New Permian Pipelines Boost U.S. Gulf Coast Crude Exports

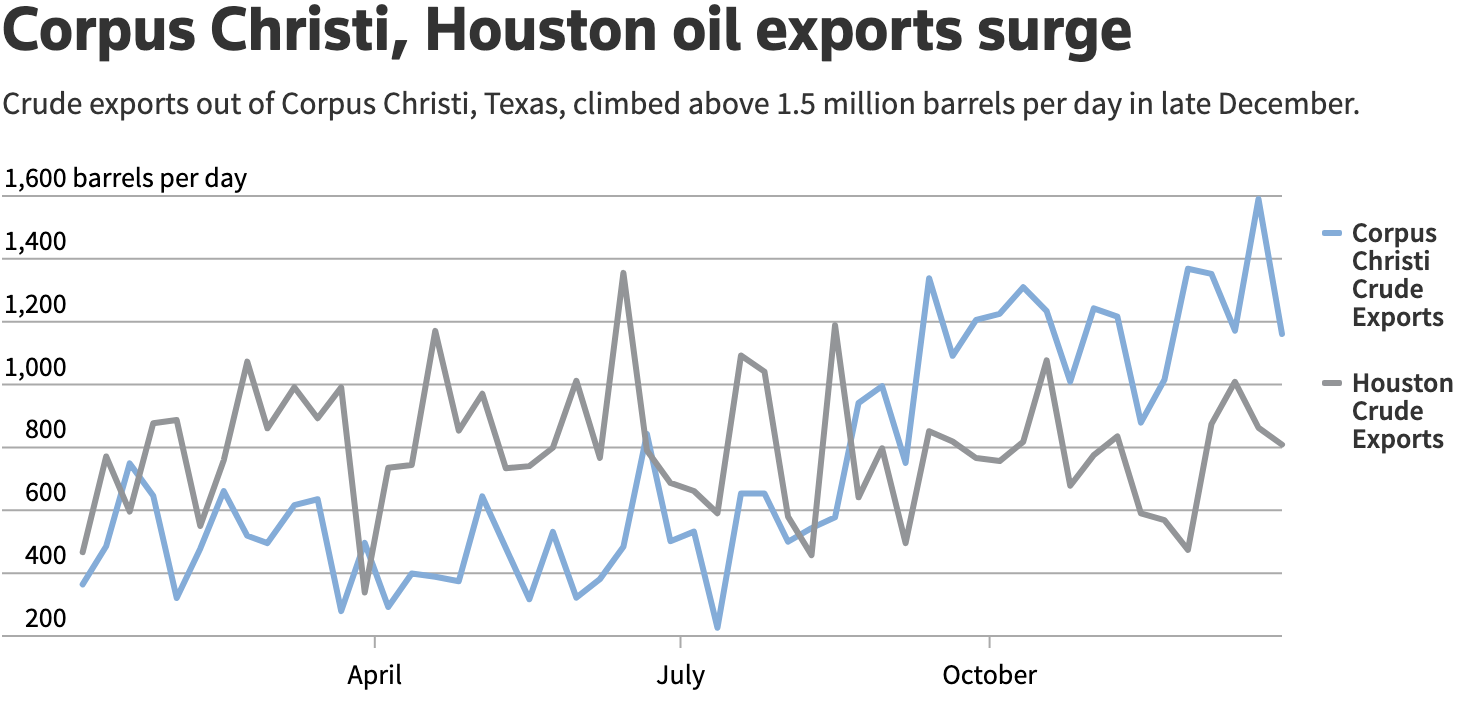

HOUSTON/NEW YORK (Reuters) — Three new major pipelines coming out of the Permian Basin have helped crude exports from Corpus Christi, Texas surge in recent weeks, often surpassing hubs such as Houston and Beaumont, Texas.

The infrastructure boom at Corpus Christi helped push crude exports there to a weekly record of 1.59 million barrels per day (bpd) in late December, more than doubling levels that held for the first eight months of last year, and above Houston’s 2019 peak of 1.36 million bpd, according to vessel-tracking firm ClipperData.

The heavy flows suggest that fears of a bottleneck that would impede U.S. exports have not materialized.

“Those (export) numbers are truly astonishing, and at times, Corpus volumes have accounted for more than half of all crude exports moving out of the U.S. on a weekly basis,” said John Zanner, senior strategist at Uplift Energy Strategy.

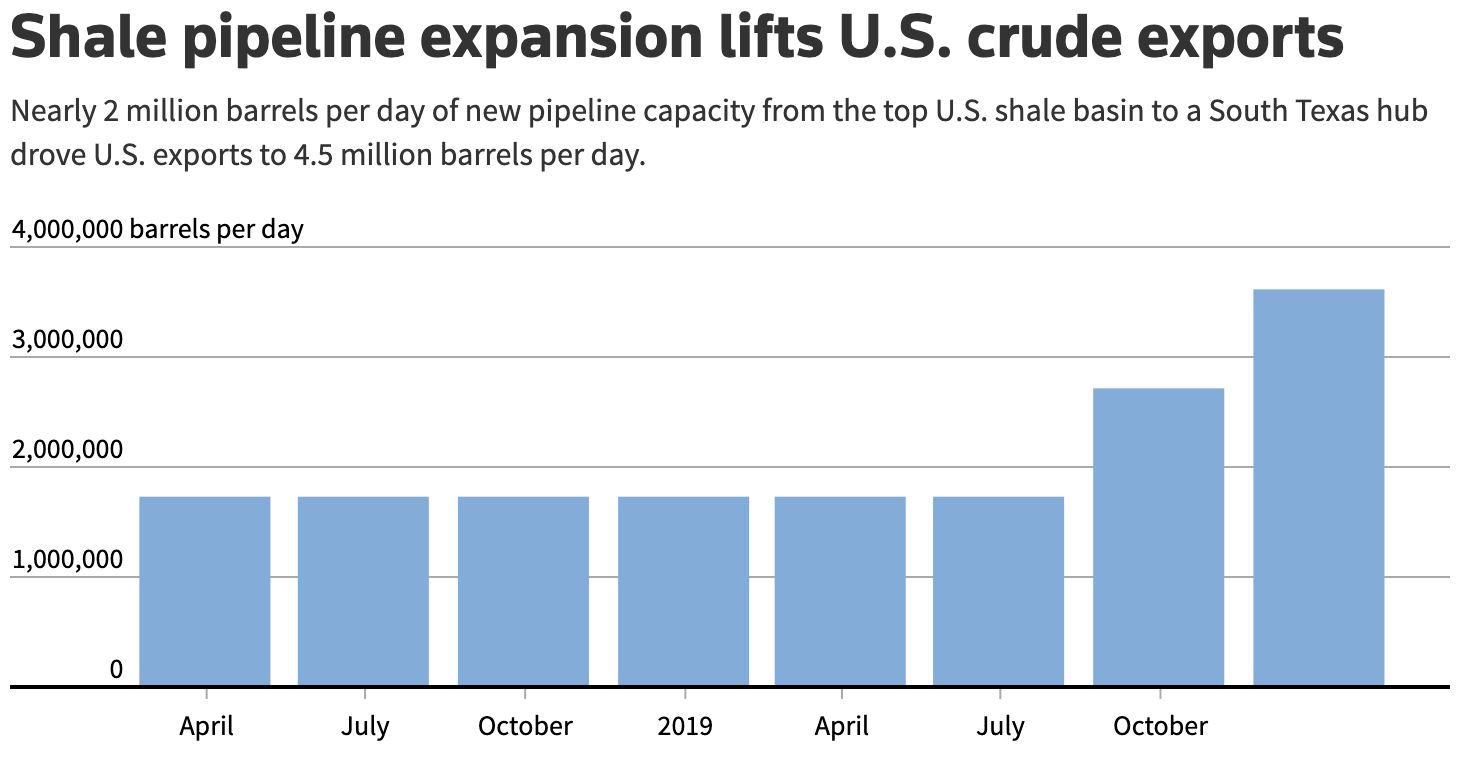

The four-week average of overall U.S. crude exports reached a record 3.72 million barrels per day (bpd) in the week ended Dec. 27, according to the U.S. Energy Information Administration.

To view interactive graphic, click here.

Analysts had expected a crude bottleneck in the Permian Basin to shift to the Gulf Coast as three new pipelines opened last year. New flows out of the nation’s biggest oil field were expected to overwhelm export capacity in Corpus Christi and weigh on regional prices.

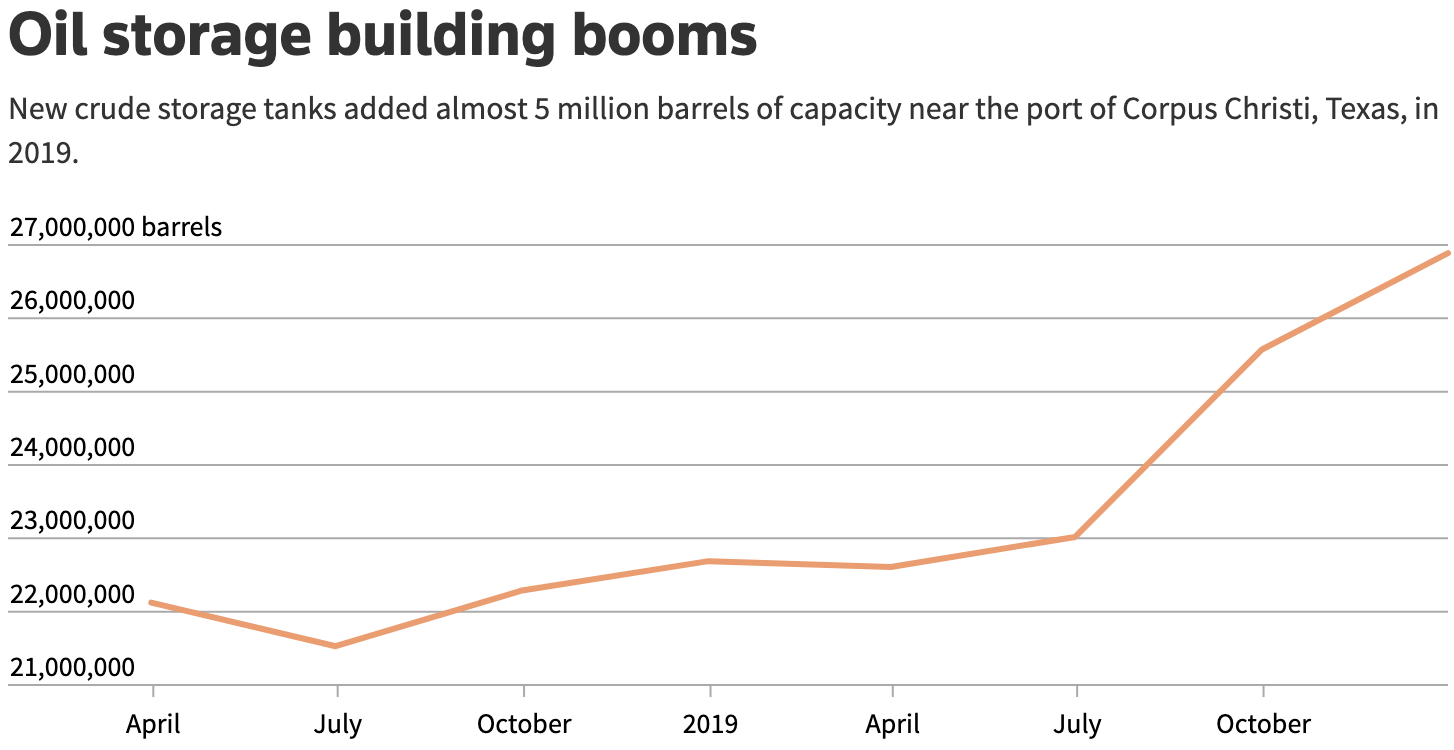

But the rush of crude has been absorbed following last year’s addition of almost 2 million bpd of inbound pipeline capacity and 5 million barrels of storage capacity in Corpus Christi, according to market intelligence provider Genscape.

To view interactive graphic, click here.

Analysts expect flows to rise further as three new pipelines from the Permian Basin to the U.S. Gulf Coast begin full service in the first half of 2020. The lines are owned by EPIC Midstream, Plains All American Pipeline LP (PAA.N) and Phillips 66 Partners LP (PSXP.N).

Another 18 million barrels of storage capacity were under construction in the Corpus Christi area in the week to Jan. 3.

Waterborne trading dominates Corpus Christi, in contrast to Houston markets where the established grade trades at Magellan’s East Houston terminal. Corpus prices have on average traded 50 cents to $1 per barrel below West Texas Intermediate (WTI) crude at Magellan East Houston, or MEH WTC-MEH, traders and analysts said.

To view interactive graphic, click here.

Related News

Related News

- Enbridge Plans 86-Mile Pipeline Expansion, Bringing 850 Workers to Northern B.C.

- Intensity, Rainbow Energy to Build 344-Mile Gas Pipeline Across North Dakota

- U.S. Moves to Block Enterprise Products’ Exports to China Over Security Risk

- 208-Mile Mississippi-to-Alabama Gas Pipeline Moves Into FERC Review

- Court Ruling Allows MVP’s $500 Million Southgate Pipeline Extension to Proceed

- U.S. Pipeline Expansion to Add 99 Bcf/d, Mostly for LNG Export, Report Finds

- A Systematic Approach To Ensuring Pipeline Integrity

- 275-Mile Texas-to-Oklahoma Gas Pipeline Enters Open Season

- LNG Canada Start-Up Fails to Lift Gas Prices Amid Supply Glut

- Kinder Morgan Gas Volumes Climb as Power, LNG Demand Boost Pipeline Business

Comments