Investors Flock to Finance Calcasieu Pass LNG Construction

HOUSTON (P&GJ) — Venture Global LNG said it has made a final investment decision to proceed with development of its $5.8 billion Calcasieu Pass liquefaction facility after financing was nearly two times oversubscribed with more than $10 billion in binding commitments.

The proceeds of the construction financing, along with the equity investment from Stonepeak Infrastructure Partners, will fund the construction and commissioning of the Calcasieu Pass facility and the associated TransCameron pipeline, Venture Global said.

"The incredible market response to our Calcasieu Pass debt facility is the culmination of many years of work by our team," Venture Global LNG Co-CEOs Mike Sabel and Bob Pender said in a joint statement.

"We are incredibly proud that the world's leading project finance institutions have responded with such a validation of the quality of our structure and partners with outstanding terms and a significant oversubscription," they said. "The company has now secured more than $8.6 billion of capital and is continuing full construction and fabrication activity at Calcasieu Pass."

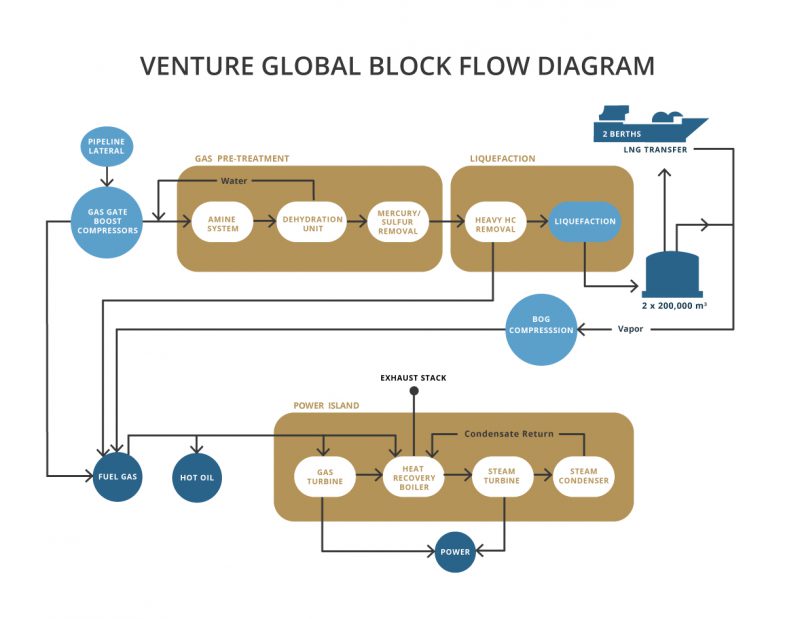

The 10 million metric ton per annum (MTPA) Venture Global Calcasieu Pass facility will employ a comprehensive process solution from Baker Hughes, a GE company (BHGE) that utilizes efficient mid-scale, modular, factory-fabricated liquefaction trains. Kiewit is designing, engineering, constructing, commissioning, testing and guaranteeing the facility.

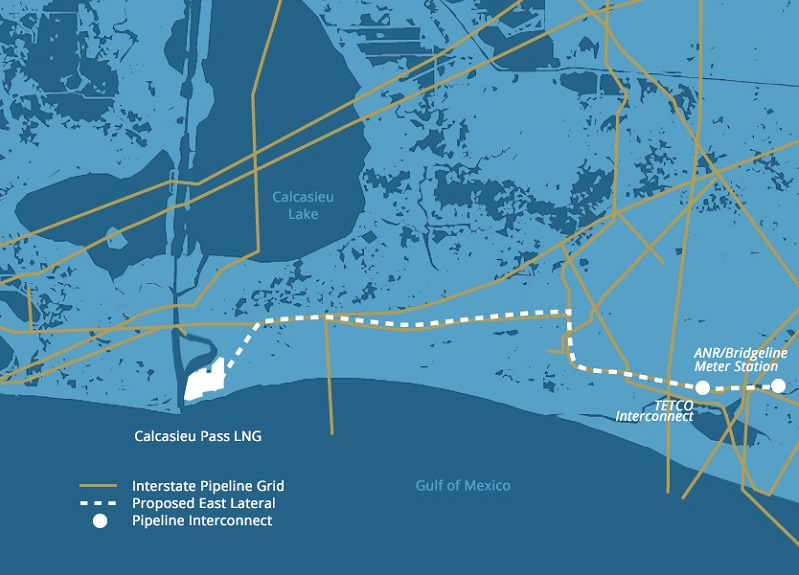

Venture Global started construction of Calcasieu Pass earlier this year in Cameron Parish, at the at the intersection of the Calcasieu Ship Channel and the Gulf of Mexico, and is targeting commercial operations in 2022. The project has received all necessary permits, including FERC authorization and Non-FTA export authorization from the U.S. Department of Energy.

Calcasieu Pass is being built on a 930-acre plot with more than a mile of deepwater frontage and two ship loading berths for LNG vessels carrying a capacity of up to 185,000 cubic meters, along with two 200,000 cubic-meter, full-containment LNG storage tanks. The project also includes an electrically driven, 611-MW combined cycle gas turbine power plant with an additional 25-MW gas-fired turbine.

The facility will be interconnected via the TransCameron natural gas pipeline, a single 42-inch diameter, 24 mile long pipeline that will extend from interconnection points within the vicinity of Grand Cheniere Station in Cameron Parish. TransCameron will have capacity to deliver 1.9 Bcfd and meet the full plant gas supply demand, Venture Global said.

Under its contract, BHGE said it will provide an LNG liquefaction train system (LTS) with 18 modularized compression trains across nine blocks, for a total nameplate capacity of 10 MTPA.

The modularized system enables faster installation and lower construction and operational costs," BHGE said. These modules will be manufactured, assembled, tested and transported from BHGE’s plants in Italy. Additionally, BHGE will deliver a comprehensive power island system (PIS) that includes power generation and electrical distribution equipment for the facility. Equipment deliveries are expected to begin in the second half of 2020.

BHGE will also provide associated field support services to assist in the oversight, installation and commissioning of the supplied equipment. These are the first contracts awarded under the master equipment supply agreement between Venture Global LNG and BHGE for 60 MTPA of production capacity.

In addition to Calcasieu Pass, Venture Global LNG also is developing the 20-MTPA Venture Global Plaquemines LNG facility 30 miles south of New Orleans on the Mississippi River, and the 20 MTPA Venture Global Delta LNG facility, also on the Mississippi River south of New Orleans. Both of those projects are located in Plaquemines Parish.

Related News

Related News

- Trump Aims to Revive 1,200-Mile Keystone XL Pipeline Despite Major Challenges

- ONEOK Agrees to Sell Interstate Gas Pipelines to DT Midstream for $1.2 Billion

- Energy Transfer Reaches FID on $2.7 Billion, 2.2 Bcf/d Permian Pipeline

- Boardwalk Approves 110-Mile, 1.16 Bcf/d Mississippi Kosci Junction Pipeline Project

- Kinder Morgan Approves $1.4 Billion Mississippi Crossing Project to Boost Southeast Gas Supply

- Tullow Oil on Track to Deliver $600 Million Free Cash Flow Over Next 2 Years

- GOP Lawmakers Slam New York for Blocking $500 Million Pipeline Project

- Energy Transfer Reaches FID on $2.7 Billion, 2.2 Bcf/d Permian Pipeline

- Enbridge Should Rethink Old, Troubled Line 5 Pipeline, IEEFA Says

- Polish Pipeline Operator Offers Firm Capacity to Transport Gas to Ukraine in 2025

Comments