June 2025, Vol. 252, No. 6

Features

Middle East Gas Pipeline Surge Led by ADNOC, Leviathan, Iran

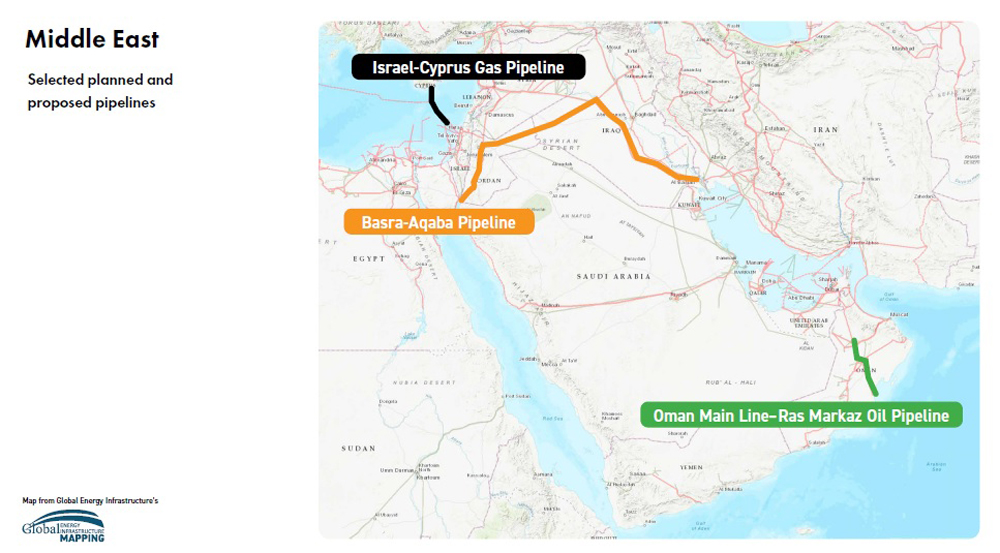

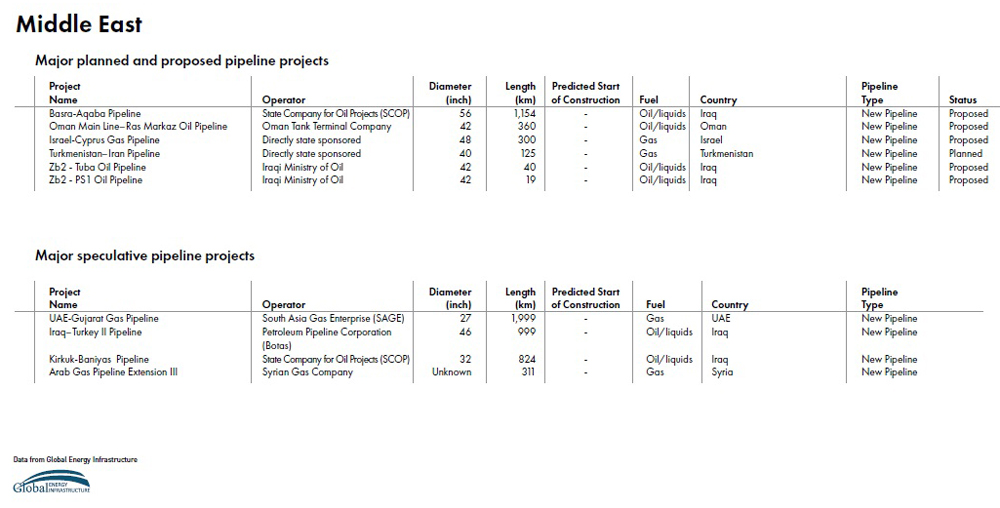

(P&GJ) – Several significant natural gas pipeline projects are planned or under construction in the Middle East, with expected operational dates between this year and 2028.

Separately, the most prominent crude oil pipeline during that period, Iraq’s Basrah-Haditha, has been confirmed for operation by 2028. Additionally, a substantial number of new and expansion crude oil pipeline projects are planned across the region, particularly in Iran, Saudi Arabia, UAE and Turkey, reflecting the Middle East’s ongoing investment in oil transport infrastructure to meet future production and export targets.

The Middle East is expected to see as many 150 midstream projects between 2024 and 2028, primarily reflecting robust investment in gas transport infrastructure.

Most of these projects are new builds, pointing to the region’s focus on expanding crude oil transport infrastructure to support production growth and export capacity.

These projects are driven by the region’s strategic push to diversify energy exports, enhance energy security, and meet growing domestic and international demand for natural gas.

Between 2025 and 2028, the Middle East will see several major natural gas pipelines become operational as well, including ADNOC’s UAE pipelines, the Leviathan expansion in Israel and Saudi pipeline expansions. Additionally, upgrades and extensions will continue on the Arab Gas Pipeline.

Among the key gas pipeline projects:

ADNOC Gas Transmission Pipelines (UAE): ADNOC Gas awarded $2.1 billion in contracts for LNG pre-conditioning plants, compression facilities and transmission pipelines, aimed at enhancing LNG export capacity. These projects are part of the UAE’s ongoing efforts to expand its gas infrastructure and are expected to come online within the next few years.

SDNOC Gas estimates its extensive pipeline network of more than 2,025 miles (3,260 km) enables delivery of gas to customers across Abu Dhabi, Dubai and the Northern Emirates, meeting over 60% of UAE gas requirements.

Leviathan Gas Field Expansion Pipeline: Chevron and its partners are expanding the Leviathan gas field offshore Israel, including the addition of a third subsea pipeline. Originally scheduled for earlier completion, the pipeline is now expected to be operational by the end of 2025.

This expansion will boost Leviathan’s production capacity from 12 Bcm/a to up to 21 Bcm/a. The project includes drilling additional production wells and upgrading offshore processing facilities. The Leviathan reserve, with 22.9 Tcf of recoverable gas is the largest natural gas reserve in the Mediterranean.

Arab Gas Pipeline Extensions: The Arab Gas Pipeline, which currently connects Egypt, Jordan, Syria, and Lebanon, has several proposed and ongoing upgrades, including a possible extension through Turkey to the Ceyhan terminal. While the main pipeline is operational, new sections and capacity upgrades may come online within this timeframe.

National Iranian Oil Company (NIOC) Pipeline: The 748-mile, 56-inch pipeline, which is under construction, originates in the southern city of Asalouyeh, Bushehr Province and extend to the northern regions of Iran, GEI data shows. The pipeline will have an estimated capacity of 110 MMcm/d of natural gas.

It is expected in service in 2026.

East-West Pipeline Expansion: Saudi Arabia is strategically investing in expanding its East-West pipeline network to support its Vision 2030 goals, which include diversifying the energy mix and increasing natural gas exports. These expansions are expected to be operational before 2028.

Among the largest of those projects is the Basrah-Haditha Oil Pipeline in Iraq, which has been approved for construction. The project includes two 56-inch pipelines of 216 and 720 miles that have capacities of 2.3 MMbpd and 1 MMbpd, respectively, according to Gulf Energy Infrastructure (GEI) data.

The project, which is expandable to 6 MMbpd, will transport oil from the southern oil fields in Basrah to the central region of Haditha. Construction is underway, with the pipeline expected to be operational before 2028.

In the Middle East, most new pipelines will be shorter and will connect new fields across the region to existing pipeline networks with little in the way of major transmission pipelines that are in development for either oil, refined products or gas.

Examples of this type of project include those of Abu Dhabi National Oil Company (ADNOC), which has two pipelines expected to start up this year.

The first, the 53-mile (85-km), 34-inch Lower Zakum-to-Das Island offshore pipeline, has an estimated capacity of 270 MMcf/d, while the second, the 34-mile (56-km), 24-inch Arzahah-Zirku Island pipeline, has a 600 MMcf/d capacity, according to Gulf Energy Infrastructure data.

According to the 2025 Pipeline & Gas Journal Global Pipeline Construction Report, there were 1,211 miles of pipeline under construction in the Middle East in January and 6,117 miles in the planning stages.

Comments