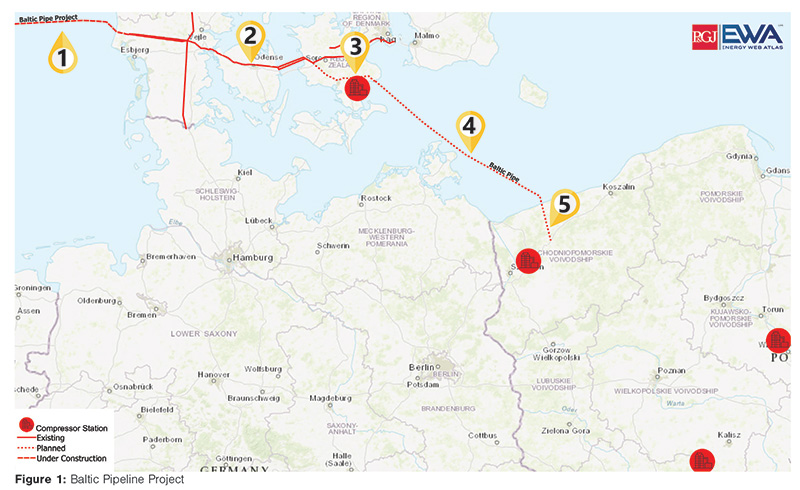

Norway-Poland Gas Link on Track for 2022

OSLO, May 8 (Reuters) - A planned pipeline linking Norwegian natural gas fields to markets in Denmark and Poland is on track for completion by October 2022, Polish Foreign Minister Jacek Czaputowicz said on Wednesday.

The Eastern European country sees the Baltic Pipe as a way to diversify its gas supply, most of which is currently imported from Russia under a long-term contract with Gazprom that expires in 2022.

"It is going well. We try to finish that investment by October 2022. For the moment it is in accordance with the schedule," Czaputowicz told a news conference after meeting Norwegian counterpart Ine Eriksen Soereide in Oslo.

The Polish minister told Reuters the construction of the Baltic Pipe could only increase the interest of Polish energy firms such as state-run PGNiG and refiner Lotos in investments in Norway.

"Definitely if the Baltic Pipe is constructed, it will be another argument for investing in the fields here in Norway... Knowing the philosophy of the company (PGNiG), they are very interested," he said.

PGNiG, which agreed in October to buy Equinor's 42.38 percent stake in the Tommeliten Alpha gas and condensate field in Norway, has said it plans to increase its gas output in the country via acquisitions.

The firm is targeting a total gas output of 2.2 billion cubic meters (bcm) by 2022 from 0.55 bcm in 2017.

Poland Wants Out of Gazprom Deal

Poland uses around 17 billion cubic metres (bcm) of gas a year and imports more than half of that from Gazprom. The Baltic Pipe's capacity will be 10 bcm a year.

"We want to have it ready in order not to be forced to continue that contract with Gazprom. Simply we do not want to prolong that contract," said Czaputowicz.

Asked how Poland would fill any supply gap in case the Baltic Pipe's construction takes longer, he said there were more possibilities to guarantee it.

"For example our LNG (liquefied natural gas) terminal, which will be also enlarged," added the minister.

Poland's Swinoujscie LNG terminal is due to expand annual capacity to 7.5 bcm from 5 bcm by 2021, hoping to capitalise on higher gas demand in central Europe and lessen the region's dependence on Russia.

"We treat Norway as a reliable international partner. Russia is not such a partner for us," Czaputowicz said.

PGNiG had already bought four spot LNG cargoes by March 7 this year, compared with five cargoes for all of last year. (Editing by Terje Solsvik/Mark Heinrich)

Related News

Related News

- Enbridge Plans 86-Mile Pipeline Expansion, Bringing 850 Workers to Northern B.C.

- Intensity, Rainbow Energy to Build 344-Mile Gas Pipeline Across North Dakota

- U.S. Moves to Block Enterprise Products’ Exports to China Over Security Risk

- 208-Mile Mississippi-to-Alabama Gas Pipeline Moves Into FERC Review

- Strike Pioneers First-of-Its-Kind Pipe-in-Pipe Installation on Gulf Coast with Enbridge

- U.S. Pipeline Expansion to Add 99 Bcf/d, Mostly for LNG Export, Report Finds

- A Systematic Approach To Ensuring Pipeline Integrity

- 275-Mile Texas-to-Oklahoma Gas Pipeline Enters Open Season

- LNG Canada Start-Up Fails to Lift Gas Prices Amid Supply Glut

- Kinder Morgan Gas Volumes Climb as Power, LNG Demand Boost Pipeline Business

Comments