Aqua America to Acquire Peoples in Merger of Water, Gas Utilities

Water and wastewater utility Aqua America said it agreed to acquire natural gas utility operator Peoples in a $4.2 billion deal to create a company that is “uniquely positioned to have a powerful impact on improving the nation’s infrastructure reliability.”

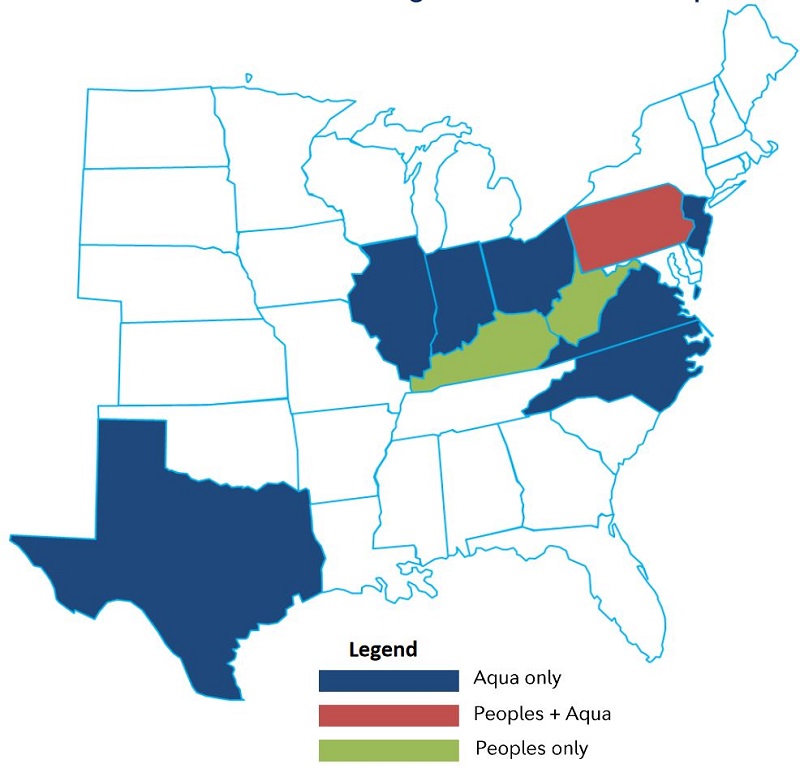

The combined company would have $10.8 billion in assets and serve 1.74 million water and gas utility customer connections in 10 U.S. states with a projected regulated rate base of more than $7.2 billion.

“By bringing together water and natural gas distribution utility companies that share a core mission of providing essential services to customers, the resulting company will be positioned to grow and drive value, as well as make a long-term, positive contribution to our nation’s infrastructure challenges and ensure service reliability for generations to come,” said Christopher Franklin, chairman and CEO of Aqua America.

“The acquisition of Peoples is a great strategic fit and aligns directly with our growth strategy and core competencies of building and rehabilitating infrastructure, timely regulatory recovery, and operational excellence,” Franklin said, adding that “the new leadership team will take an integrated management approach to cooperatively running the utilities.”

Franklin would continue lead the combined company after the merger, with Aqua’s headquarters remaining in Bryn Mawr, Penn., and Peoples and its employees remaining in Pittsburgh as its natural gas operating subsidiary. Morgan O’Brien would continue to lead Peoples, which consists of Peoples Natural Gas Company, Peoples Gas Company and Delta Natural Gas Company.

In the merger announcement, O’Brien noted “the Pennsylvania Public Utility Commission has demonstrated its support for our infrastructure investment program, through which we will replace more than 3,100 miles of bare steel and cast-iron pipe in the coming years at a current rate of about 150 miles per year,” said O’Brien.

Peoples reportedly has sought to expand into the water and wastewater utility business through a deal with the Pittsburgh Water and Sewer Authority (PWSA) to replace its aging infrastructure, and the Aqua announcement prompted widespread media coverage and speculation in Pennsylvania, which accounts for more than 77 percent of the companies’ combined total rate base.

“Some of the same things that attracted Peoples to make a pitch to help operate the (PWSA) earlier this year also made the Pittsburgh gas company appealing for Aqua. Namely, old pipes in the ground,” Pittsburgh Post Gazette columnist Anya Litvak wrote. “Those pipes need to be replaced and utilities can recover the cost of doing so — along with an attractive rate of return — through surcharges on customer bills. That’s quicker than asking regulators to fold those costs into rate increases.”

Aqua said it expects significant growth in rate base and earnings will be “driven by pipe-replacement capital expenditures, new customer connections and continued success in municipal acquisitions.”

The proposed merger reflects an enterprise value of Peoples of $4.275 billion, which includes the assumption of approximately $1.3 billion of debt. The acquisition is supported by a fully committed bridge facility, with permanent financing to include “an appropriate mix of equity and debt to target a strong balance sheet and investment-grade credit ratings,” Aqua said.

The transaction is projected to close in mid-2019, subject to approval by public utility commissions in Pennsylvania, Kentucky and West Virginia.

- P&GJ Staff Report

Related News

Related News

- Enbridge Plans 86-Mile Pipeline Expansion, Bringing 850 Workers to Northern B.C.

- Intensity, Rainbow Energy to Build 344-Mile Gas Pipeline Across North Dakota

- U.S. Moves to Block Enterprise Products’ Exports to China Over Security Risk

- Strike Pioneers First-of-Its-Kind Pipe-in-Pipe Installation on Gulf Coast with Enbridge

- 208-Mile Mississippi-to-Alabama Gas Pipeline Moves Into FERC Review

- U.S. Pipeline Expansion to Add 99 Bcf/d, Mostly for LNG Export, Report Finds

- A Systematic Approach To Ensuring Pipeline Integrity

- 275-Mile Texas-to-Oklahoma Gas Pipeline Enters Open Season

- LNG Canada Start-Up Fails to Lift Gas Prices Amid Supply Glut

- Kinder Morgan Gas Volumes Climb as Power, LNG Demand Boost Pipeline Business

Comments