February 2024, Vol. 251, No. 2

Features

Spotlight on Bakken: Gas Expansions Offer Alternative to Permian Constraints

P&GJ Staff Report

(P&GJ) — Fueled primarily by U.S. production growth concentrated around the oil-generating geology of North Dakota, the Williston Basin’s midstream footprint has expanded according to the region’s evolving needs.

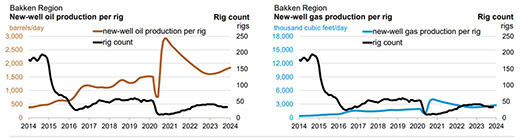

Overall, Bakken trends remain positive for both oil and natural gas production, although high Midwest storage levels and limited capacity to Gulf Coast and West Coast markets caused a regional supply glut and a substantial drop in North Dakota gas prices in early 2023.

Gas-to-oil ratios have flipped in the Williston Basin during recent years, increasing more than 90% since 2016 from 1.51 MMcf/d to 2.8 MMcf/d per of oil produced. Additionally, drilling activity in the Bakken shale is nearly four times higher than it was three years ago.

In other words, while oil is still an important commodity in the Bakken Shale, as far as midstream projects go natural gas is where the real money can be found.

Oil production in the Bakken shale play were expected to grow following Chevron’s acquisition of Hess, but not to the record levels hit in 2020, according to analysts. This is expected to lift production to about 200,000 boepd in 2025.

Dakota Access Limbo

Meanwhile on the legal front, federal officials, in late September, released a draft environmental review of the Dakota Access oil pipeline, but said they would not determine the fate of its controversial river crossing in North Dakota until more data were provided.

The partial review come more than three years after a federal judge ordered the it, and in the process revoked the permit for the Missouri River crossing, located upstream of the Standing Rock Sioux Tribe’s reservation. The tribe is concerned a pipeline oil spill could contaminate its water supply.

Rich Gas

As in the Permian Basin, oil production in the Williston has a high rate of associated natural gas. But the Bakken’s residual gas is rich in natural gas liquids (NGLs), and that requires infrastructure generally more akin to North Texas’ Barnett Shale than West Texas’ Permian.

North Dakota’s natural gas is heavy with ethane, and that dictates many of its midstream demands for both pipeline egress and processing capacity. When natural gas production outpaces midstream capacity, natural gas flaring goes up – and the Bakken is famous for it.

Expanded fractionation capacity has helped the Williston dramatically reduce flaring in recent years from 36% in 2014 to about 4% in 2023. Impressive as that is, North Dakota still has a higher flaring intensity than other basins at about 150 MMcf/d.

And, because ethane has a higher heat content than methane, Bakken pipeline operators have to mind their BTUs.

Infrastructure additions have helped reduce ethane rejection and deliver more natural gas and NGLs to market, but systems like Northern Border Pipeline (NBPL) must be managed to keep heat in check.

Midstream Buildout

North Dakota’s largest processor of natural gas, Oneok led the recent spate of midstream growth in the Williston Basin with the construction of its 900-mile Elk Creek NGL pipeline, which was completed in 2019. That project added 240,000 bpd of unfractionated NGL takeaway capacity from the basin, supporting increased gas production in the Bakken.

The company’s $400 million Bear Creek natural gas processing plant expansion and related infrastructure in Dunn County, North Dakota increased the company’s Williston Basin gas processing capacity to more than 1.6 Bcf/d in 2021. That expansion was designed to produce 25,000 bpd of NGLs in ethane rejection.

In January 2023, the number of rigs operating in the Bakken increased by one from December to a total of 42. That’s up from 27 rigs in January 2022 and 11 at the start of 2021. Some producers were struggling to find completion crews by late 2022.

The region’s expanded takeaway capacity could bring a near-term boost to the Bakken if some Permian producers begin to curb output due to natural gas pipeline takeaway constraints.

Midstream companies were continuing to respond in 2023 to Bakken natural gas production growth with planned and potential projects to increase processing volumes, expand pipeline capacity or, in one case, reverse pipeline flows in response to regional trends.

Northern Border Pipeline

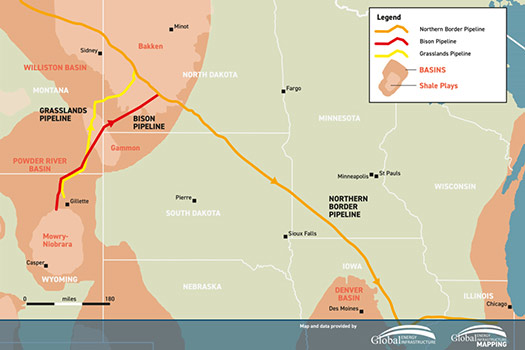

Bakken growth has been displacing Canadian volumes off the Northern Border system for nearly a decade, with only about 0.9 Bcf/d of the 2.5 Bcf/d flowing on the pipeline from Canada by 2022, according to BTU Analytics. Gas-driven midstream projects still on the horizon include a potential capacity boost of the 1,412-mile (2,272-km) NBPL.

TC Energy held a non-binding open season in the second quarter of 2022 to assess interest in an expansion of NBPL via horsepower additions to three North Dakota compressor stations. While the expansion of NBPL would only occur in North Dakota, it would enable NBPL to deliver 430 MMcf/d of natural gas into Bison Pipeline, which connects the Northern Border system to the Powder River Basin in Wyoming.

Bison Pipeline

The midstream response to Bakken natural gas growth goes beyond expansion projects. TC Energy is also looking to reverse the direction of gas on its 30-inch Bison pipeline.

The 420 Mcf/d Bison system went into service in 2011 to move Powder River Basin natural gas from Wyoming to midwestern markets. Although Bison continues to generate contractual revenue, changing natural gas dynamics in the U.S. Midwest have resulted in intermittent gas flows on Bison.

A reversal would allow TC Energy to transport Bakken gas into the Cheyenne market. While this appears to be the likely course for Bison, the company has said its business development activities would determine the best use for the system, including whether it can be “reversed, re-directed or re-purposed.”

Viking Pipeline

Oneok’s Viking Gas Transmission Company is preparing to add facilities to meet demand for incremental service on its pipeline system.

The Viking Project – Line MNB2204C involves construction of 14 miles of 12-inch pipeline and a new meter station, as well as the modification of existing infrastructure to support delivering 42,000 dekatherms per day of natural gas from existing receipt points on the Viking mainline to a new delivery location in Grand Forks, North Dakota.

More than 12 miles of the new pipeline is along an existing Viking pipeline corridor east of Grand Forks. About 1 mile of 12-inch pipeline and a new meter setting will be constructed in Grand Forks.

Construction began in the third quarter of 2023 and the anticipated in-service date in the fourth quarter of 2023 was met.

Grasslands South

WBI Energy’s Grasslands South Expansion Project will provide 94,000 dekatherms per day of firm natural gas capacity from a new receipt station at OKEOK’s Bear Creek natural gas processing facility in Dunn County, North Dakota, to a new interconnect with Big Horn Gas Gathering in Sheridan County, Wyoming.

The project includes construction of 15.3 miles of 12-inch natural gas lateral pipeline from the Bear Creek Plant to WBI Energy’s existing Manning Compressor Station, with one valve setting midway.

Outlook

As Permian Basin natural gas takeaway capacity becomes increasingly constrained, some producers who operate in both regions may find the Bakken to be an attractive alternative until bottlenecks are addressed.

Overall Bakken trends remain positive for both oil and natural gas production, although high Midwest storage levels and limited capacity to Gulf Coast and West Coast markets caused a regional supply glut and a substantial drop in North Dakota gas prices in late January.

The midstream expansions completed during the past two years, appear to have put Bakken’s midstream infrastructure ahead of that curve.

Comments