August 2024, Vol. 251, No. 8

Global News

Global News August 2024

[To explore the full digital edition, including the Page Raft version of this article, click here.]

ONEOK Closes on 450-Mile Texas-Louisiana NGL Pipeline

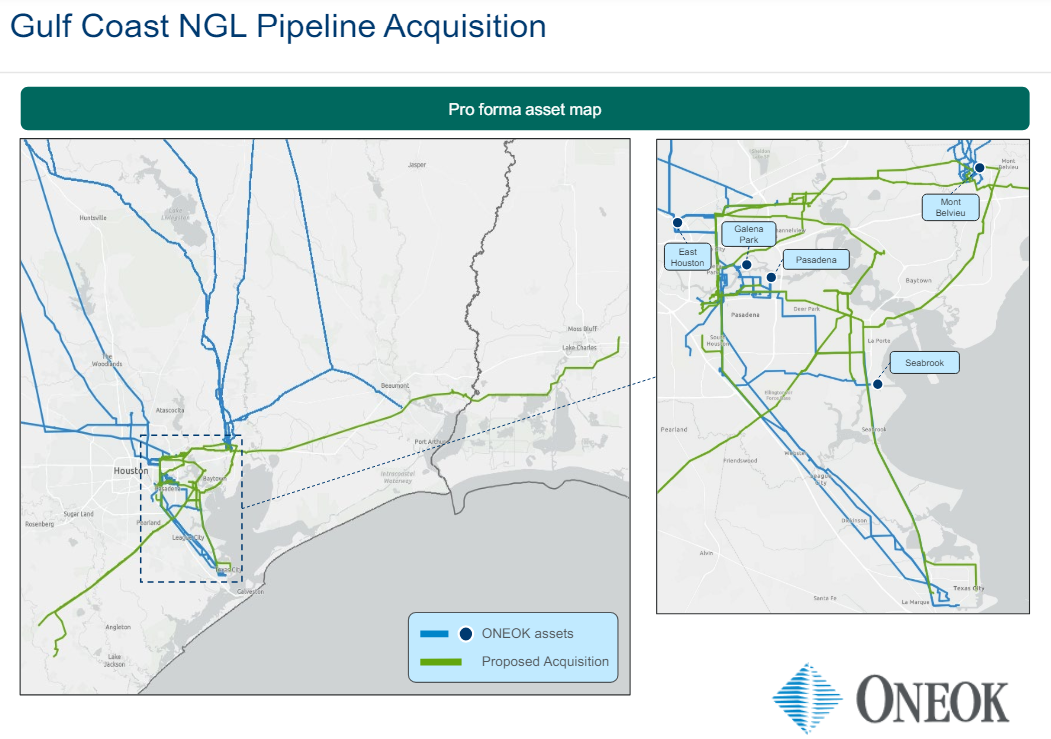

ONEOK has completed its acquisition of a system of natural gas liquids (NGL) pipelines from Easton Energy for approximately $280 million.

The system is comprised of approximately 450 miles of NGL pipelines, located in the Texas and Louisiana Gulf Coast market centers for NGLs, refined products and crude oil. These pipelines transport a wide range of liquids products through a portion of their capacity to existing customers.

“These pipelines are a critical piece of the U.S. Gulf Coast NGL and hydrocarbon value chain,” G.R. “Jerry” Cardillo, Easton’s CEO, said in May. “This transaction recognizes value for our customers, shareholders, and our business partners. We will now pivot our focus to our remaining business, our NGL and olefins storage business.”

ONEOK plans to connect the pipelines to ONEOK's Mont Belvieu, Texas, NGL infrastructure and ONEOK's Houston refined products and crude oil infrastructure, accelerating commercial synergies.

"The closing of this strategic acquisition provides immediate earnings, expands our natural gas liquids asset portfolio and accelerates ONEOK's ability to capture commercial synergies related to our recent acquisition of Magellan," said Pierce H. Norton II, ONEOK president and chief executive officer. "These new assets offer significant connectivity between critical Gulf Coast supply and demand centers."

ONEOK plans to connect the pipelines to its Mont Belvieu, Texas, NGL infrastructure and to ONEOK's Houston refined products and crude oil infrastructure.

In May 2023, ONEOK agreed to purchase Magellan Midstream Partners in a deal valued at approximately $18.8 billion, inclusive of debt. The acquisition, structured as a cash-and-stock transaction, saw ONEOK offering $25 in cash and 0.6670 shares of its common stock for each outstanding Magellan common unit.

This move diversified ONEOK's portfolio from natural gas transportation to include Magellan's refined products and crude oil transportation business, significantly altering its revenue composition.

The acquisition aimed to create a North American midstream infrastructure giant, with a substantial portion of its earnings derived from fee-based sources. ONEOK's CEO, Pierce H. Norton II, expressed optimism about the deal, emphasizing the resultant company's robust balance sheet and financial flexibility.

Despite concerns over oversupply in the natural gas market and fluctuating crude prices, the merger was expected to bolster the resilience of the combined entity, through diverse commodity cycles.

Financial analysts noted the premium ONEOK paid for Magellan, yet they characterized the move as bold, citing the resulting company's formidable scale and diversification.

The deal, subject to regulatory approvals, was anticipated to close in the third quarter of 2023, with ONEOK expecting earnings accretion starting in 2024 and continuing through subsequent years, promising enhanced shareholder value. Leading financial advisory firms, including Goldman Sachs and Morgan Stanley, were instrumental in facilitating the transaction.

– Mary Holcomb, P&GJ

Pemex, Billionaire Investor Discus Reviving Deepwater Gas Project

(Reuters) — Mexican state energy company Pemex and billionaire investor Carlos Slim’s team are discussing ways to revive development of the country’s first deepwater natural gas field that was shelved twice before, two sources told Reuters.

The sources, both having direct knowledge of the matter, said executives of companies controlled by the Slim family met with Pemex on Tuesday to discuss the Gulf of Mexico gas field. One of the sources said the parties had agreed to meet again.

The Lakach field has been hailed as a potential gateway to a new deepwater Mexican gas frontier. The sources said Pemex declared it a top priority to find a new partner after its last pulled out at the end of last year.

Pemex wants to develop the offshore field using a service contract where partners finance projects upfront, a mechanism used prior to the country’s energy sector opening during, one of the sources said.

It was unclear whether Pemex and Slim’s companies plan to move forward with the project or whether others would be involved. The sources said Pemex had reached out to other companies, too.

Pemex did not immediately respond to a request for comment. A spokesman for Slim declined to comment.

Slim, whose empire extends from telecommunications to mining to retail, has been increasing his participation in the energy sector since last year, with stakes in shallow water fields Zama, Ichalkil and Pokoch.

Phillips 66 to Sell 25% Stake in Rockies Pipeline to Tallgrass Unit

(Reuters) — U.S. oil refiner Phillips 66 said on Friday it would sell its 25% stake in the Rockies Express Pipeline (REX) for about $1.28 billion, including debt, to a subsidiary of Tallgrass Energy.

"This sale is an important step in our commitment to deliver over $3 billion in asset divestitures," Phillips 66 CEO Mark Lashier said in a statement.

REX, a 1,714-mile (2758.42 km) pipeline system, is one of the largest natural gas pipelines in the U.S., and it provides over 5 Bcfd of bi-directional natural gas transportation service between the Rockies, Appalachia and the northeastern United States.

Privately owned Tallgrass Energy operates the pipeline and owns the remaining 75% stake.

Sound Energy Sells Moroccan Gas Assets for $45.2 Million

(Reuters) — UK gas company Sound Energy Plc sold its subsidiary, Sound Energy Morocco East Limited, to Morocco's largest mining company, Managem, the two companies said.

The transaction amounts to $45.2 million in total, Sound Energy said, adding the sale was key to develop production in the eastern Morocco gas field, known as Tendrara.

The field is expected to start production at 100 MMcm annually, starting next year, Managem said in a statement.

Managem plans to further increase production there to 280 MMcm annually, when the field will be connected to an existing gas pipeline that connects Morocco to Spain, Managem added.

"The group is actively looking for other gas assets in Africa," Managem CEO, Imad Toumi, was quoted in the statement as saying.

Under the deal, Sound Energy will continue to hold a 20% interest in the Tendrara Production concession, and a 27.5% working interest in each of the Grand Tendrara Exploration Concession and the annual exploration permit.

In addition to Morocco, Casablanca-listed Managem operates in six African countries and produces cobalt, copper, zinc, gold and silver.

Morocco imports most of its gas needs, estimated at 1 Bcm, currently — enough to power two small stations in its northwest and northeast.

Its gas needs are expected to grow to 8 Bcm as the country seeks to reduce its carbon footprint, according to energy ministry estimates.

New Fortress Begin LNG Production at Mexico Plant

(Reuters) — New Fortress Energy expects to start production of liquefied natural gas at its offshore Altamira-based plant in Mexico in the next 10 days and would begin shipping the gas in July.

The pre-operations and remaining commissioning activities have been completed, New Fortress said.

The U.S. LNG producer's Altamira plant is Mexico's first such facility, and it has been delayed several times.

In May, the company said it expected to export the first cargo in June. The production deadlines were missed in September and December last year, as well as in February this year.

Earlier, the company had said the first LNG train — the liquefaction unit — would cost about $1 billion.

Comments