Marcellus Producers Lock 100% of Planned Transco Expansion

Demonstrating pent-up takeaway demand for Marcellus Basin natural gas production, Williams said its Transco interstate pipeline unit has secured binding 15-year commitments on 100% of capacity of its proposed Leidy South expansion project

The agreements with Seneca Resources Company and Cabot Oil & Gas Corp. would provide for the full 580 Mmcf/d of expanded pipeline capacity connecting natural gas production in Pennsylvania with growing demand centers along the Atlantic Seaboard.

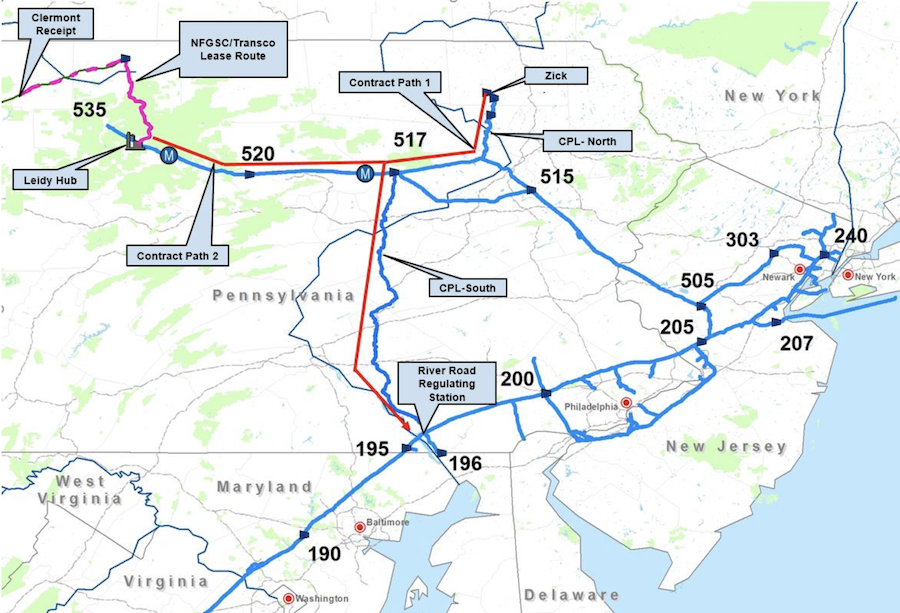

The Leidy South project would consist of compression and looping of existing Transco facilities in Pennsylvania. The project also would include two lease agreements; one with National Fuel Gas Supply Corporation from Leidy Hub to Clermont, Pennsylvania; and a second with Meade Pipeline Company from Zick to River Road on the Central Penn Line.

The project could be in service by late 2021 with timely regulatory approvals, Williams said. It plans to ask the Federal Energy Regulatory Commission (FERC) this month for permission to start the pre-filing process.

Transco is the nation’s largest-volume interstate natural gas pipeline system, with a 10,000 mile pipeline system and a mainline extending nearly 1,800 miles from Texas to New York. Williams said the Leidy South project would expand Marcellus and Utica takeaway capacity from the Leidy Hub and Zick interconnect to points downstream.

“The Leidy South project allows Williams to continue to grow our strategic footprint in the gas-rich Marcellus region, creating a unique opportunity to expand Transco by leveraging recent expansions on Williams’ Northeast Gathering & Processing assets in Pennsylvania,” said Frank Ferazzi, senior vice president of Williams’ Atlantic-Gulf Operating Area.

Jim Scheel, senior vice president of the Northeast Gathering & Processing Operating Area, said the project helps Williams and its customers "capitalize on our extensive gathering system, optimizing connectivity with producers strategically positioned throughout the basin, and demonstrating mutual growth.”

Williams said the project will not impact its 2019 capital expenditures guidance, indicating that construction would begin no sooner than 2020.

Related News

Related News

- Enbridge Plans 86-Mile Pipeline Expansion, Bringing 850 Workers to Northern B.C.

- Intensity, Rainbow Energy to Build 344-Mile Gas Pipeline Across North Dakota

- U.S. Moves to Block Enterprise Products’ Exports to China Over Security Risk

- 208-Mile Mississippi-to-Alabama Gas Pipeline Moves Into FERC Review

- Court Ruling Allows MVP’s $500 Million Southgate Pipeline Extension to Proceed

- U.S. Pipeline Expansion to Add 99 Bcf/d, Mostly for LNG Export, Report Finds

- A Systematic Approach To Ensuring Pipeline Integrity

- LNG Canada Start-Up Fails to Lift Gas Prices Amid Supply Glut

- 275-Mile Texas-to-Oklahoma Gas Pipeline Enters Open Season

- TC Energy’s North Baja Pipeline Expansion Brings Mexico Closer to LNG Exports

Comments