Critical Notice on Alliance Pipeline Rearranges Midwest Flows

The Alliance Pipeline posted a critical notice announcing zero flows on the line between June 18-21 to perform pipeline repairs in Iowa and Illinois, according to the U.S. Energy Information Agency (EIA).

Despite the magnitude of this event, the region met customer demand using alternative supply options and storage access, and as a result, prices were not significantly affected, EIA reported in its Natural Gas Weekly Update.

Alliance typically imports about 1.7 billion cubic feet per day (Bcf/d) of natural gas from Western Canada into the United States through Sherwood, North Dakota, and delivers into Midwestern markets. The pipeline also feeds several interstate pipelines, in particular ANR and Vector pipelines. Sherwood, North Dakota is the second-largest receipt point for imports from Canada after Eastport, Idaho, which brings natural gas into the Pacific Northwest on TC Energy’s (formerly TransCanada) Gas Transmission Northwest system.

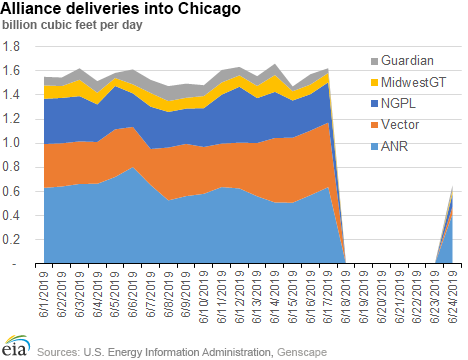

Genscape data show that Alliance deliveries into North Dakota were zero or very close to zero for six days, encompassing June 18-23. On June 24, flows resumed to 1.6 billion cubic feet per day (Bcf/d), which is close to normal levels. As a result of the outages, supplies into ANR and Vector were reduced, which also reduced exports into Canada on the Vector pipeline at St. Clair, Michigan.

In the days leading up to the outage, flows on Vector increased compared to earlier in the month, reaching about 800 million cubic feet per day (MMcf/d) before dropping by about 50% after Alliance’s outage. Similarly, flows on ANR-East out of Chicago fell by almost 50% on average during the outage. Platts S&P Global storage data show that ANR, which is one of the largest storage operators in the region, had an unusually large injection of 7.2 Bcf for the week ending June 14 and a smaller injection of 5.9 Bcf for the week ending June 21.

In addition, receipts from the Northern Border pipeline increased by about 300 MMcf/d during the outage to help supplement missing volumes. Northern Border imports natural gas at Port of Morgan, Montana, the nation’s third-largest pipeline import point, and also receives some volumes from production basins in Wyoming.

Between June 14-17, prices in the Midwest appear to have jumped by 10 cents to 20 cents per million British thermal unit (MMBtu). However, prices at the Chicago Citygate remained near $2.20/MMBtu in the days following the shut-in, declining toward the end of the event.

As of June 24, the Chicago Citygate price traded at $1.91/MMBtu. This price level indicates that the reduced supply on Alliance was more than offset by supply from other regions, as well as mild weather and high production levels.

Related News

Related News

- Intensity, Rainbow Energy to Build 344-Mile Gas Pipeline Across North Dakota

- Energy Transfer to Build $5.3 Billion Permian Gas Pipeline to Supply Southwest

- Enbridge Sees High Demand to Expand 593-Mile Canada-to-U.S. Gulf Oil Pipeline

- Strike Pioneers First-of-Its-Kind Pipe-in-Pipe Installation on Gulf Coast with Enbridge

- 208-Mile Mississippi-to-Alabama Gas Pipeline Moves Into FERC Review

- A Systematic Approach To Ensuring Pipeline Integrity

- 275-Mile Texas-to-Oklahoma Gas Pipeline Enters Open Season

- LNG Canada Start-Up Fails to Lift Gas Prices Amid Supply Glut

- Strike Pioneers First-of-Its-Kind Pipe-in-Pipe Installation on Gulf Coast with Enbridge

- Enbridge Sees High Demand to Expand 593-Mile Canada-to-U.S. Gulf Oil Pipeline

Comments