New Gas Pipelines Adding Capacity from U.S. South Central, Northeast

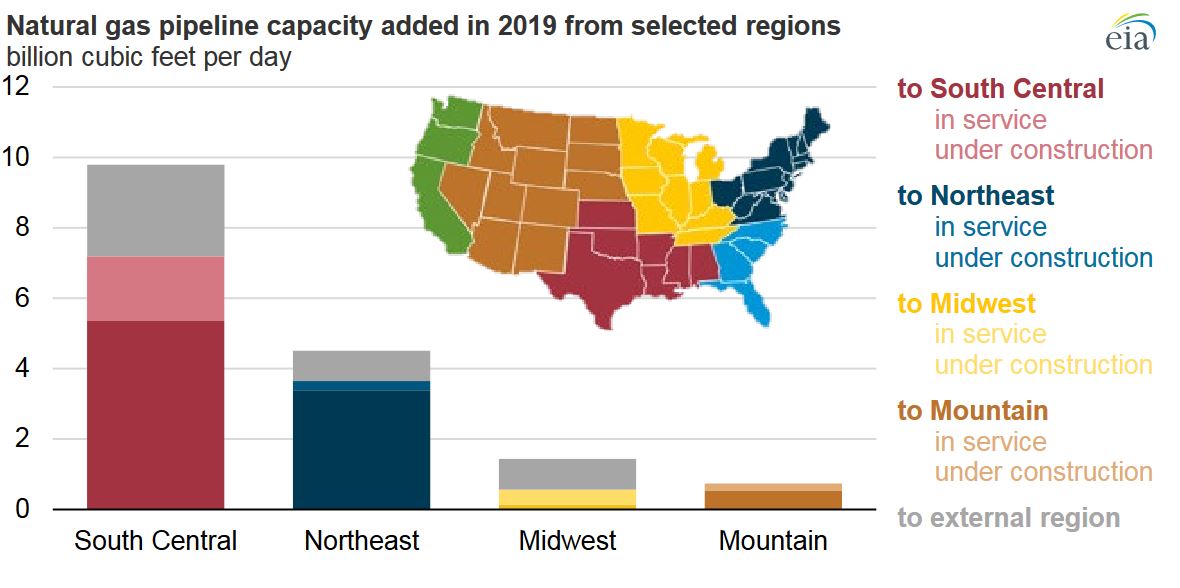

(P&GJ) — The United States is expected to add between 16 billion cubic feet per day (Bcf/d) and 17 Bcf/d of natural gas pipeline capacity in 2019, most of which was built to provide additional takeaway capacity out of supply basins, according to the latest tally by the U.S. Energy Administration (EIA)

Of the 134 active natural gas pipeline projects the EIA tracks, 46 have entered or are expected to enter service in 2019. These projects will increase deliveries by pipeline to Mexico or to LNG export facilities in the Gulf Coast region.

More than 40% of this new pipeline capacity—7.2 Bcf/d—delivers natural gas to locations within the South Central region. Many of these pipeline projects will provide additional takeaway capacity out of the Permian Basin in western Texas or enable additional Permian natural gas production to reach the interstate pipeline system. Some of these pipelines include:

- Kinder Morgan’s 2.0 Bcf/d Gulf Coast Express Pipeline, which provides takeaway capacity from the Waha Hub in the Permian Basin (near the Texas-New Mexico border) to demand markets on the Gulf Coast at the Agua Dulce Hub.

- ONEOK'S Roadrunner Eastbound Expansion, which added about 1.0 Bcf/d of bidirectional capacity on the pipeline, and the 300 million cubic feet per day (MMcf/d) WesTex Expansion, which added northbound takeaway capacity out of the Permian Basin.

- El Paso Natural Gas Pipeline’s 320 MMcf/d Northern Delaware Basin Expansion Project, which is still under construction and will add additional capacity to the El Paso system in western Texas, allowing additional volumes to flow westward on the system

The remainder of the natural gas pipeline projects slated for completion in the South Central region in 2019 will deliver natural gas to demand centers, in particular to LNG export facilities on the Gulf Coast. Cheniere’s 1.4 Bcf/d MIDSHIP Pipeline is still under construction. When completed, it will connect natural gas supply from Oklahoma to the Sabine Pass LNG facility in Louisiana, providing additional sources of secure supply to the export terminal.

The Texas East Transmission Company (TETCO) completed expansions to its existing pipeline infrastructure during the second quarter of 2019, including the 400 MMcf/d Stratton Ridge Expansion, for additional deliveries to the Freeport LNG facility on the Texas Gulf Coast.

The only pipeline project in the South Central region in 2019 that moves natural gas outside its region is the 2.6 Bcf/d Valley Crossing Pipeline, which exports to markets in Mexico. This pipeline connects to the newly built Sur de Texas-Tuxpan pipeline, a 497-mile underwater project that was also completed in 2019 and transports U.S. natural gas to the southern Mexican state of Veracruz.

Related News

Related News

- Kinder Morgan Proposes 290-Mile Gas Pipeline Expansion Spanning Three States

- Enbridge Plans 86-Mile Pipeline Expansion, Bringing 850 Workers to Northern B.C.

- Intensity, Rainbow Energy to Build 344-Mile Gas Pipeline Across North Dakota

- Tallgrass to Build New Permian-to-Rockies Pipeline, Targets 2028 Startup with 2.4 Bcf Capacity

- U.S. Moves to Block Enterprise Products’ Exports to China Over Security Risk

- U.S. Pipeline Expansion to Add 99 Bcf/d, Mostly for LNG Export, Report Finds

- A Systematic Approach To Ensuring Pipeline Integrity

- US Poised to Become Net Exporter of Crude Oil in 2023

- EIG’s MidOcean Energy Acquires 20% Stake in Peru LNG, Including 254-Mile Pipeline

- Enbridge Sells $511 Million Stake in Westcoast Pipeline to Indigenous Alliance

Comments