February 2024, Vol. 251, No. 2

Projects

Projects February 2024

East African Crude Pipeline Delivers First Shipment

The 62-mile (100-km) segment of the East African Crude Oil Pipeline (EACOP) transported its first shipment to the port of Dar es Salaam, signaling the initiation of the main construction phase for this cross-border pipeline project.

An event to mark the occasion was held Dec. 12 among EACOP’s shareholders, at the storage yard operated by EACOP’s Tanzanian logistics partner, SuperDoll.

EACOP will transport crude oil from the Lake Albert region of Uganda to the Chongoleani Peninsula near Tanga in Tanzania, where it can access world markets.

The project represents a major inward investment in Uganda and Tanzania.

EACOP is focused on ensuring that its activities adhere to the most stringent social, environmental and safety standards. The onward transportation of pipes to their point of use will be conducted using high-specification trucks and trailers.

The company has also invested in extensive driver training, focusing on defensive driving practices, route planning, and compliance with road regulations.

The technology in use for line pipe-lifting operations includes vacuum lifting and “robo-rigging.”

As the on the ground construction of the 896-pipeline (1,443-km) pipeline progresses, EACOP said it remains committed safety and sustainable for East Africa.

Pembina Acquires Enbridge’s Stake in Alliance Pipeline

Enbridge Inc. has entered into a definitive agreement to sell its 50% interest in Alliance Pipeline and its 42.7% interest in Aux Sable to Pembina Pipeline Corp. for a purchase price of $3.1 billion, including non-recourse debt at Alliance of approximately $0300 million, and subject to customary closing adjustments.

Alliance delivers liquids rich natural gas sourced in Northeast B.C., Northwest Alberta and the Bakken region to Chicago.

Aux Sable operates natural gas liquids (NGL) extraction and fractionation facilities in both Canada and the U.S., with extraction rights on Alliance, offering connectivity to key U.S. NGL hubs.

Pembina would assume US$246 million (C$327 million) of debt as part of the deal, helping Enbridge offload some leverage, Reuters reported.

The sale price represents an attractive valuation of 11 times projected 2024 EBITDA for Alliance and seven times for Aux Sable, which is in line with other commodity exposed businesses.

As part of the transaction, Pembina, a long-standing partner on Alliance and the current operator of Aux Sable, will also assume operatorship of Alliance. Enbridge will work closely with Pembina to ensure a safe and orderly transition.

The divestiture represents an important element of Enbridge’s financing plan.

The sales proceeds will fund a portion of the strategic U.S. gas utilities acquisitions and be used for debt reduction. Any remaining Acquisitions funding will be satisfied through financing programs available to Enbridge, including ongoing capital recycling program, issuance of further hybrid securities and bonds, reinstatement of our DRIP Program, or at-the-market equity issuances.

The effective date of the transaction was Jan 1, 2024, with closing expected to occur in the first half of the year.

KM Boosts Permian Highway Pipeline Capacity by 550 MMcf/d

Pipeline operator Kinder Morgan augmented the capacity of its Permian Highway natural gas pipeline by an additional 550 MMcf/d.

Kimberly Dang, the CEO, disclosed this development in a recent investor call, revealing that the expansion was brought into operation Dec. 1, according to Permian Basin Oil and Gas. Using compression techniques, the enhanced capacity now stands at 2.65 Bcf/d for the pipeline, extending from the Waha hub in west Texas to Katy.

During an interview with S&P Global, Dang there is currently no urgent requirement for new greenfield takeaway projects in the Permian region. She highlighted the significant addition of over 1 Bcf/d in the fourth quarter and anticipated the Matterhorn project to come online in the latter half of the next year.

With this influx of capacity into the market, Dang emphasized the likelihood of a demand for new greenfield pipelines in the Permian not emerging until the latter half of the decade.

In a notable milestone, gas production in the Permian region achieved record highs in November, peaking at 19.8 Bcf/d on Nov. 8.

Pipeline’s Fate in Barossa Gas Project’s Entangled in Legal Dispute

Australian major Santos gained approval for a revised drilling plan at its $4.3 billion Barossa gas project, even though the construction of a pipeline to transport gas to shore is mired in a legal dispute.

Santos stop drilling at the field roughly 285 km off northern Australia in September 2022, following the Federal Court decision that the company had failed to sufficiently consult Indigenous people on the nearby Tiwi Islands.

Following further consultation, the National Offshore Petroleum Safety and Environmental Management Authority accepted the updated drilling proposal, Santos said.

Santos has not said when it will resume drilling.

Positive news for the expansion comes just shortly after Santos revealed preliminary talks with its bigger rival Woodside Energy over a potential US$54.3 billion (A$80 billion) merger.

Separately, Santos is awaiting a ruling on whether it can resume work on a key section of pipeline that will take gas to Darwin for processing.

In November, a court ordered work on a portion of the pipeline be stopped after a traditional landowner from the Tiwi Islands called for a halt to pipeline work until its impact on underwater cultural heritage is clear.

Despite the various challenges, Santos affirmed in November it still expects to start producing Barossa gas in the first half of 2025.

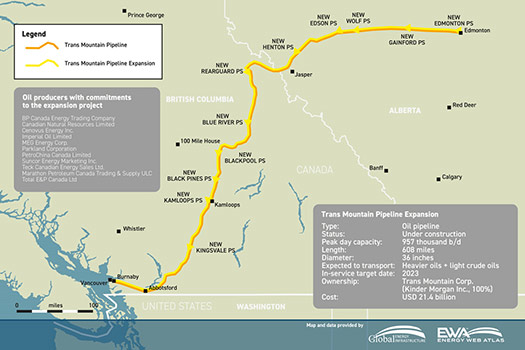

Trans Mountain Warns of 2-Year Delay Over Regulatory Setback

Canadian government-owned Trans Mountain Corp. requested that regulators withdraw a ruling that rejected proposed construction changes on its oil pipeline expansion, warning of a potential “catastrophic” two-year delay and billions of dollars in losses.

If Trans Mountain goes forward with its current plan, problems could result in a borehole for the pipeline becoming compromised, forcing Trans Mountain to find an alternative installation plan, the company said in a letter to the Canada Energy Regulator (CER).

The CER had denied Trans Mountain’s request for a variance on a section of pipeline under construction in British Columbia. Trans Mountain wants to install smaller diameter pipe in a 1.4-mile (2.3-km) section of the oil pipeline’s route after encountering difficult drilling conditions due to the hardness of the rock in a mountainous area between Hope and Chilliwack.

The CER decision was yet another setback for the over-budget, delayed $23.05 billion (C$30.9-billion) expansion project (TMEP), intended to triple shipments of crude from Alberta to Canada’s Pacific coast to 890,000 bpd once it starts operating.

In the letter, Trans Mountain said the hard rock conditions and fractured areas within the bedrock have allowed high rates of water ingress, causing complications. Those problems are likely to worsen if Trans Mountain has to proceed with installing larger-diameter pipe, it said.

Serbia Launches Gas Pipeline Interconnector with Bulgaria

Serbia completed the interconnector to a pipeline in Bulgaria, which would allow the Balkan country to diversify its gas supplies and reduce its dependence on Russia.

The launch of the interconnector, according to Reuters, will make operational the pipeline from the town of Novi Iskar in Bulgaria to the Serbian city of Nis, allowing Belgrade to access gas from Azerbaijan and LNG terminal in the Greek port of Alexandroupolis.

The capacity of the pipeline on the Serbian side is 1.8 Bcm/a, which accounts for 60% of the country’s annual gas needs.

The European Commission donated $53.37 million (49.6 million euros) for construction of the interconnector. Additionally, $27.4 million (25 million euros) was secured in a single loan from the European Investment Bank.

“With this interconnector we are securing alternative gas supplies, apart from the Russian gas,” Serbian energy minister, Dubravka Djedovic Handanovic said.

On Nov 15, Serbia signed a deal with Azerbaijan to purchase 400 MMcm of natural gas per year from 2024.

“If in 2021, our gas exports to Europe totaled a little more than 8 billion cubic meters, then this year the volume of supplies will reach around 12 billion cubic meters,” Aliyev said.

European countries now account for half of all Azerbaijan’s gas deliveries, Aliyev said. Baku is well on the way to doubling its gas supplies to Europe to 20 Bcm by 2027, he said.

Azerbaijan is considered by Europe as an alternative source of energy imports amid a deep political fallout with Moscow over the war in Ukraine and sharp cuts in Russian gas purchases.

Comments