Permian Basin Natural Gas Prices Rise as GCX Nears Completion

HOUSTON (P&GJ) — Natural gas spot prices at the Waha hub in West Texas closed at their highest price since March as the 2 Bcf/d Gulf Coast Express (GCX) pipeline is preparing to enter service, according to a Thursday update from the U.S. Energy Information Administration (EIA).

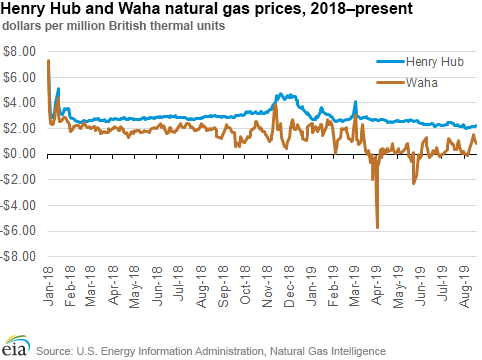

Limited natural gas pipeline takeaway capacity in the region has kept prices very low or negative in recent months. In the first eight months of 2019 (through August 19), the Waha spot price averaged just 65 cents per British thermal units (MMBtu).

GCX will provide much-needed additional natural gas take-away pipeline capacity in the Permian Basin, and prices have begun to anticipate this new capacity, closing at $1.55/million on August 15. Initial deliveries into the pipeline began on Aug. 8.

The Waha spot price has been consistently lower than the Henry Hub spot price, the national benchmark price for natural gas. However, in recent days, that differential has significantly decreased, with Waha spot prices closing 59 cents per MMBtu lower than the Henry Hub spot price last Thursday—the lowest daily differential since mid-March. In comparison, this differential averaged between $2 and $3 per MMBtu between March and June of this year.

This recent uptick in the Waha price clearly coincides with flows on the GCX, as deliveries at El Paso Natural Gas Pipeline’s interconnection with GCX reached nearly 0.26 Bcf/d on August 14, S&P Global Platts reported.

The movement also supports industry reports that GCX is packing its lines in anticipation of entering service late next month, ahead of its announced in-service date of Oct. 1.

Once fully operational, the pipeline will transport up to 2 Bcf/d of natural gas to the Agua Dulce receipt point near Corpus Christi, on the Texas Gulf Coast.

Natural gas produced in the Permian Basin is largely gas that is produced as a byproduct of targeted crude oil production. Producers in the region may vent or flare this associated gas to a limited extent, but these activities are subject to regulation by the Texas Railroad Commission.

While expanded natural gas pipeline capacity has had a positive impact on natural gas prices, there are some indications that new Permian Basin crude oil pipelines are hurting oil prices, if only temporarily.

Kinder Morgan built and will operate and own a 34% interest in the $1.75 billion GCX project, which began construction in May 2018. Other equity holders include Altus Midstream, DCP Midstream and an affiliate of Targa Resources.

The pipeline has been fully subscribed under long-term, binding transportation agreements. Shippers that have committed to the project include DCP Midstream, Targa, Apache Corporation, Pioneer Natural Resources Company and XTO Energy, a subsidiary of ExxonMobil.

Kinder Morgan Texas Pipeline (KMPT) also has committed volumes that are backstopped by a long-term purchase agreement that locks in the equivalent transport fee on the pipeline.

Related News

Related News

- Kinder Morgan Proposes 290-Mile Gas Pipeline Expansion Spanning Three States

- Enbridge Plans 86-Mile Pipeline Expansion, Bringing 850 Workers to Northern B.C.

- Intensity, Rainbow Energy to Build 344-Mile Gas Pipeline Across North Dakota

- Tallgrass to Build New Permian-to-Rockies Pipeline, Targets 2028 Startup with 2.4 Bcf Capacity

- U.S. Moves to Block Enterprise Products’ Exports to China Over Security Risk

- U.S. Pipeline Expansion to Add 99 Bcf/d, Mostly for LNG Export, Report Finds

- A Systematic Approach To Ensuring Pipeline Integrity

- 275-Mile Texas-to-Oklahoma Gas Pipeline Enters Open Season

- TC Energy’s North Baja Pipeline Expansion Brings Mexico Closer to LNG Exports

- Consumers Energy Begins 135-Mile Michigan Gas Pipeline Upgrade, Taps 600 Workers

Comments