North Dakota Losing Appeal Among Drillers, Refiners

The performance of Blood & Oil, a soap opera based on the North Dakota oil boom, is not going well. The show saw its episodes trimmed by ABC amid tepid viewer interest. But the real life Bakken is also suffering from a lack of interest, a development that doesn’t bode well for the oil-producing region.

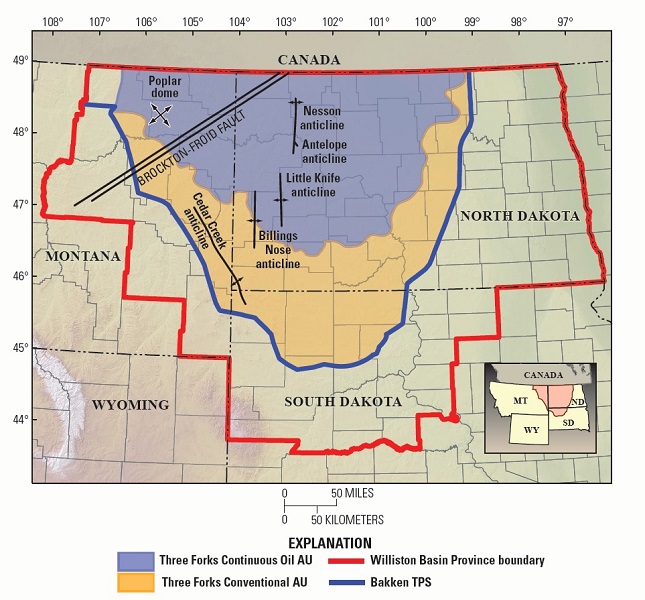

The Bakken had been a key part of the U.S. shale boom over the past half-decade. But production peaked at 1.22 MMbpd in December 2014. Since then production has bounced around, with month-to-month fluctuations, but is slightly down from that high point reached almost a year ago.

The EIA expects the Bakken’s production to drop by 23,000 barrels in November, a decline second only to the Eagle Ford in terms of size.

But falling production is contributing to another problem for the region. Several East Coast refiners are losing interest in Bakken crude, instead preferring to import oil from abroad to use in their refineries. According to Reuters, it is now cheaper for East Coast refiners to import oil from South America, Africa, or the Middle East, than it is to buy oil from North Dakota. The transit costs of moving crude by rail from North Dakota across the country tips the balance in favor of foreign oil.

The U.S. had managed to significantly cut its dependence on imported oil over the past decade, but the share of imports has stopped declining as foreign oil is cheap again.

PBF Energy, Philadelphia Energy Solutions Inc. and Monroe Energy are looking to cut their purchases of oil from North Dakota to their lowest levels in over two years, Reuters reported. After investing in rail links in order to improve access to the Bakken, PBF Energy is slashing its purchases. PBF is opting to import from Colombia, for example, even though it has to pay fees to rail companies after promising to take deliveries of 85,000 bpd. PBF has to pay $2 per bpd ($170,000 per day) even if it no longer wants deliveries. Still, importing from abroad apparently makes sense.

Philadelphia Energy Solutions has already cut its purchases of oil from North Dakota by 80%, switching to imports from Nigeria, Chad and Azerbaijan.

The problem is that the drop off in production has eliminated the discount that Bakken oil traded at to WTI, making it more expensive than oil from other areas that are still suffering from excess supply. Transporting oil by rail can add $10 to the price of a barrel of oil, but importing by tanker only adds $2 to $3 per barrel. The rail transport costs have made North Dakota unattractive for refiners.

“They are looking for the lowest cost supplies,” Sandy Fielden of RBN Energy told Reuters, referring to refiners. “A few years ago, that was North Dakota, but not today.”

To make matters worse for North Dakota, upstream companies are also finding the region less attractive. Occidental Petroleum announced at the end of October that it was pulling up its stakes and leaving the state. Occidental’s oil fields in North Dakota were losing money and the company saw little prospect of turning things around. Instead, Occidental will focus on the Permian Basin in West Texas, where production is still profitable. Occidental says it sold its North Dakota assets, which it believes will bring in $600 million.

In its third quarter earnings call, Occidental CEO Steve Chazen said that North Dakota simply isn’t as attractive as other shale basins. “We just can’t see a situation where we would invest in it…we just don’t see how it competes for capital inside the Company in any reasonable price scenario that we can come up with,” Chazen said, referring to North Dakota. Chazen says it is a no brainer to pull out and shift its sights to West Texas. “For us, this $600 million, we could run four rigs in the Permian Basin for a year with this money, or five, somewhere in that range, and generate more production than we would get out of the Bakken.”

Related News

Related News

- Kinder Morgan Proposes 290-Mile Gas Pipeline Expansion Spanning Three States

- Valero Plans to Shut California Refinery, Takes $1.1 Billion Hit

- Three Killed, Two Injured in Accident at LNG Construction Site in Texas

- Tallgrass to Build New Permian-to-Rockies Pipeline, Targets 2028 Startup with 2.4 Bcf Capacity

- TC Energy Approves $900 Million Northwoods Pipeline Expansion for U.S. Midwest

- U.S. Pipeline Expansion to Add 99 Bcf/d, Mostly for LNG Export, Report Finds

- Enbridge Adds Turboexpanders at Pipeline Sites to Power Data Centers in Canada, Pennsylvania

- Great Basin Gas Expansion Draws Strong Shipper Demand in Northern Nevada

- Cheniere Seeks FERC Approval to Expand Sabine Pass LNG Facility

- Heath Consultants Exits Locate Business to Expand Methane Leak Detection Portfolio

Comments