Pipeline Expansion, Reversal May Offset Pa. Refinery Losses

HOUSTON (P&GJ) – The Central Atlantic Region is boosting imports to offset the closure of Philadelphia Energy Solutions' (PES) 335,000-bpd refinery after last month's fire, but a longer-term solution may involve the expansion or reversal of a major pipeline to bring more product from Ohio or Texas, according to a report released Monday by Morningstar Commodities Research.

The PES refinery accounted for 16.5% of gasoline and 27% of distillate supply to the Central Atlantic region, which includes New York, New Jersey, Pennsylvania, Delaware, Maryland and the District of Columbia. Its loss caused CME Nymex gasoline prices to jump 8% and diesel prices to increase 4% between June 20 and July 1, with further increases expected as supplies tighten over the summer.

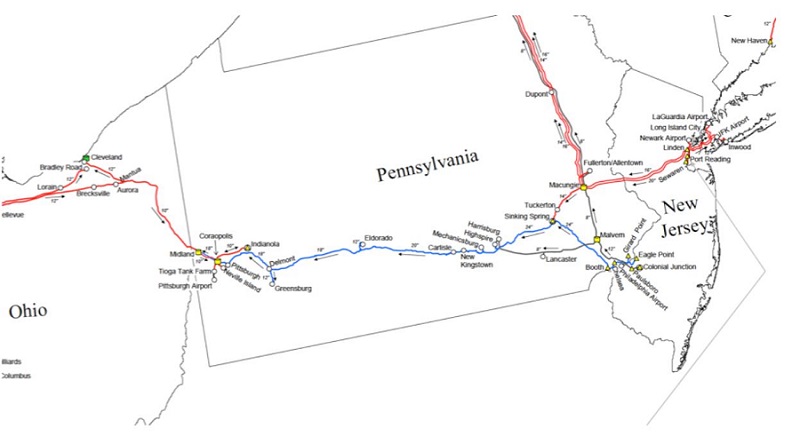

The supply shortage is being that will be filled by increased imports in the short term but could prompt expansion of Colonial Pipeline or the reversal of the Buckeye-owned Laurel Pipeline system, according to the report by Morningstar's director of Oil and Products Research, Sandy Fielden.

"In the longer term, assuming that PES isn’t restarted, the most economic new supplies into the Central Atlantic region—assuming imports are relatively more expensive—would be pipeline deliveries on Colonial or from (Energy Petroleum Administration for Defense District) PADD 2 in Ohio," Fielden wrote. "The Colonial pipeline is currently running close to capacity year-round, so would need to be expanded to accommodate the close to 300,000 of additional refined product now missing from PES."

Colonial added 160,000 bpd of capacity in 2013 and 2014 through pump station and line improvements, but the system is currently running near capacity, and any meaningful expansion would require new pipe in the ground, which Fielden noted, "would be both expensive and contentious because of the route through a highly populated area."

Another option would be the expansion of pipeline flows into the Central Atlantic region from Ohio, and Morningstar concluded that the quickest way to accomplish this would be to reverse the Laurel system, which currently moves refined product west from the Philadelphia region to Pittsburgh. "The potential reversal of the Buckeye Laurel pipeline would allow increased flows of refined product from Midwest refineries" with access to both shale crude from North Dakota and Canadian heavy supplies.

With the loss of PES, remaining Central Atlantic refiners should benefit from higher prices and tighter supplies, Fielden said, but their continued lack of pipeline access to domestic shale and Canadian crudes still puts them at a disadvantage compared with Gulf Coast and Midwest competitors

"In the end, expansion of pipeline supplies from PADD 2 could increase competitive pressure on remaining plants in the Central Atlantic region," he said.

Related News

Related News

- Trump Aims to Revive 1,200-Mile Keystone XL Pipeline Despite Major Challenges

- Valero Considers All Options, Including Sale, for California Refineries Amid Regulatory Pressure

- ConocoPhillips Eyes Sale of $1 Billion Permian Assets Amid Marathon Acquisition

- ONEOK Agrees to Sell Interstate Gas Pipelines to DT Midstream for $1.2 Billion

- Energy Transfer Reaches FID on $2.7 Billion, 2.2 Bcf/d Permian Pipeline

- U.S. LNG Export Growth Faces Uncertainty as Trump’s Tariff Proposal Looms, Analysts Say

- Tullow Oil on Track to Deliver $600 Million Free Cash Flow Over Next 2 Years

- Energy Transfer Reaches FID on $2.7 Billion, 2.2 Bcf/d Permian Pipeline

- GOP Lawmakers Slam New York for Blocking $500 Million Pipeline Project

- Texas Oil Company Challenges $250 Million Insurance Collateral Demand for Pipeline, Offshore Operations

Comments