OPEC Winning Price War, According to IEA

Oil markets may not balance until late 2016, but supply is finally contracting in a big way.

Early last week the EIA confirmed that U.S. oil production was down sharply since peaking in April at 9.6 MMbpd. The agency estimates that U.S. output fell by 140,000 barrels per day in August, a steeper decline than in previous months. In its latest weekly estimate (which is less accurate than monthly retrospective estimates), U.S. oil production is now down to just 9.1 MMbpd.

The, the Paris-based International Energy Agency (IEA) added its voice to the debate on Sept. 11 with its latest monthly Oil Market Report. The IEA believes that the U.S. could see a loss of 400,000 bpd in 2016.

Not only that, but the IEA acknowledges the wisdom of OPEC’s strategy of pursuing market share. “On the face of it, the Saudi-led OPEC strategy to defend market share regardless of price appears to be having the intended effect of driving out costly, ‘inefficient’ production.”

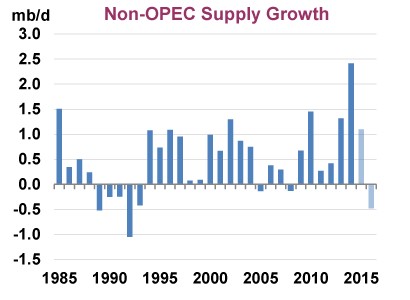

That is because non-OPEC supply is contracting while OPEC is keeping production elevated. Low oil prices, as a result, are “closing down high-cost production from Eagle Ford in Texas to Russia and the North Sea, which may result in the loss next year of half a million barrels a day – the biggest decline in 24 years.”

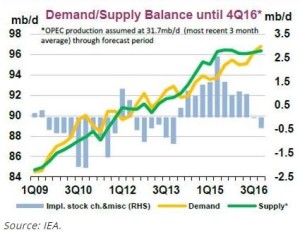

Although the adjustment will be painful, even for OPEC, the oil cartel could succeed in its objective. Global supplies will contract, and demand will pick up the slack. Demand is already at a five-year high, potentially growing by 1.7 MMbpd this year.

The “call on OPEC,” a phrase the agency uses to describe the demand for OPEC’s oil, could rise to 32 MMbpd in late 2016, the highest level in over seven years. OPEC produced 31.6 MMbpd in August. In other words, OPEC is holding on, while non-OPEC producers are being forced out, exactly what OPEC had sought to achieve all along.

Related News

Related News

- Kinder Morgan Proposes 290-Mile Gas Pipeline Expansion Spanning Three States

- Enbridge Plans 86-Mile Pipeline Expansion, Bringing 850 Workers to Northern B.C.

- Intensity, Rainbow Energy to Build 344-Mile Gas Pipeline Across North Dakota

- U.S. Moves to Block Enterprise Products’ Exports to China Over Security Risk

- Court Ruling Allows MVP’s $500 Million Southgate Pipeline Extension to Proceed

- U.S. Pipeline Expansion to Add 99 Bcf/d, Mostly for LNG Export, Report Finds

- A Systematic Approach To Ensuring Pipeline Integrity

- 275-Mile Texas-to-Oklahoma Gas Pipeline Enters Open Season

- LNG Canada Start-Up Fails to Lift Gas Prices Amid Supply Glut

- TC Energy’s North Baja Pipeline Expansion Brings Mexico Closer to LNG Exports

Comments