also progressing on schedule, with anticipated in-service dates in the first- and third-quarter of 2024, respectively. This project will increase LEAP's total capacity to 1.9 Bcf/d, offering flexibility for future expansions up to 3 Bcf/d.

LEAP currently establishes connectivity between Haynesville production and burgeoning Gulf Coast markets, which are projected to witness growth of more than 8 Bcf/d by 2030.

LEAP currently has access to various operational or under-construction LNG terminals, including Sabine Pass, Cameron, Calcasieu Pass, Plaquemines, and Golden Pass through interconnections with Creole Trail, Cameron Interstate Pipeline, Texas Eastern, and Transco.

Russia Indicates Power of Siberia-2 Plan Finalized

Russia is said to be putting the final touches on the Power of Siberia-2 gas pipeline to China, according to an entry the energy ministry’s in-house publication and reported by Reuters.

The new infrastructure, if completed, would boost piped gas supplies gas supplies to China by 50 Bcm/a, while the existing Power of Siberia pipeline would target providing 38 Bcm/a year by 2025.

The route, which will cross Mongolia, is seen as essential to increasing trade with Asia as the country’s ties with the West become grow more tenuous.

The gas for the proposed pipeline would ship gas from the Yamal peninsula fields in western Siberia.

In his in-house publication, Deputy Prime Minister Alexander Novak said he “assumed” the pipeline will pass near the eastern Siberian cities of Achinsk, Krasnoyarsk, Kansk, Sayansk, Angarsk and Irkutsk, then through the Buryatia region south of Lake Baikal, reaching the Mongolian border near the settlement of Naushki.

State-controlled Gazprom began a feasibility study on the project in 2020 and has targeted an initial delivery date by 2030.

One Dakotas CO2 Pipeline Permit Rejected, One in Limbo

In a recent development, South Dakota regulators have denied a construction permit for a carbon dioxide pipeline project, the Associated Press reported. This decision closely follows a similar rejection by a North Dakota panel regarding another company's project.

Navigator CO2 Ventures had proposed constructing a 1,300-mile pipeline network spanning Illinois, Iowa, Minnesota, Nebraska, and South Dakota. This network aimed to transport carbon dioxide emissions from over 20 industrial plants to be buried more than a mile underground in Illinois, mitigating their impact on climate change.

The South Dakota Public Utilities Commission voted unanimously to reject Navigator's application for its Heartland Greenway pipeline. Chair Kristie Fiegen cited multiple reasons for the denial, including the company's delays, objections to commission staff inquiries, and difficulties in informing landowners about routes and meetings. Concerns were raised regarding safety, community growth, landowner interests, and emergency response readiness, among other issues.

The proposed South Dakota route was intended to cover 112 miles and serve three ethanol plants. The decision followed evidentiary hearings held in July and August. Navigator expressed disappointment over the permit denial and is currently evaluating its future options. The company emphasized its unwavering commitment to environmental stewardship and safety while hinting at pursuing permitting processes in other regions.

This decision comes shortly before the South Dakota panel is scheduled to commence an evidentiary hearing for a separate CO2 pipeline project proposed by Summit Carbon Solutions. The final decision on this project is expected by Nov. 15.

Brian Jorde, an attorney representing South Dakota landowners opposed to both Navigator and Summit projects, told AP that he hopes that Navigator might reconsider the South Dakota leg of its project, particularly since most of the plants it would serve are located in Iowa and other states.

Kingston Midstream to Acquire Marten Hills Pipeline System

Rangeland Energy has entered into a definitive agreement to sell Rangeland Midstream Canada Ltd. to Kingston Midstream Alberta Ltd. in an all-cash transaction. The overall transaction value has not been released.

Midstream assets included in the transaction consist of the Marten Hills Pipeline System, comprised of crude oil and condensate pipelines, both 51 miles (82 km) in length, and related assets serving the core of the Marten Hills region of north central Alberta in the prolific Clearwater play.

Rangeland Canada initiated construction in October 2019 and the system was placed into service in July 2020. The Marten Hills Pipeline System terminates at an interconnect with a third-party pipeline which ultimately serves the Edmonton, Alberta hub and refining market.

The transaction is expected to close by the end of the third quarter of 2023, subject to customary regulatory approvals. Rangeland Canada’s field employees and Athabasca office will remain with the business and become part of Kingston, an established pipeline operator with a proven track record of safe and reliable operations.

Western Midstream to Buy Meritage Pipelines in Powder River Basin

Western Midstream Partners LP said one of its operating subsidiaries has signed an agreement to acquire Meritage Midstream Services II LLC in an all-cash transaction for a purchase price of $885 million, subject to customary adjustments.

The acquisition includes the Thunder Creek NGL pipeline, a 120 mile, 38 MMbpd FERC-regulated NGL pipeline that connects to Meritage’s processing facilities.

Meritage, a privately held midstream company headquartered in Denver, Colorado, owns and operates a large-scale natural gas gathering and processing business in the Powder River Basin of Wyoming. Completion of the transaction is expected in the fourth quarter of 2023, subject to customary closing conditions and regulatory approvals.

Meritage’s assets, located in Converse, Campbell and Johnson counties, Wyoming, include 1,500 miles of high- and low-pressure natural gas gathering pipelines and 380 MMcf/d natural gas processing capacity.

The Meritage assets are supported by more than 1.4 million dedicated acres from a diverse set of majority investment grade counterparties, with an average remaining contract life of approximately eight years. Following the integration of the Meritage assets, WES will be well positioned to compete for additional acreage dedications and business development opportunities from offset producers in the basin.

WES expects the transaction to close during the fourth quarter of 2023. Given the uncertain timing of closing within the fourth quarter, WES is not updating its 2023 Adjusted EBITDA guidance range at this time.

“The addition of the Meritage assets meaningfully expands the financial and operational scale of our existing Powder River Basin footprint by adding significant producer inventory and further diversifying our growing G&P customer portfolio,” Michael Ure, president and CEO of WES, said.

Trans Mountain Route Change Approved by Canadian Regulator

In a major victory, Energy Regulator CER approved the Trans Mountain expansion route change request for the Canadian government-owned project, which had sought a 0.8 mile deviation (1.3 km) for a section of pipe.

The change, near Kamloops, British Columbia, will circumvent a construction challenge that would have required micro-tunneling.

The request was opposed by the SSN First Nation, where the pipeline will cross due to site’s “profound spiritual and cultural significance.” CER held a three-day hearing in Calgary before ruling in favor of Trans Mountain.

The 590,000 bpd expansion is estimated to cost $22.97 billion (C$30.9 billion) and has experience long regulatory delays, even prior to its acquisition by the Canadian government in 2018.

The pipeline had targeted the first quarter of 2024 crude late in the first quarter of 2024 for initial crude oil shipments, but analysts say that appears overly optimistic at this point.

But the last-minute route deviation request, filed in August, had raised concerns the pipeline could face further delays.

TMC said being forced to continue with micro-tunneling could mean that particular pipeline segment would not be completed until December 2024, versus a January 2024 completion date if the route adjustment was granted.

Canada Carbon Capture Project Struggles for Key Contract

Canada is struggling to get a key tool in place for major carbon capture and storage (CCS) projects, said a representative of one of the largest such ventures, as the country seeks to launch incentives vital to cutting emissions from Alberta's oil sands.

A government fund has told the Pathways Alliance, comprised of the six largest oil and gas producers in Canada, that their project is too large and too risky for a contract for difference, a tool which would lock in future carbon credit prices, the representative told Reuters.

The mechanism gives investors in CCS certainty about their future revenue by setting a minimum price for their carbon credits. Oil companies in the country's highest-emitting sector are counting on CCS to help dramatically cut emissions while continuing to pump oil and gas.

Pathways is still in talks with the government to set up such a contract, though probably not through the C$15 billion ($11 billion) Canada Growth Fund — a body set up last year by the Finance Ministry to help attract private investment in clean tech by mitigating financing risks — the representative said.

"We sincerely do want to figure out a path to work with them," said a finance ministry official who was not authorized to speak on the record.

Canada is the world's fourth-largest oil producer, and Prime Minister Justin Trudeau has made getting to net-zero by 2050 a guiding principle of his government in recent years.

However, Canada is lagging behind the U.S., which has offered massive incentives to clean tech companies under the U.S. Inflation Reduction Act (IRA) for more than a year now.

Comments