NextDecade and Enbridge Agree to Pursue Rio Bravo Pipeline

HOUSTON (P&GJ) — NextDecade Corporation and Enbridge announced an agreement to jointly pursue development of the Rio Bravo Pipeline and other pipelines to transport natural gas to NextDecade’s proposed Rio Grande LNG project in Brownsville, Texas.

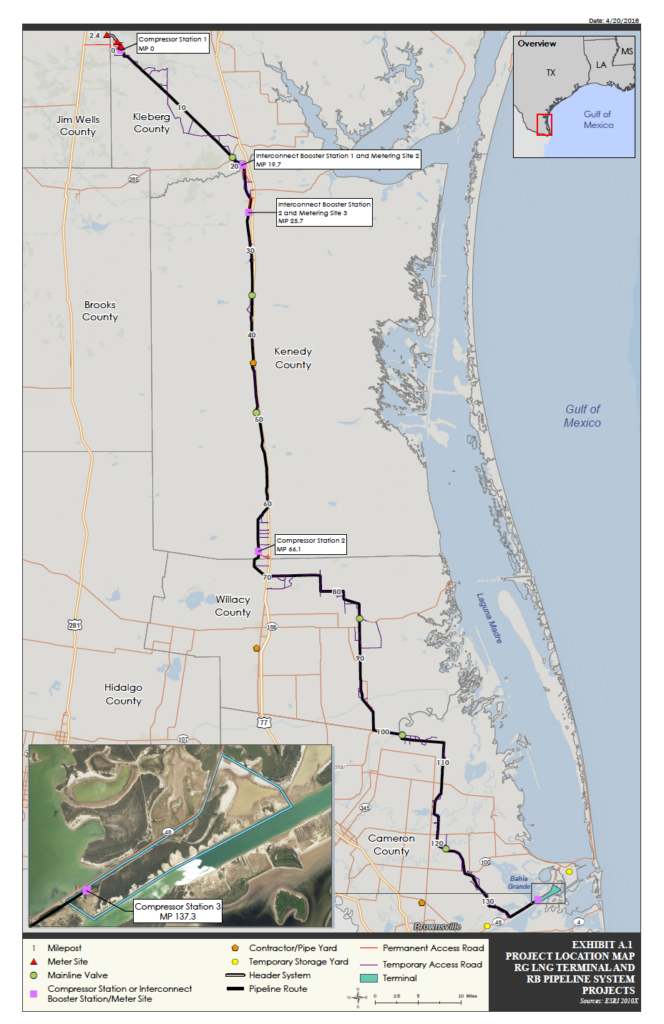

The proposed Rio Bravo Pipeline project is designed as a twin, 42-inch pipeline system originating in the Agua Dulce area of Kleberg and Jim Wells counties, Texas. The 138-mile system would include three, 180,000-horsepower compressor stations, six mainline valve sites and six meter stations with capacity to deliver up to 4.5 Bcf/d.

Bill Yardley, Enbridge’s president of Gas Transmission and Midstream, described the Rio Bravo agreement as "a continuation of our strategy to bring our major projects execution and permitting capability to the expanding LNG export efforts in North America."

"Our existing infrastructure fits very well with the Brownsville location," Yardley said.

NextDecade said it expects to make a final investment decision on Rio Grande LNG by the end of this year and to begin commercial operations in 2023.

The 984-acre project at the Port of Brownsville would have a total capacity of 27 million tons of LNG per year. Development would include construction of deepwater port access with supporting marine infrastructure, including two marine jetties, a berth pocket and a turning basin.

NextDecade announced in late May that it signed two contracts with Bechtel Oil, Gas and Cheicals for the engineering, procurement and construction (EPC) of the Rio Grande LNG project.

The EPC contracts are for the first phase of the Rio Grande LNG project, which consists of three liquefaction trains, two 180,000 cubic meter storage tanks and two marine berths totaling $9.565 billion. Each liquefaction train is expected to have capacity up to 5.87 million tons per year of LNG, which would generate an EPC cost of approximately $543 per ton for the first three trains, NextDecade said.

Related News

Related News

- Kinder Morgan Proposes 290-Mile Gas Pipeline Expansion Spanning Three States

- Enbridge Plans 86-Mile Pipeline Expansion, Bringing 850 Workers to Northern B.C.

- Intensity, Rainbow Energy to Build 344-Mile Gas Pipeline Across North Dakota

- Tallgrass to Build New Permian-to-Rockies Pipeline, Targets 2028 Startup with 2.4 Bcf Capacity

- U.S. Moves to Block Enterprise Products’ Exports to China Over Security Risk

- U.S. Pipeline Expansion to Add 99 Bcf/d, Mostly for LNG Export, Report Finds

- A Systematic Approach To Ensuring Pipeline Integrity

- 275-Mile Texas-to-Oklahoma Gas Pipeline Enters Open Season

- TC Energy’s North Baja Pipeline Expansion Brings Mexico Closer to LNG Exports

- Consumers Energy Begins 135-Mile Michigan Gas Pipeline Upgrade, Taps 600 Workers

Comments