Pipeline Shares Sink on Oil Decline, Coronavirus Impact

By Jeff Awalt, Executive Editor

HOUSTON (P&GJ) – It’s a common refrain among investors that “a rising tide lifts all boats,” meaning the share prices of similar companies tend to act in unison. Unfortunately, that’s equally true of falling tides, as demonstrated by the performance of North American midstream equities in recent weeks.

The impact has been felt by midstream service companies and interstate pipeline operators alike, as well as those involved in LNG production and export. Their responses to the market downturns have ranged from the expected reductions in capital spending and debt restructuring to legal maneuvers designed to protect companies from takeover while their prices are depressed.

Calgary-based pipeline operator Pembina Pipeline, notably, announced it is cutting nearly $700 million, or 43 percent, from a 2020 budget originally set at more than $1.5 billion.

Five others cut a combined $1.2 billion from their capital expenditure (Capex) budgets, according to a research note from investment banking firm Simmons Energy, including Noble Midstream, Rattler Midstream, Targa Resources, EnLink Midstream and Tulsa's ONEOK. That figure represents an average reduction of 30% in planned Capex for new pipeline and storage projects, Simmons said.

Other pipeline operators may soon follow. Co-CEO Jim Teague, for one, said Enterprise Products Partners is reviewing its Capex program "due to the potential impacts of lower commodity prices and demand on our customers," offering a glimpse of how major operators are responding even when projects are underpinned by long-term contracts.

"While substantially all of our major growth capital projects are supported by long-term bi-lateral agreements, we are in discussions with our customers and evaluating opportunities to reduce or defer capital expenditures, as well as continuing to explore joint venture opportunities with strategic partners," Teague said. "We will provide an update to our 2020 capital expenditure guidance in our first quarter 2020 earnings announcement."

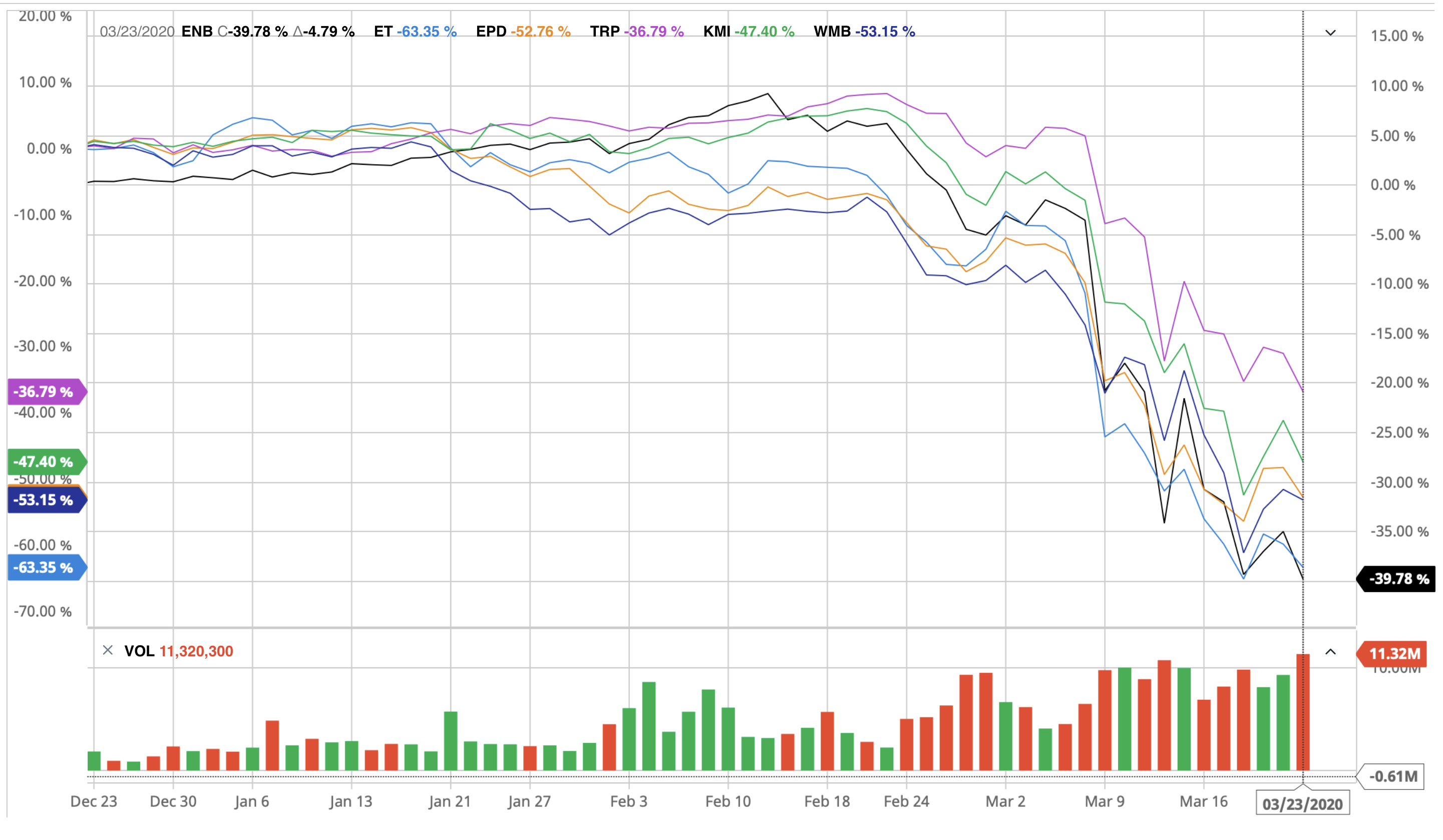

Meanwhile, many companies in the midstream sector retreated to 52-week lows after Russia and Saudi Arabia failed to agree on production cuts, launching an oil war just as global energy demand was falling due to the Covid-19 pandemic.

In response, some companies, including Tulsa-based Williams, adopted limited duration stockholder rights agreements that would make it difficult for anyone to take them over during a period of historically low prices. The maneuver involves distributing a stockholder dividend of one "right" for each share they own

Stockholders can exercise those rights if a person or group acquires beneficial ownership of 5% or more of common stock in a transaction not approved by the board of directors. Each holder can use their rights to purchase additional stock under specific circumstances.

"The adoption of the Rights Agreement is intended to enable all Williams stockholders to realize the full potential value of their investment in the company and to protect the interests of the company and its stockholders by reducing the likelihood that any person or group gains control of Williams through open market accumulation or other tactics (especially in recent volatile markets) without paying an appropriate control premium," Williams said.

The downturn has also hit the still-emerging U.S. Gulf Coast LNG industry, which has driven construction of production and export infrastructure, as well as natural gas pipelines from the Permian Basin and Haynesville Shale.

Cheniere Energy, which saw a 52-week share price high of $42.88 on January 16, hit its low of $17.75 only two months later, although it has since recovered some lost ground. Barclays upgraded the stock to overweight recently with a price target of $31 per share.

Tellurian announced it reached an agreement to amend the terms of its 2019 term loan, including an 18-month extension of the maturity date.

"We have restructured the organization and entered into an agreement to extend our Term Loan maturity to late 2021, which swiftly completes the second critical step toward resiliency in the current market," Tellurian President and CEO Meg Gentle said. "We are working remotely with potential equity partners for the Driftwood project and implementing measures to keep our team safe and productive to regain commercial momentum when the effects of COVID-19 subside.”

Related News

Related News

- Enbridge Plans 86-Mile Pipeline Expansion, Bringing 850 Workers to Northern B.C.

- Intensity, Rainbow Energy to Build 344-Mile Gas Pipeline Across North Dakota

- U.S. Moves to Block Enterprise Products’ Exports to China Over Security Risk

- 208-Mile Mississippi-to-Alabama Gas Pipeline Moves Into FERC Review

- Strike Pioneers First-of-Its-Kind Pipe-in-Pipe Installation on Gulf Coast with Enbridge

- U.S. Pipeline Expansion to Add 99 Bcf/d, Mostly for LNG Export, Report Finds

- A Systematic Approach To Ensuring Pipeline Integrity

- 275-Mile Texas-to-Oklahoma Gas Pipeline Enters Open Season

- LNG Canada Start-Up Fails to Lift Gas Prices Amid Supply Glut

- Kinder Morgan Gas Volumes Climb as Power, LNG Demand Boost Pipeline Business

Comments