Canadian Pension Fund Takes 50% Stake in BridgeTex Pipeline

Plains All American and Magellan Midstream have completed the sale of a 50% stake in BridgeTex Pipeline to OMERS, the defined benefit pension plan for municipal employees in Ontario, Canada, and its infrastructure investment manager.

Plains retains a 20% interest following the $1.438 billion transaction, while Magellan will continue to operate the Permian-to Gulf Coast pipeline and own a 30% interest.

Originally developed as a 50/50 venture between Magellan and Occidental Petroleum, the BridgeTex Pipeline began commercial service in September 2014 with an initial capacity of 300,000 bpd. Occidental agreed to sell its interest in the project to Plains only two months later. BridgeTex currently has a capacity of 400,000 bpd, and is being expanded to 440,000 barrels per day by early 2019.

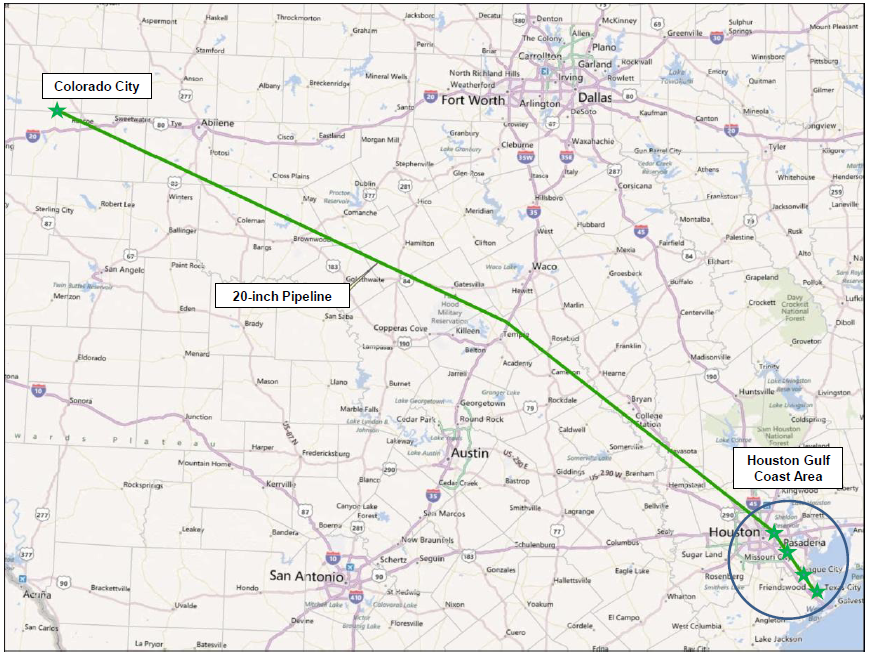

The pipeline delivers crude oil from Colorado City in West Texas to Houston, with further connectivity for BridgeTex shippers to the Texas City area. At Colorado City, BridgeTex pipeline sources crude oil from Plains’ Basin and Sunrise pipeline systems. BridgeTex delivers volumes into Magellan’s East Houston terminal and Magellan’s Houston crude oil distribution system with connection to refineries in Houston and Texas City as well as to marine export capabilities via Magellan’s Seabrook Logistics joint venture terminal.

OMERS Infrastructure is one of Canada's largest defined benefit pension funds, with net assets of more than C$95 billion.

Related News

Related News

- Enbridge Plans 86-Mile Pipeline Expansion, Bringing 850 Workers to Northern B.C.

- Intensity, Rainbow Energy to Build 344-Mile Gas Pipeline Across North Dakota

- U.S. Moves to Block Enterprise Products’ Exports to China Over Security Risk

- Strike Pioneers First-of-Its-Kind Pipe-in-Pipe Installation on Gulf Coast with Enbridge

- 208-Mile Mississippi-to-Alabama Gas Pipeline Moves Into FERC Review

- U.S. Pipeline Expansion to Add 99 Bcf/d, Mostly for LNG Export, Report Finds

- A Systematic Approach To Ensuring Pipeline Integrity

- 275-Mile Texas-to-Oklahoma Gas Pipeline Enters Open Season

- LNG Canada Start-Up Fails to Lift Gas Prices Amid Supply Glut

- Strike Pioneers First-of-Its-Kind Pipe-in-Pipe Installation on Gulf Coast with Enbridge

Comments