Oryx Secures $550 Million Investment From Qatar Investment Authority

(P&GJ) — Oryx Midstream Services (Oryx), the largest privately-held midstream crude operator in the Permian Basin, has announced that an affiliate of Qatar Investment Authority (QIA) has acquired a significant stake in Oryx from an affiliate of Stonepeak Infrastructure Partners (Stonepeak).

In addition, QIA has committed to invest in the development of Oryx alongside Stonepeak. The total QIA investment in Oryx will be approximately $550 million.

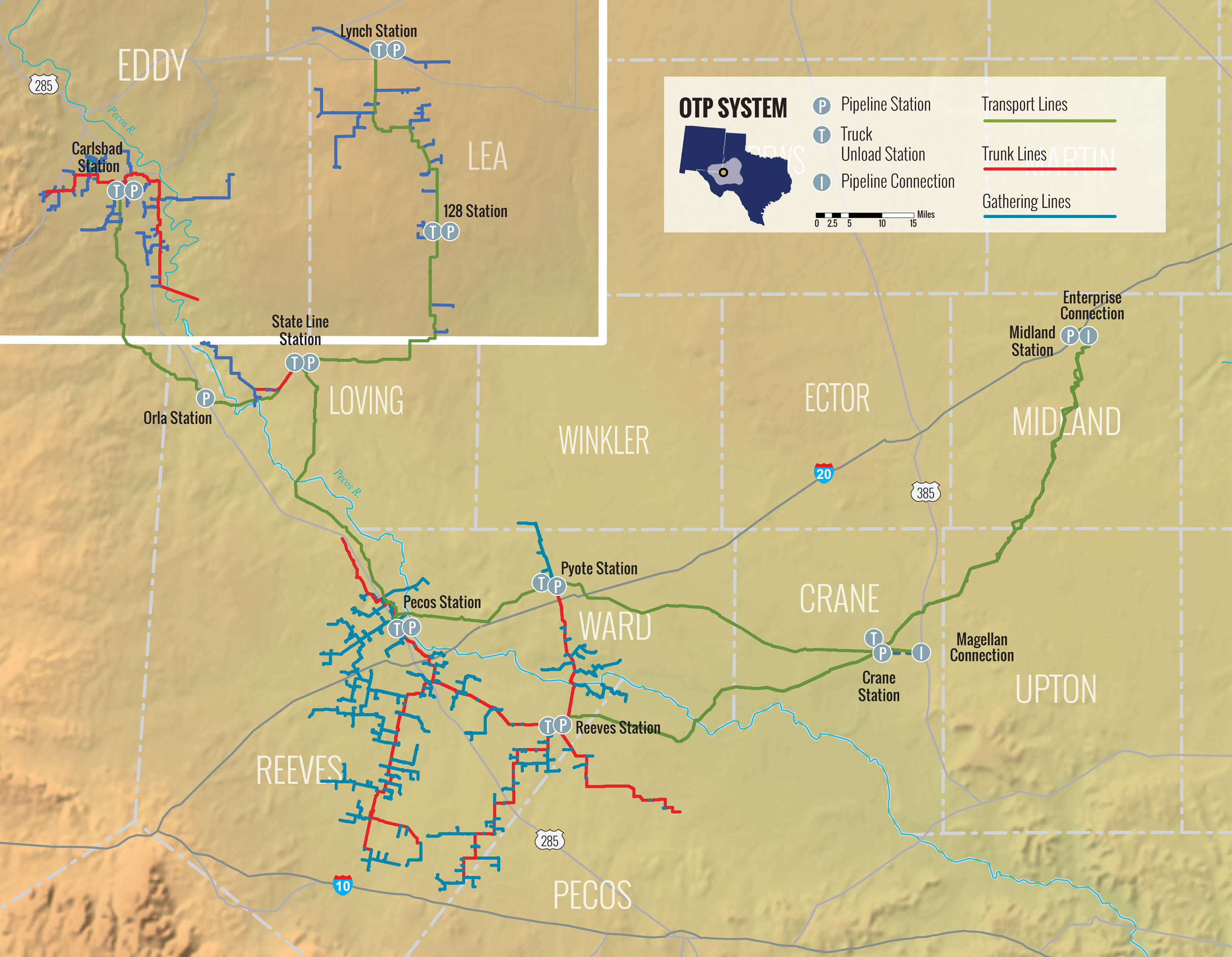

The Oryx system transports crude oil to market hubs for ultimate delivery to the Gulf Coast. The system helps supply domestic refineries and the growing US export market. The company operates 500 miles of transport and gathering pipelines and is constructing an additional 680 miles of gathering pipelines to be operational in the second quarter of 2019.

Upon completion of the remaining part of the system under construction, Oryx's total transportation capacity will exceed 900,000 barrels per day and access multiple takeaway options across the Texas and New Mexico Stateline area. The system will also allow the company to expand deliverability into major liquidity points in the Permian Basin.

The CEO of QIA, Mansoor Al-Mahmoud, said, "We believe that Oryx represents a strong midstream platform with tremendous growth potential, and we look forward to working with our new partners at Stonepeak. This acquisition is a further demonstration of QIA's strategy to increase the size of our US portfolio, and to invest more in major infrastructure projects."

The partnership is the latest in a series of investments undertaken by QIA across the US where QIA aims to increase investment to $45 billion in the coming years.

Brett Wiggs, CEO or Oryx said, "The significant investment and commitment from QIA alongside Stonepeak's strong operational and capital support will allow us to continue to grow our footprint in the Permian Basin and deliver the highest level of service to current and future customers. We are thrilled to lead Oryx in partnership with these world-class investors."

Related News

Related News

- Enbridge Plans 86-Mile Pipeline Expansion, Bringing 850 Workers to Northern B.C.

- Intensity, Rainbow Energy to Build 344-Mile Gas Pipeline Across North Dakota

- U.S. Moves to Block Enterprise Products’ Exports to China Over Security Risk

- Strike Pioneers First-of-Its-Kind Pipe-in-Pipe Installation on Gulf Coast with Enbridge

- 208-Mile Mississippi-to-Alabama Gas Pipeline Moves Into FERC Review

- U.S. Pipeline Expansion to Add 99 Bcf/d, Mostly for LNG Export, Report Finds

- A Systematic Approach To Ensuring Pipeline Integrity

- 275-Mile Texas-to-Oklahoma Gas Pipeline Enters Open Season

- LNG Canada Start-Up Fails to Lift Gas Prices Amid Supply Glut

- Strike Pioneers First-of-Its-Kind Pipe-in-Pipe Installation on Gulf Coast with Enbridge

Comments