Tellurian Withdraws Application for Permian Global Access Pipeline

(Reuters) - LNG developer Tellurian Inc told federal energy regulators it wants to withdraw its application to build the Permian Global Access natural gas pipeline in Texas and Louisiana.

The Tuesday filing with the U.S. Federal Energy Regulatory Commission (FERC) came a day after Tellurian said its President and Chief Executive Meg Gentle will leave the company.

In what has been a tough year for the LNG industry after coronavirus demand destruction caused global energy prices to collapse, Tellurian said in the filing that "current market conditions do not support the economic thresholds to pursue the (Permian pipe) further at this time."

Houston-based Tellurian said it "continues to believe that in time the proposed project will provide significant benefits" and it will host a new open season "in the event market conditions rebound and the market needs an additional transportation solution."

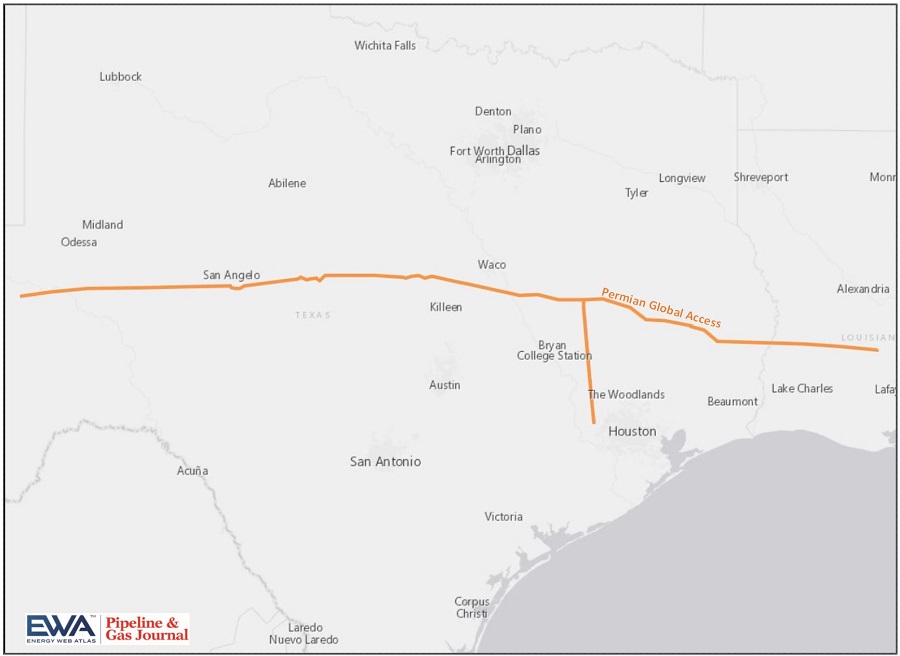

The 625-mile (1,005-km) Permian pipeline was designed to transport up to 2.3 Bcf/d of gas from the Permian shale in West Texas and eastern New Mexico to southwest Louisiana near where Tellurian wants to build the Driftwood LNG export plant.

In addition to the Permian pipe, Tellurian has also proposed to build the 4.0-bcfd Driftwood, 2.0-Bcfd Haynesville Global Access and 2.0-bcfd Delhi Connector gas pipelines in Louisiana.

The company has estimated the Permian pipe would have cost about $4.2 billion, Driftwood about $2.3 billion and Haynesville and Delhi around $1.4 billion each.

In the past, Tellurian estimated the Driftwood project would cost about $27.5 billion and include the pipelines, the 3.6-Bcf/d LNG export plant, and gas production and other assets.

But in August, the company reduced the cost of the first phase of the project by deferring most of the pipelines and including liquefaction trains capable of producing around 2 Bcf/d of LNG.

Related News

Related News

- Enbridge Plans 86-Mile Pipeline Expansion, Bringing 850 Workers to Northern B.C.

- Intensity, Rainbow Energy to Build 344-Mile Gas Pipeline Across North Dakota

- Energy Transfer to Build $5.3 Billion Permian Gas Pipeline to Supply Southwest

- Enbridge Sees High Demand to Expand 593-Mile Canada-to-U.S. Gulf Oil Pipeline

- Strike Pioneers First-of-Its-Kind Pipe-in-Pipe Installation on Gulf Coast with Enbridge

- A Systematic Approach To Ensuring Pipeline Integrity

- 275-Mile Texas-to-Oklahoma Gas Pipeline Enters Open Season

- LNG Canada Start-Up Fails to Lift Gas Prices Amid Supply Glut

- Strike Pioneers First-of-Its-Kind Pipe-in-Pipe Installation on Gulf Coast with Enbridge

- Enbridge Sees High Demand to Expand 593-Mile Canada-to-U.S. Gulf Oil Pipeline

Comments