Gazprom Rapidly Losing Grip on European Markets

When talking about energy security in Central and Eastern Europe (CEE), most governments think of gas pipelines. The bigger they are, the more secure they feel.

In the past decade, at least 10 large-scale pipeline projects have been initiated and proclaimed as the ultimate source of gas diversification and energy security. However, just one has been actually realized – Nord Stream – and still Gazprom can fill its capacity only half-way making the project largely uneconomical.

The reason is that large cross-continental pipelines are risky business endeavors in a very volatile market. They require enormous fixed investment, long-term predictable demand and companies with a lot of cash to afford the project’s development.

In many cases, CEE pipelines have been focusing much more on politics, rather than economics. When the Nabucco and South Stream pipelines were announced back in 2006, for example, their construction depended on the simple proposition that European gas demand would continue rising in perpetuity.

The simple, and seemingly correct logic at the time, was that falling domestic gas production in Europe and rising consumption based on a coal-replacing scenario for utilities, would shoot up imports.

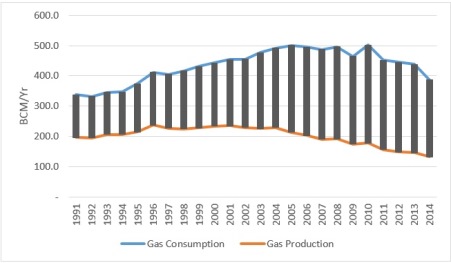

One IEA scenario from 2011 (Figure 2) even claimed that gas demand in Europe would reach close to 600 bcm per annum in 2020. The European Commission was also very bullish as in 2007 it also projected that gas consumption could be 629 bcm per year in 2025, 81% of which would be imported.

How wrong they all have been. Not only has gas consumption been steadily declining since 2009 but is now hovering around levels not seen since 1995. Most of the decline has been the result of an aggressive EU policy for improving energy efficiency levels in the residential sector, the rise of wind and solar energy in power generation, and the industrial slump in the EU following a protracted economic stagnation.

The fact that cheap U.S. coal, driven out of the market by shale gas, is replacing more expensive Russian gas in the utilities’ mix is not helping either.

Hence, all major EU and Gazprom-backed pipelines fell through at the dismay of CEE politicians, who have been feeding off pipelines to gain election support from voters, who miss the old times when large infrastructure projects were always part of a five-year Socialist plan. At the end of the day, the simpler and less expensive way of improving the energy security of the country, such as enhanced gas network interconnectedness, reverse-flow availability and storage capacity, are too boring to win votes.

Fast-forward to 2015 and Russia has again launched a major pipeline idea, namely the Turkish Stream, planning to carry 64 bcm of gas through Turkey to the border with Greece. The idea then has been that European clients would build a pipeline to carry that gas from the Greek border to Central Europe.

Similar to the South Stream saga, a swarm of European energy experts began to praise Gazprom for its shrewd market strategy of both circumventing Ukraine and reaching out to new markets.

Yet already at the start, Gazprom’s proposal to replace the now-cancelled South Stream with an alternative pipeline, seemed more like political rhetoric than a realistic new export strategy. The project has aimed to galvanize support among CEE and Balkan countries for a new Russian gas project distracting their governments from their source diversification strategies.

Gazprom quickly painted a grim picture, in which it stops the gas supply through Ukraine from 2019 leaving Southeast Europe in the cold. This is also consistent with the Russian long-term strategy of leveraging the gas dependence of CEE countries to capture political elites in the region.

Instead of accelerating the regional efforts to receive gas either from the LNG terminals in Greece or by linking themselves to the planned Transadriatic Pipeline (TAP) that would bring Azeri gas from 2019, CEE governments initiated the TESLA project planning to bring the Russian gas from Turkish Stream across Greece, Macedonia, Serbia, Hungary and ultimately Austria. Most recently, the European Commission even included TESLA among the list of its Projects of Common Interest (PCI) allowing it to seek EU financing.

However, while Turkish Stream is likely to cost less ($11.4 billion according to recent reports) than South Stream if implemented, it is unclear how Gazprom could fund such a project considering its ongoing $100 billion Eastern Siberia gas program.

Moreover, it is unlikely that Gazprom would actually follow through on its promise to cut the transit through Ukraine in 2019. This would undermine its long-term contractual obligations with European clients, which are usually bilateral and continue well into the 2020’s. Another story is that it is difficult to see who would buy all these new gas supply considering the stagnant demand forecasts for the CEE and the large variety of gas alternatives in Western Europe.

The recent row between Turkey and Russia after the downing of a Russian jet fighter has also made the project susceptible to the regional geopolitical instability. Russia has already suspended works on the first 16-bcm link of the Turkish Stream, actually the only one that made some economic sense. Even before the incident on the Syrian border, Turkey has shied away from committing to the new pipeline as the government is unlikely to abandon a decade-long energy strategy not to be fully dependent on one gas supply source.

Even so, close to 60% of its annual gas consumption is already coming from Russia. Turkey would not want this dependence to increase even if it diminishes the country’s transit risk from Ukraine under a scenario with only one pipeline link directly from Russia.

On top of this, Gazprom is already charging Turkey one of the highest gas prices in Europe although Turkey seems to be the only growing market for Russian gas.

Already in mid-2015, it became clear to Gazprom officials that the Turkish Stream project would be difficult to achieve. Hence, a new pipeline dream was born. In early September, Gazprom and some of its major European partners including E.ON, BASF/Wintershall, OMV, ENGIE and Royal Dutch Shell signed a shareholders’ agreement for the construction of a second gas pipeline on the Nord Stream route under the Baltic Sea.

Although deemed again by Gazprom analysts as a strategic move to capture a bigger share of the growing West European spot market, the Nord Stream-2 pipeline, estimated to cost about 10 billion euros, is also more about politics than economics. The project’s main goal is to circumvent the transit through Ukraine and CEE countries, which cost Gazprom 2.5 billion euros per year in transit fees.

However, under a long-term ship-or-pay contract, the Russian gas company is obliged to pay the transit tariffs until 2030 irrespective of actual gas flows. Moreover, Gazprom would have to finance 50% of the project, which it simply cannot afford to do considering its shrinking profits.

The net income of the company in U.S. dollar terms shrank by 86% in 2014 and is likely to continue falling in the environment of low oil-indexed gas prices. The IEA also capped the total Russian gas sales to Europe at 160 Bcm through 2020, almost the same as today.

The project also faces a number of regulatory and political obstacles. First, it is unclear that the EU would grant Nord Stream-2 an exemption to the EU Third Energy Package – the first Baltic pipeline also lacks such a derogation on the key German transit pipeline, OPAL, linking North and South Germany, as well as the Czech Republic and Austria.

Second, both the EU and the US would not like to see Ukraine hanged on the Russian-German gas rope. This would be quite cynical after a two-year-long attempt to stabilize Ukraine politically and economically. Last but not least, Moscow would lose some of its growing political clout in the CEE capitals if it unilaterally decides to cut a significant slice of their budget revenue stream such as the transit tariffs.

Instead of Pipeline Dreams

The governments in the CEE region have to realize that amid changing global gas markets, building large gas pipelines dependent on fixed, long-term contractual terms is not consistent with bringing competitive and reliable gas supply. The problem with gas security in the region could be solved much more easily through regional cooperation and demand-driven responses. The former requires political will to accelerate strategic gas interconnectors along the North-South gas corridor, the expansion of existing storage facilities and the construction of new regasification terminals.

The outcome would be more robust supply management in times of shortages, increased competition on a regional market scale and the entry of new gas sources via LNG that is likely to drive prices down in the medium-term. The latter includes public investment in energy efficiency programs, and the development of decentralized energy supply.

The business logic of both supply and demand projects is not entirely visible as they would not transform the gas market in the short-run, there is a need for much more political will and strategic thinking both on the side of the EU and the individual governments in the region.

The mega-pipeline alternative would be to dream big but actually achieve very little.

[inline:2.jpg]

Figure 2: Natural gas demand scenarios for Europe as of 2011. Source: IEA WEO 2011 Golden Gas Scenarios

[inline:3.jpg]

Figure 3 Peak gas demand in selected CEE countries (MMcm/d).

[inline:4.jpg]

Figure 4: Gas pipelines in CEE.

Related News

Related News

- Trump Aims to Revive 1,200-Mile Keystone XL Pipeline Despite Major Challenges

- Valero Considers All Options, Including Sale, for California Refineries Amid Regulatory Pressure

- ConocoPhillips Eyes Sale of $1 Billion Permian Assets Amid Marathon Acquisition

- ONEOK Agrees to Sell Interstate Gas Pipelines to DT Midstream for $1.2 Billion

- Energy Transfer Reaches FID on $2.7 Billion, 2.2 Bcf/d Permian Pipeline

- U.S. LNG Export Growth Faces Uncertainty as Trump’s Tariff Proposal Looms, Analysts Say

- Tullow Oil on Track to Deliver $600 Million Free Cash Flow Over Next 2 Years

- Energy Transfer Reaches FID on $2.7 Billion, 2.2 Bcf/d Permian Pipeline

- GOP Lawmakers Slam New York for Blocking $500 Million Pipeline Project

- Texas Oil Company Challenges $250 Million Insurance Collateral Demand for Pipeline, Offshore Operations

Comments