U.S. Natgas Demand Up as Total Energy Use Hits 30-Year Low

(P&GJ) — U.S. natural gas consumption defied trends through the pandemic days of April 2020 with a year-over-year increase during a month in which total energy demand fell to a 30-year low, government statistics show.

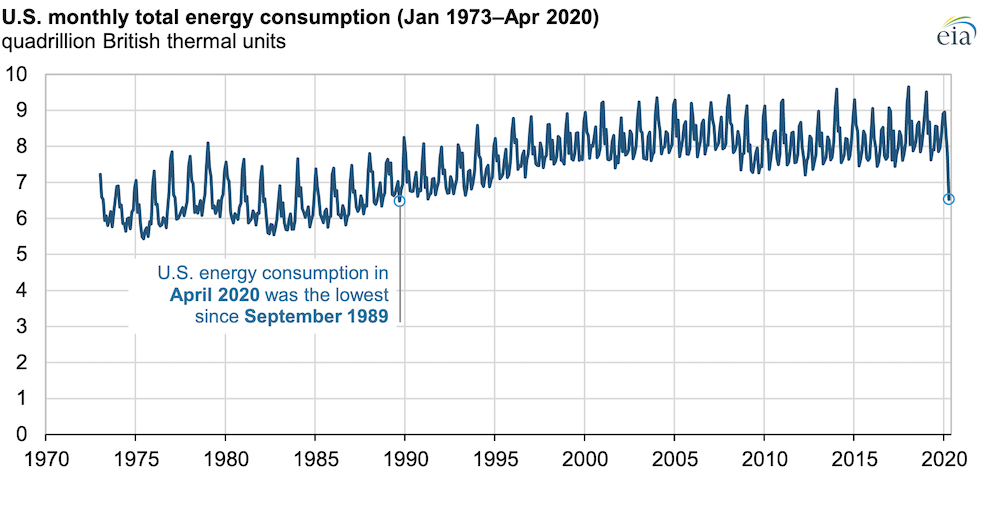

According to the U.S. Energy Information Administration’s (EIA) most recent Monthly Energy Review, the United States consumed 6.5 quadrillion British thermal units of energy in April 2020, the lowest monthly energy consumption since September 1989. Energy consumption in April 2020 was 14% lower than in April 2019, the largest year-over-year decrease in EIA’s monthly total energy consumption, a data series that dates back to 1973.

Before April 2020, the largest year-over-year change in U.S. total energy consumption occurred between December 2000 and December 2001, when consumption decreased by about 10% because of economic and weather-related factors. The third-largest decrease was between March 2019 and March 2020.

April is a month with relatively low energy consumption in the United States, as typically mild temperatures reduce energy demand for heating and cooling. In 2020, April was the height of stay-at-home measures enacted to mitigate the spread of Covid-19, which caused a large drop in transportation, industrial, and commercial sector energy consumption.

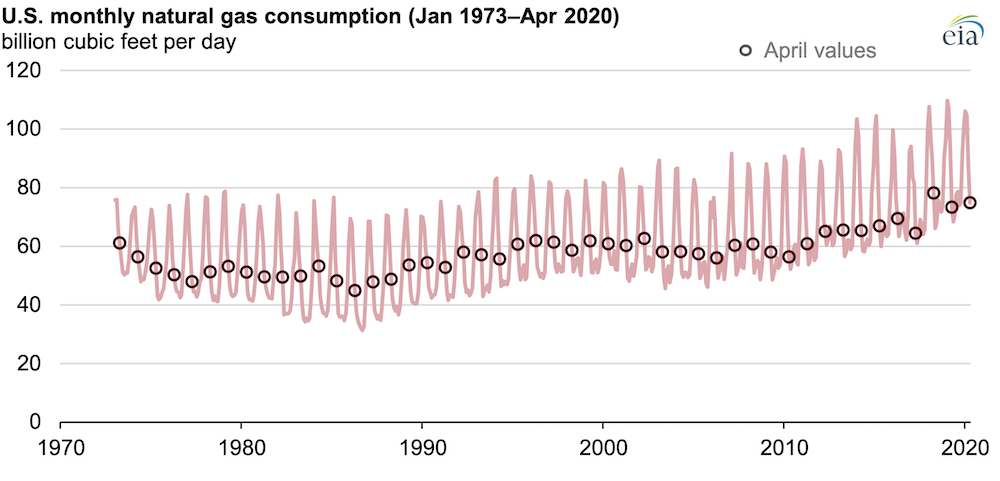

Natural gas consumption in April 2020 was 74.9 Bcf/d, a 2% increase in consumption from 73.4 Bcf/d in April 2019. Residential consumption of natural gas, which was likely affected by stay-at-home orders, was 15% higher in April 2020 than in April 2019, and residential consumption was the main factor leading to the increase in total natural gas consumption.

“While global energy markets were seriously affected in the immediate wake of COVID-19, the north American natural gas market remained stable and delivered even more affordable energy when consumers needed it most," the American Gas Association said in response to the EIA report. "Moreover, natural gas utilities took immediate steps to ensure continued safe and reliable service.”

Natural gas is the most common residential heating fuel in the United States, and April 2020 was about 24% colder than the previous April, as measured by population-weighted heating degree days. Consumption of natural gas in the electric power sector has also increased in 2020 because of historically low natural gas prices.

Natural gas-fired power plants provided the largest share of electricity generation in April 2020; coal’s share of electricity generation (15%) was lower than natural gas (39%) and nuclear (22%).

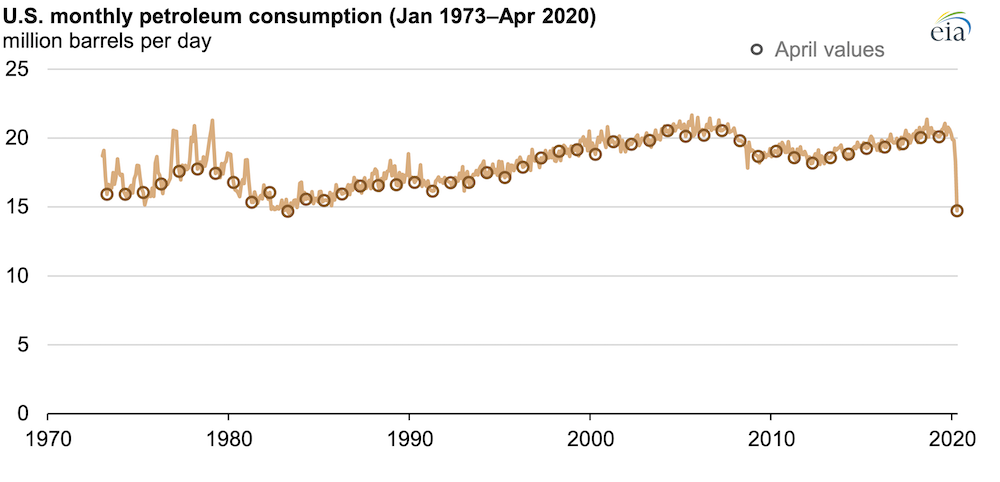

U.S. petroleum consumption fell from 20.1 MMbpd in April 2019 to 14.7 MMbpd in April 2020, a 27% decrease and the lowest monthly petroleum consumption in the United States since May 1983. Stay-at-home orders and other travel limitations caused petroleum product supplied (a proxy for consumption) for fuels such as motor gasoline and jet fuel to fall to their lowest levels in decades.

Electricity end-use consumption in April 2020 totaled less than 269 billion kilowatthours (kWh), a 4% decrease from April 2019 and its lowest level since November 2001. Consumption of electricity by the commercial and industrial sectors declined by 11% and 9%, respectively, from levels in April 2019. Residential sector electricity consumption increased from 90 billion kWh in April 2019 to 97 billion kWh in April 2020, an 8% increase.

Coal consumption, which has declined since its 2007 peak, fell to its lowest point in EIA’s monthly records in April. The 27.4 million short tons of coal consumed in April 2020 was 27% less than the 37.4 million short tons consumed in April 2019. The electric power sector accounted for nearly all of coal’s year-over-year decline, falling from 33.5 million short tons to 23.6 million short tons from April 2019 to April 2020.

EIA’s Short-Term Energy Outlook forecasts that U.S. total energy consumption will increase from its low point in April but remain lower than 2019 levels for the rest of 2020.

Related News

Related News

- Enbridge Plans 86-Mile Pipeline Expansion, Bringing 850 Workers to Northern B.C.

- Intensity, Rainbow Energy to Build 344-Mile Gas Pipeline Across North Dakota

- Enbridge Sees High Demand to Expand 593-Mile Canada-to-U.S. Gulf Oil Pipeline

- Energy Transfer to Build $5.3 Billion Permian Gas Pipeline to Supply Southwest

- Strike Pioneers First-of-Its-Kind Pipe-in-Pipe Installation on Gulf Coast with Enbridge

- A Systematic Approach To Ensuring Pipeline Integrity

- 275-Mile Texas-to-Oklahoma Gas Pipeline Enters Open Season

- LNG Canada Start-Up Fails to Lift Gas Prices Amid Supply Glut

- Strike Pioneers First-of-Its-Kind Pipe-in-Pipe Installation on Gulf Coast with Enbridge

- Enbridge Sees High Demand to Expand 593-Mile Canada-to-U.S. Gulf Oil Pipeline

Comments