May 2024, Vol. 251, No. 5

Features

EU Ramps Up Support for CO2 Pipelines, Decarbonization Efforts

By Andreas Walstad, P&GJ European Correspondent

(P&GJ) – In January, the EC confirmed that it will allocate almost $522 million (Euro 480 million) to four CO2 transport and storage projects in France, the Netherlands, Poland and Norway.

The projects were eligible for funding under the EU’s $6.3 billion (Euro 5.8 billion) Connecting Europe Facility (CEF) fund for energy because they have been earmarked as Projects of Common Interest (PCIs).

This followed the inclusion of 14 CO2 transport projects on the EC’s sixth PCI list, announced in November last year, which means that even more such projects are now eligible for EU grants and faster permitting.

As for the grants confirmed in January, up to $205 million (Euro 189 million) will go to D’Artagnan — a planned CO2 export hub in the port of Dunkirk in northern France — which is led by Air Liquide and which has a cost estimate of $239 million (Euro 220 million).

The project has two components; the first contains infrastructure to transport captured CO2 via pipelines from the industrial sites in Lumbres and Réty to the port of Dunkirk. The second part is a terminal in the port that will receive and handle the CO2 before it is shipped by vessels for storage in the North Sea.

Lumbres is a cement plant operated by EQIOM and the plan is, with help from Air Liquide, to capture and liquify the CO2 emitted there. Some of the CO2 that is not transported would also be used in building materials. Meanwhile, Réty has France’s largest lime plant, operated by Lhoist, and the plan is to capture more than 600,000 tons of CO2 per year starting in 2028 through Cryocap, a carbon capture technology developed by Air Liquide.

During transportation from the two industrial plants, the CO2 will have a density close to liquid. This means it occupies less space, so that a smaller pipeline can be used, while at the same time being easier to move than liquid, according to Air Liquide. Around 49 miles (80 kilometers) of pipelines would be built between Lumbres, Réty and the CO2 Terminal of the Port of Dunkirk. The exact route has not yet been decided.

The project would be able to transport and store 1.5 mtpa of CO2 from 2027, according to plans. However, this capacity could be increased to 4 mtpa of CO2 at a later stage.

Rotterdam Hub

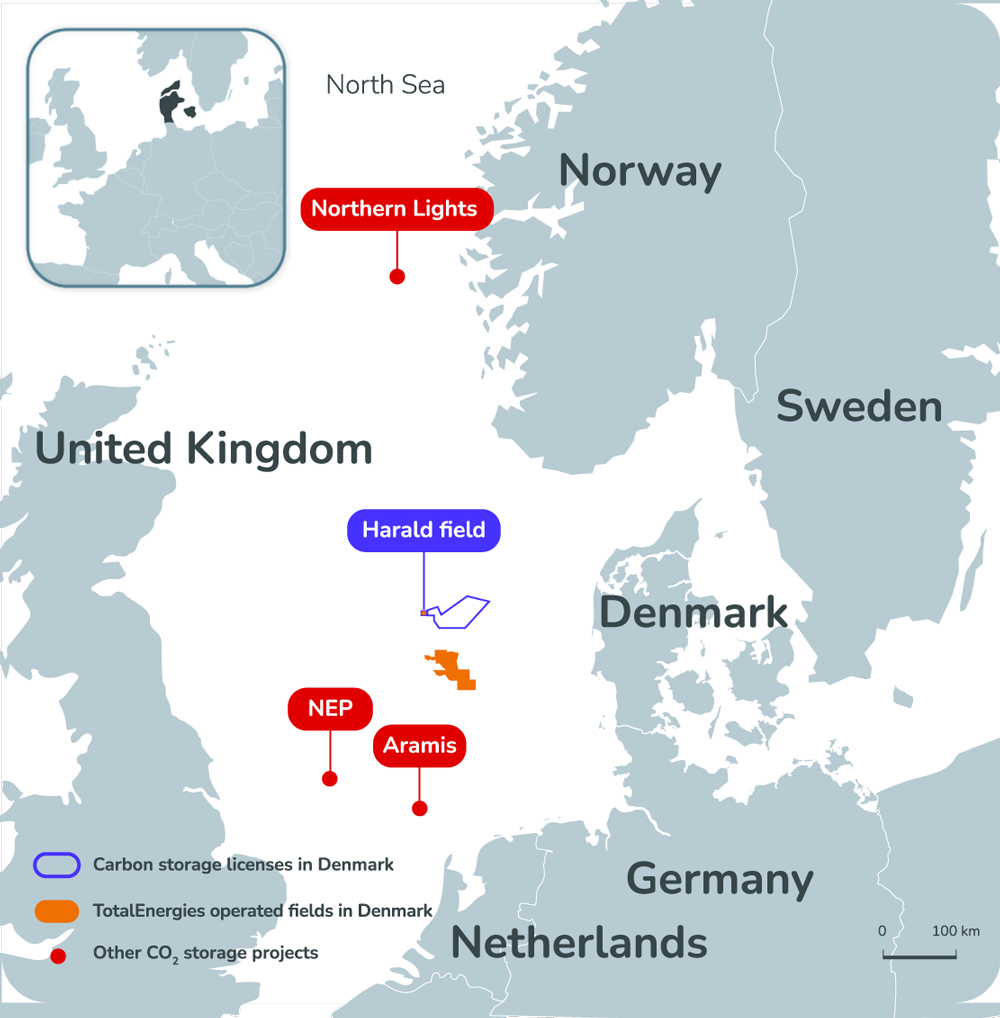

Meanwhile, the Aramis CO2 pipeline project — a collaboration between TotalEnergies, Shell, public energy company EBN and Gasunie, in the port of Rotterdam — received a CEF grant of $135 million (Euro 124 million) in the latest round. The 137-mile (200-km) pipeline project involves a trunkline, which will be designed to transport up to 22 mtpa of CO2 from the port to storage facilities in the North Sea, in depleted gas fields about 2.5 miles (4 km) under the seabed. In the first phase, a minimum of 7.5 mtpa will be transported through the pipeline and stored.

A final investment decision (FID) is expected in 2025 or 2026, and the project could become operational by 2028.

“One of the conditions for taking FID is having obtained the irrevocable permits. The permitting process has been ongoing since 2022. If in the end a significant delay would occur regarding permitting, FID decision could be delayed to 2026,” Marcel Hoenderdos, a spokesperson for EBN, told the P&GJ.

The total cost for the whole value chain of Aramis is estimated at $7.62 billion (Euro 7 billion).

It will be up to industrial emitters to capture the CO2 and transport it to the collection hub, either via pipeline or ship. In the Aramis commercial model, emitters conclude contracts with storage companies that provide offshore storage capacity. After that, the storage company books transport capacity for the emitter at the Aramis project, says Hoenderdos. Shell, TotalEnergies and Neptune Energy will be the storage companies in the first phase.

At the port in Rotterdam, a proposed terminal operated by Vopak and Gasunie, CO2NEXT (CEF grant EUR 33 million), would be able to load and unload — as well as temporarily store — liquid CO2 from vessels and rail cars. The terminal — to be operated on an open access basis — will also provide send-out of liquid CO2 to the Aramis pipeline for offshore storage. The planned terminal would have a throughput capacity of 5.4 mtpa to start with, potentially rising to 15.7 mtpa in the future.

In the CEF round, $142 million (Euro 131 million) was also earmarked for the Northern Lights project, backed by Equinor, Shell and TotalEnergies, which will see CO2, captured from industrial sites in the Oslo area, transported in liquid form by ship to an onshore terminal on the Norwegian west coast and then via pipeline for permanent storage 8.530 feet (2,600 meters) under the seabed in the North Sea.

The CEF grant will support the expansion of the CO2 import terminal in Øygarden, in Norway, as well as the construction of the 100 km offshore pipeline to the storage site.

Phase one of the project will be operational next year, with a CO2 injection capacity of up to 1.5 mtpa of CO2. The second phase of the project will see the injection capacity expanded, with industrial emitters across Europe also shipping and piping CO2 for storage on the Norwegian Continental Shelf (NCS).

In November last year, for example, Northern Lights and fertilizer company Yara International signed a binding commercial transport and storage agreement, with the ambition to capture and store 800,000 tons of CO2 from the ammonia production in Sluiskil in the Netherlands from 2025. The CO2 will be liquefied and shipped from the Netherlands to the storage site on the NCS by Northern Lights.

Poland’s Potential

A smaller CEF grant of $2.76 million Euro ($2.54 million) was granted for studies on the EU CCS Interconnector, a CO2 infrastructure project in Gdansk in northern Poland. The marine terminal for the transshipment of CO2 is a joint venture between Orlen, Lafarge Cement and Air Liquide. The construction of the terminal will be in two phases, with the initial phase aimed at having a capacity of 3 mtpa of CO2.

According to the plans, CO2 will be transported to the facility from industrial plants located in the central and northern parts of Poland. It will then be loaded onto ships for transportation to sequestration beneath the seabed. Initially, the transportation of CO2 to the terminal will be carried out by rail, but the long-term solution will be a dedicated CO2 transmission pipeline, according to Orlen.

Agnieszka Baran, director of the CCS Programme Office at Orlen, tells P&GJ that construction of a dedicated CO2 transmission pipeline depends on many factors, including political support and selecting a pipeline operator, which will be responsible for construction.

She said the first phase of the project could be completed between 2027 and 2030.

“Poland — with its access to the Baltic Sea and other European basins, including the North Sea, and with plenty of CO2 emitters located close to the coast — is in an ideal position to play a key interconnection role in the emerging EU CCS market, which remains more developed in Northern Europe,” Baran said.

She added that the terminal in Gdańsk will bring new impetus to reinforce and densify the EU CO2 transport network on its Central and Eastern side.

“Well-developed CO2 transportation infrastructure will also enable future expansion of commercial CO2 capture capabilities in the European CO2 transport and storage network,” Baran said. “The interconnector will make available world-class CO2 export infrastructures to allow Polish industry and primarily hard-to-abate-sectors to get, via liquid CO2 shipping, effective and competitive access to the North Sea CCS hub and potentially Baltic-Sea CCS hub in the future and the wider European CO2 transport and storage network.”

Denmark Re-Purposing

The EC’s sixth list of PCI, to be formally adopted this spring, features 14 CO2 transport projects. The list is updated every two years, means that these projects are now eligible for EU grants and faster permitting. The projects span a number of countries including Netherlands, Belgium, Germany, France, Spain, UK, Poland, Ireland and Norway.

One of the PCI projects to look out for is the TotalEnergies-led Bifrost CCS project in the Danish North Sea which is a partnership between the Danish Underground Consortium DUC (Nordsøfonden, BlueNord and TotalEnergies), Ørsted and the Technical University of Denmark (DTU).

A recent study has shown that the former Harald gas field and nearby areas can function well as storage reservoirs. This applies to both the rate at which the CO2 can be stored as well as the capacity and integrity of the reservoirs, the according to the study. The partners will now continue studies for oil fields to see if the same is true for them.

Analysis of re-purposing offshore pipelines from transport of natural gas to transport of CO2 is also showing promising results, according to the study.

Thorkild Diness Jensen, spokesperson for TotalEnergies in Denmark, tells the P&GJ that the Bifrost project would benefit from the development of an onshore and offshore CO2 transportation network to connect with major emitters in Denmark and the EU.

“Especially important is the establishment of pipeline infrastructure in Germany from some of the main industrial emitters and clusters to the Danish-German boarders for connection to a future Danish CO2-grid,” he said.

“The capacity of the future pipelines should ideally be dimensioned to enable a volume growth in line with CCS developments but also to ensure flexibility and cater for transport needs from several CCS service providers.”

Marine transport and the development of CO2 importing harbors is also being considered in the scope of the project Bifrost.

“This is to ensure the possibility of sourcing before a connection by pipelines is available, but also to cater for imports from the neighboring countries around the Baltic Sea and more remote locations looking at shipping export solutions,” Jensen said.

Bifrost is expected to store a minimum of 5 mtpa of CO2 by 2030.

Comments