AG&P Breaks Ground on LNG Terminal in India; Plans Two More

SINGAPORE (Reuters) - Singapore-based Atlantic Gulf and Pacific (AG&P), which has just broken ground in India on its first LNG terminal, is confident it will be able to give the green light to two more within the next two years.

"Our aim is to be a global LNG terminal developer focusing on smaller demand centres," Karthik Sathyamoorthy, president of the company's LNG Terminals and Logistics division told Reuters.

He did not specify where the terminals might be located but said the company was actively working on projects across Southeast Asia and also in the Caribbean.

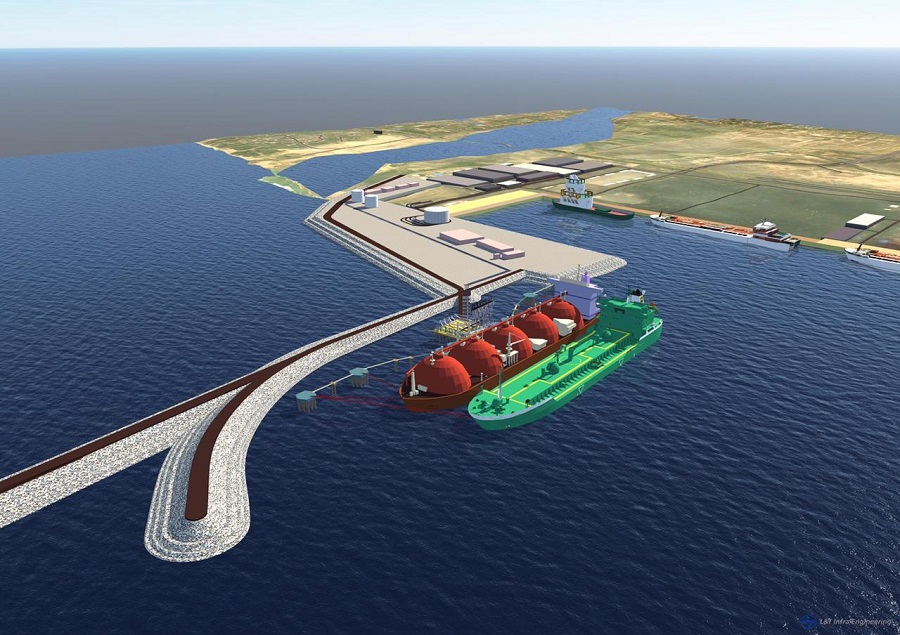

AG&P broke ground on its first import facility for liquefied natural gas at Karaikal port in the southern Indian city of Puducherry on Thursday.

Owned and operated by AG&P, Karaikal LNG is being built on a 12-hectare site. It will have an initial capacity of one million tonnes per annum (mtpa) and provide natural gas to power plants, industrial and commercial customers within a 300 kilometre radius.

It will house a floating storage unit leased from an ADNOC unit and commercial operations are expected to start by the fourth quarter of 2021.

The terminal will also serve the city gas networks of AG&P and other companies which deliver compressed natural gas and LNG to vehicles and pipe natural gas to households and other clients. Remote customers will have LNG delivered by AG&P's own fleet of trucks.

The company is negotiating deals with potential gas buyers in the area, Sathyamoorthy said, adding that it would target customers along an existing pipeline network near its terminal including a 800-megawatt power plant.

India wants to raise the share of gas in its energy mix as it battles high levels of pollution in many big cities. The country is working to expand its pipeline network and build new terminals but has been hobbled by constraints on infrastructure such as difficulties in establishing pipeline connectivity.

AG&P is also in advanced stages of discussion with LNG suppliers, Sathyamoorthy said.

"We're kind of cognizant of what's happening in market in terms of very low spot prices. We're just being cautious in coming up with a strategy to have a mix of spot and long term contracts," he said.

Related News

Related News

- Kinder Morgan Proposes 290-Mile Gas Pipeline Expansion Spanning Three States

- Enbridge Plans 86-Mile Pipeline Expansion, Bringing 850 Workers to Northern B.C.

- Intensity, Rainbow Energy to Build 344-Mile Gas Pipeline Across North Dakota

- Tallgrass to Build New Permian-to-Rockies Pipeline, Targets 2028 Startup with 2.4 Bcf Capacity

- U.S. Moves to Block Enterprise Products’ Exports to China Over Security Risk

- U.S. Pipeline Expansion to Add 99 Bcf/d, Mostly for LNG Export, Report Finds

- A Systematic Approach To Ensuring Pipeline Integrity

- 275-Mile Texas-to-Oklahoma Gas Pipeline Enters Open Season

- US Poised to Become Net Exporter of Crude Oil in 2023

- EIG’s MidOcean Energy Acquires 20% Stake in Peru LNG, Including 254-Mile Pipeline

Comments