January 2025, Vol. 252, No. 1

Features

Changes Underfoot in the Appalachian Basin

By Richard McDonough, U.S. Correspondent

(P&GJ) – Local and regional leaders in the oil and natural gas industry continue to see great potential for growth in the Marcellus Shale and Utica Shale formations of the Appalachian Basin.

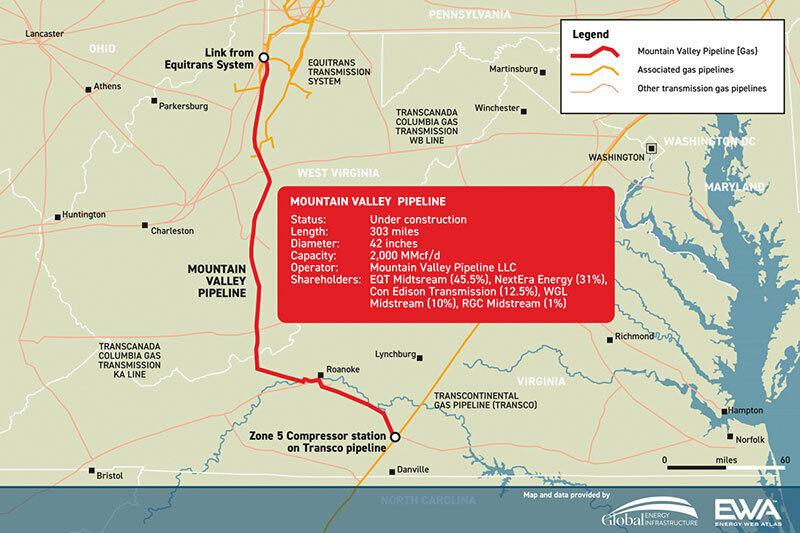

The major development in the region during 2024 was the decision by the Federal Energy Regulatory Commission (FERC) to authorize the Mountain Valley Pipeline (MVP) to begin operations.

MVP, 303 miles long, can move up to 2 Bcf/d of natural gas from Wetzel County, West Virginia, to an interconnection with Transcontinental Gas Pipeline’s (Transco) compressor station 165 in Pittsylvania County, Virginia and Transco delivers natural gas through a 10,000-mile interstate transmission pipeline system extending from South Texas to New York.

“The MVP has been recognized as a critical infrastructure project that is essential for our nation’s energy security, energy reliability, and ability to effectively transition to a lower-carbon future,” said Shawn Day, spokesperson for the Mountain Valley Pipeline. “MVP is now flowing domestic natural gas for the benefits of energy reliability and affordability in the form of lower natural gas prices for consumers.”

In a filing with the United States Securities and Exchange Commission on Oct. 30, EQT Corporation reported that on July 1, the MVP began long-term firm capacity obligations, beginning June 14.

Capacity for MVP remains fully subscribed under long-term, binding contracts, and the project is strongly supported by a broad coalition of elected federal, state and local officials; state chambers of commerce and other business groups; landowners; public utilities; natural gas producers; and other non-governmental organizations.

“Increased use of natural gas has played an important role in our country’s efforts to lower carbon emissions and keep energy prices affordable,” Day said.

This pipeline has faced some penalties, though.

According to the Virginia Department of Environmental Quality (VADEQ) those total $178,000. The latest penalties, which cover the period of June 11 to September 10, were $17,500.”

“Each quarter, the MVP project team conducts a standard review with the VADEQ regarding the project’s ongoing field inspections,” stated Day, Spokesperson for the MVP. “The recent letter from VADEQ includes stipulated penalties for the third quarter of 2024, a period that included extremely heavy rainfall associated with seasonal storms. All of the noted items, most of which relate to issues with erosion control devices, have been resolved, and full payment will be made without dispute.”

Mountain Valley continues to work collaboratively with regulators and landowners to complete final restoration activities, according to Day, who added,

“It’s important to note that Mountain Valley agreed to unprecedented oversight and transparency of project work.

Since 2018, this has included more than 47,800 state, federal and third-party environmental inspections and more than 72,000 inspections by MVP’s internal environmental team. If an issue is identified, the project team moves quickly to address it. We are committed to the safe, responsible construction and operation of this critical energy infrastructure.”

Beyond the operational start of the MVP, other activities, projects planned and hopes for policy changes with a new administration in Washington, D.C. are detailed below in comments from several oil and natural gas industry leaders from New York, Ohio, Pennsylvania, West Virginia, and beyond.

Map: https://globalenergyinfrastructure.com/

Drilling in New York

“Conventional oil wells are being drilled in New York State,” said Mary Gilstrap, executive director of the Independent Oil & Gas Association of New York (IOGANY). “To secure a New York State drilling permit for any oil or gas well a producer must submit an inventory of all emissions that will be created during the life of the wells.”

Emission mitigation steps, such as plugging other wells, must be guaranteed to offset the new emissions before a drilling permit can be issued,” she continued.

In addition, New York state has designated areas known as ‘disadvantaged communities. Wells permitted near these communities need to comply with another emission burden requirement. Numerous producers have successfully received permits and are drilling oil wells.

Gilstrap indicated that the state continues the implementation of the Regional Greenhouse Gas Initiative (RGGI) and Community Protection and Climate Leadership Act (CLCPA). Both programs focus on significantly reducing fossil fuel emissions and providing emission-free electric, solar, and wind energy sources within New York State.”

“NAPE permitting delays and increasing construction costs have slowed or stopped planned wind and solar construction projects to supply replacement power,” Gilstrap said. “Currently, it is unclear if CLCPA goals can be reached in the original timeframes. Significant reductions of fossil fuel use as planned could result in an energy shortfall. The state is currently revisiting the CLCPA goals and cost impacts to New York citizens and businesses. As a result, portions of this CLCPA plan have not been implemented at this time.”

Concerning to the oil and natural gas industry are the potential impacts of legislation passed by the New York State Legislature.

The New York Senate and Assembly passed a bill establishing a climate change adaptation cost recovery program and the climate change adaptation fund this year, which was recently signed by the governor.

“The bill tries to hold oil and gas companies accountable for climate change-related damage by collecting $75 billion dollars over 25 years,” Gilstrap said. “Most oil and gas industry companies in New York State are small and have less than 100 employees.”

Gilstrap explained that the IOGANY is currently working with other industries in New York State also being impacted by these regulations and working to modify or stop what has been proposed. The work with other industries involves general pushback on the CLCPA goals, such as emissions reduction goals, scaling back oil and natural gas use.

Oil and gas businesses are looking for potential regulatory changes with the new administration coming to power.

“One size fits all regulations with limited options for compliance do not work with the diversity of companies and wells that currently make up the oil and gas industry,” Gilstrap said. “An example is EPA’s [Environmental Protection Agency’s] OGI [Optical Gas Imaging] camera for emission detection. Leak detection has been done in the oil and gas industry for decades but none of the existing tools we use are acceptable for monitoring leaks. Remember natural gas – which we sell – is mostly methane.”

Increase in Ohio

Oil production has continued to increase in Ohio, while natural gas production has leveled off, according to the Ohio Oil and Gas Association.

“Due to enhanced technology, and increased knowledge of the geology, the Utica shale formation continues to see growth in crude oil production quarter after quarter from the western edge of the play,” said Rob Brundrett, president of the Ohio Oil and Gas Association (OOGA).

Ohio saw exponential growth in gas production over the past decade, he continued. In the past few years, we have seen a leveling off as producers have shown production discipline understanding the prices and demand.

Still, permits and rig counts have remained steady in the natural gas window in Ohio.

Brundrett said that challenges include continued constrained oil refining capacity as well as limited natural gas “…pipeline takeaway capacity in Ohio and really the entire Appalachian Basin. This makes it difficult along with the basis pricing in the region.”

The regulatory structure plays a major role in the operations in Ohio as well as the other states with the Appalachian Basin.

“OOGA members continue to follow the federal methane regulations including Subpart W, and the new waste emissions charge with great interest,” said Brundrett. “With the change of administrations next year, we anticipate even more changes regarding those rules and regulations at the federal level. More locally we are going to continue to engage with the Ohio Department of Natural Resources [ODNR] to ensure that Ohio’s regulatory scheme maintains a balance that protects safety and the environment while allowing for responsible exploration, development, transportation, and refining of Ohio oil and gas.”

The OOGA is looking for improvements in regulations affecting the industry in Ohio.

“Ohio is a great place for oil and gas operations, in part because of the work ODNR has done over the years to ensure Ohio operators can safely and efficiently work,” Brundrett said. “We will continue to work with ODNR on updating Ohio’s rules to more closely reflect all the technological advancements that have taken place in the industry over the past decade. Having rules keep pace with technology remains a challenge. This includes things like addressing carbon capture and sequestration but also more traditional items regarding conventional and non-conventional operations, and well plugging.”

In addition, the OOGA is looking forward to the potential of changes in the regulatory environment on the Federal level.

“Any industry, especially one based on commodity prices, looks for as much certainty as can be achieved,” said Brundrett. “Our message to the administration is allow our members to do what they do best, which is responsibly find, lift, process and transport natural gas and crude oil. As an industry, we have a tremendous opportunity to deliver abundant, reliable, and dispatchable energy, while continuing to lower emissions, to Ohioans and beyond.”

The finalized methane rule has presented many challenges to the industry, especially for our smaller operators. Many in midstream say this rule fails to recognize the unique characteristics of marginal oil and gas wells and will lead to the premature plugging of more than 300,000 marginal oil and gas wells across the United States.

“Marginal wells don’t have the volume, pressure, or associated emissions to warrant being targeted with costly regulations designed for large producers – past regulations have recognized this and offered exemptions or accommodations for marginal wells,” Brundrett said. Brundrett added “We are hopeful that the Trump Administration will either eliminate or make substantial changes to these rules to provide relief to many of our members.”

The future continues to look bright for the oil and gas industry in Ohio, according to Brundrett.

Marcellus Shale Coalition

“The natural gas industry contributes substantially to Pennsylvania’s economy, with approximately $41 billion generated in economic impact in 2022 alone,” said Jim Welty, president of the Marcellus Shale Coalition (MSC).

He pointed out that the sector supports over 123,000 jobs, with these positions having $97,000 as an average annual wage, which is 113% higher than the state average. Since 2012, $2.5 billion has been generated in impact fees, which contributed to local governments, statewide environmental programs and state agency oversight.

Welty became president of the MSC on Jan 1, 2025. He previously served as the vice president of Government Affairs for the organization since 2013. The MSC is headquartered in Pennsylvania.

“Pennsylvania’s industry is considered the gold standard for environmental regulatory compliance, and operators prioritize the safety of our shared environment by implementing best practices and new technologies that help reduce emissions and promote responsible, safe operations,” Welty said. “The increased use of natural gas in Pennsylvania’s power sector has slashed emissions across the value chain – resulting in a 46% drop in carbon emissions since our 2005 peak.”

Data from the Clean Air Task Force and Ceres’ 2024 Benchmarking Report show that Appalachia producers reduced methane intensity by about 17% in a year, while the Pennsylvania Independent Fiscal Office’s (IFO) latest analysis, showed the electric power sector slashed CO2 emissions by over 10% in a year, while natural gas for power generation grew significantly.

Welty indicated that natural gas extraction may help provide the United States with a source for a key component in rechargeable batteries.

Meanwhile, new regulatory policies in Pennsylvania have been welcomed by the MSC.

During the 2023-2024 session, important steps were taken to reform the state’s permitting process (SPEED Act), funding the Oil and Gas Program within the Department of Environmental Protection, and establishing a policy framework for carbon capture and sequestration (CCS).

Welty noted that global demand for reliable, affordable energy is only getting stronger, and natural gas from the United States is crucial to providing that stability. However, the current permitting process is unpredictable and slow, delaying many projects for years, if not indefinitely.

Permitting reform is essential to build out new natural gas infrastructure, ensuring that reliable, affordable energy can be delivered to consumers and businesses, Welty said.

“Streamlining permits for natural gas pipelines, processing plants and storage facilities, in addition to building more export infrastructure, would not only help address energy security concerns – especially in the Northeast – but also foster job creation and economic growth.”

New development of pipelines and capacity limits on existing pipelines impact the natural gas industry in the Commonwealth, according to the MSC.

“Pennsylvania and the Appalachian region account for 20% and 30%, respectively, of America’s total natural gas production; however, pipelines in this region are at max capacity and we need more infrastructure to move our product to key demand centers,” Welty said.

Six of the last seven planned interstate pipeline projects designed to transport Appalachia natural gas out of the basin to New England, New Jersey and the Southeast U.S, have been canceled or put on indefinite hold due to regulatory red-tape.

The MSC indicated that the future looks promising for natural gas production in Pennsylvania.

“The growing demand for natural gas in the Appalachian region is driven by the need for reliable energy to support the nation’s expanding electricity requirements, as well as the increasing global market for liquefied natural gas (LNG) exports,” Welty stated. “The International Gas Union (IGU) warns that, without adequate investment, the world could face a 22% supply shortfall by 2030.”

With Appalachia already responsible for nearly a third of the United States’ natural gas production, the region is well-positioned to address this looming gap,” he continued. “Additionally, the natural gas industry is leading the charge in clean energy innovation. By leveraging advanced technical and engineering capabilities, the sector is making significant strides in decarbonization efforts.

Key areas of progress include hydrogen production and carbon capture technologies, which offer solutions for hard-to-decarbonize industries. These innovations are positioning natural gas as a crucial component in the future of both energy security and climate action.”

Estimates cited by the MSC indicate more than a century’s supply lies beneath the Appalachian region.

West Virginia Production

West Virginia remains a key source of energy within the Appalachian Basin and for the United States. Oil production for 2023 was over 18.64 million barrels – up over 3 million barrels from 2022.

“West Virginia is the fourth-largest producer of natural gas in the country at over 3.2 trillion CF,” said Charlie Burd, president of The Gas and Oil Association of WV, Inc. “The 2024 production totals will not be reported until mid-April, 2025.”

“Horizontal production accounts for 96% of this production and has been steadily growing since 2008.”

Burd added that “producers continue to acquire leases that show promise for expanded drilling. In addition, producers are applying the latest drilling, wellbore stimulation, and completion technologies to increase efficiency and productivity.

Among challenges faced by oil producers, according to Burd, are the greater use of horizontal drilling technology to enhance production in new and previously drilled formations. For natural gas producers, he noted that challenges include new pipeline access to downstream out-of-state markets.

The regulatory environment has been active on both the state and federal levels during 2024.

From a state perspective:

• Passage House Bill 5045 relating to adopting suggested changes offered by the U S EPA regarding Carbon Capture and Storage and Class VI Primacy

• Passage of Senate Bill 16 authorizing the West Virginia Department of Environmental Protection (WV DEP) to promulgate a legislative rule relating to underground injection and which compliments the provisions of House Bill 5045

• Passage of House Bill 5268, which authorizes the use of CO2 for enhanced oil recovery (EOR) for horizontal wells.

“From the Federal perspective,” Burd said, “Virtually all activities related to the reduction of methane emissions, while important, cause a tremendous financial burden on natural gas and oil producers. These regulations are quite burdensome and punitive in nature and repeated requests for reconsideration before implementation have been denied.”

The oil and natural gas industry in West Virginia would welcome several regulatory changes that could be made by the new Administration in Washington.

One of those changes that would be welcomed, Burd explained, would be placing the Methane Emissions Reduction Program (MERP) and the Waste Emissions Charge (WEC) provisions of the Inflation Reduction Act (IRA) into abeyance until they can be reviewed and reassessed prior to any implementation.

“The passage of pipeline permitting reforms is something that needs to be introduced and passed,” he said. “West Virginia is the fourth largest producer of natural gas in the country. As such, access to markets outside the state is crucial. Such permitting reforms would provide the gateway to the tremendous downstream markets for industrial expansion and power generation.”

Northeast Regulations

On July 16, the New York State Department of Public Service (DPS) issued a Staff Straw Proposal Regarding Modification of 16 NYCRR Part 230, (pertaining to the rights, requirements, and responsibilities of utilities and applicants for gas service) in its Gas Planning Procedures proceedings.

The proposal would make a number of changes, including specifically the 100-foot rule, which requires free gas hookups for new customers within that distance.

Beyond New York state, several regulatory changes elsewhere in the Northeast, including in Massachusetts.

“At the federal level, we continue to see regulators taking action pertaining to the gas industry, including the Pipeline and Hazardous Materials Safety Administration [PHMSA], which is continuing through the process pertaining to its proposed Leak Detection and Repair (LDAR) rule,” said José Costa, President and CEO of the Northeast Gas Association (NGA).

“In addition to this regulatory activity, we continue to see new rules related to pipeline safety, operator qualifications, permitting, ratemaking and building codes, proposed across the region,” he continued. “Simultaneously, future of gas-style proceedings continue in New York, New Jersey, and Rhode Island.”

He added that legislators across the region continue to consider policies that would impact the gas industry, including New York’s proposed HEAT act, and the Act promoting a clean energy grid, advancing equity, and protecting ratepayers, which was recently signed into law by Massachusetts Gov. Maura Healey.

“Where appropriate, NGA engages with our regulators and policymakers to support our shared goals of ensuring safety and energy reliability for our region,” Costa said, citing the organization’s work with the Gas Pipeline Advisory Committee to support PHMSA’s LDAR rulemaking, and its participation in Massachusetts’ Energy Transformation Advisory Board.

“While we will not opine on specific policies that might be proposed by the new administration, or by any of our state regulatory agencies, NGA is strongly in support of policies that ensure gas safety, consumer energy choice, energy reliability, and energy affordability,” Costa said. “We always stand ready to work with policymakers and stakeholders to support these goals.”

One of the biggest challenges in the Northeast, explained Costa, is pipeline capacity and development.

While several projects have been proposed to bring new capacity into the region in recent years, they have frequently failed or been delayed due to a variety of challenges, frequently related to permitting and regulatory issues. Still, several new proposals to add capacity to the region have been proposed recently, including Iroquois’s Expansion by Compression Project and Enbridge’s Project Maple.

“Yet, at the same time, we recently saw the U.S. Court of Appeals for the District of Columbia revoke the FERC certificate for Transco’s Regional Energy Access Project,” Costa said. “This could have significant ramifications for the region, and we hope to see FERC grant an Emergency Certificate to keep that project operational.”

Costa said of natural gas production, the Marcellus/Appalachian Shale region that it remains the largest shale gas-producing region in the United States and where the pipeline infrastructure exists, this is of great benefit.

“However, despite the proximity to this gas producing region, due to the constrained pipeline system, parts of the Northeast, specifically New England, are frequently reliant on foreign LNG, especially during peak demand winters, to meet demand.”

According to the EIA, on peak demand days, imported LNG can contribute up to 35% of New England’s natural gas supply.

Author: Richard McDonough writes on energy infrastructure-related issues in North America. He can be reached at newsaboutamerica@gmx.us.

Comments