Activists Urge Banks Not to Finance Ugandan Oil Pipeline

KAMPALA (Reuters) - A group of 30 international and local campaign groups have petitioned two banks to abandon plans to raise funds to build an oil pipeline to export Ugandan oil, saying the project would damage local livelihoods, water resources and wildlife.

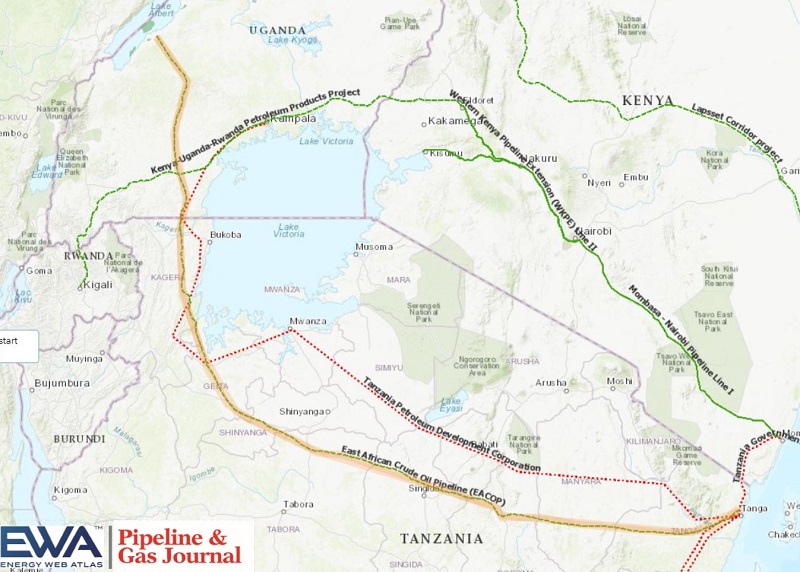

The 900-mile (1,445 km) East African Crude Oil Pipeline, which will run from fields in the west of Uganda to Tanzania’s Indian Ocean port of Tanga, is vital to developing the East African nation’s oil reserves.

South Africa’s Standard Bank Group and Japan’s Sumito Mitsui Banking Corporation are helping to raise the debt needed to finance the $3.5 billion pipeline.

“We consider this project to present unacceptable risks to local people through physical displacement and threats to incomes and livelihoods,” Global Witness and 29 other groups from Britain, the United States and elsewhere told the banks.

In a letter urging the banks not to arrange financing, the groups said the project posed “unacceptable risks to water, biodiversity and natural habitats, as well as representing a new source of carbon emissions the planet can ill afford.”

Standard Bank said in an email it had received the letter and was reviewing it. Sumito Mitsui Banking Corporation declined to comment when asked by Reuters.

Uganda found oil reserves estimated to hold 6 billion barrels in western fields in 2006. But progress on development has been slow, partly due to disagreements between the government and oil firms about strategy. Uganda also took several years to decide on a pipeline route.

France’s Total, China’s CNOOC and Britan’s Tullow Oil control the Ugandan fields.

The pipeline, which will cross rivers and swampland that act as a catchment for Lake Victoria and areas rich in wildlife, is expected to transport about 200,000 barrels per day (bpd) when oil production peaks.

Related News

Related News

- Kinder Morgan Proposes 290-Mile Gas Pipeline Expansion Spanning Three States

- Enbridge Plans 86-Mile Pipeline Expansion, Bringing 850 Workers to Northern B.C.

- Intensity, Rainbow Energy to Build 344-Mile Gas Pipeline Across North Dakota

- Tallgrass to Build New Permian-to-Rockies Pipeline, Targets 2028 Startup with 2.4 Bcf Capacity

- U.S. Moves to Block Enterprise Products’ Exports to China Over Security Risk

- U.S. Pipeline Expansion to Add 99 Bcf/d, Mostly for LNG Export, Report Finds

- A Systematic Approach To Ensuring Pipeline Integrity

- 275-Mile Texas-to-Oklahoma Gas Pipeline Enters Open Season

- TC Energy’s North Baja Pipeline Expansion Brings Mexico Closer to LNG Exports

- Consumers Energy Begins 135-Mile Michigan Gas Pipeline Upgrade, Taps 600 Workers

Comments