Spire Seeks U.S. Backing for Missouri NatGas Pipeline to Avoid Outages

(Reuters) — U.S. natural gas company Spire Inc's Spire STL Pipeline unit filed an emergency application with U.S. energy regulators to keep the STL gas pipeline in service ahead of this winter to avoid gas service outages in St. Louis.

A Spire spokesperson said on Tuesday that without STL in service "it’s estimated as many as 400,000 St. Louisans could be without natural gas service during peak cold conditions."

The filing follows a federal appeals court decision in June that threw out 2018 authorizations by the Federal Energy Regulatory Commission (FERC) allowing Spire STL to build a roughly $285 million gas line near St. Louis.

The decision was a victory against the regulator by the Environmental Defense Fund (EDF) which sued.

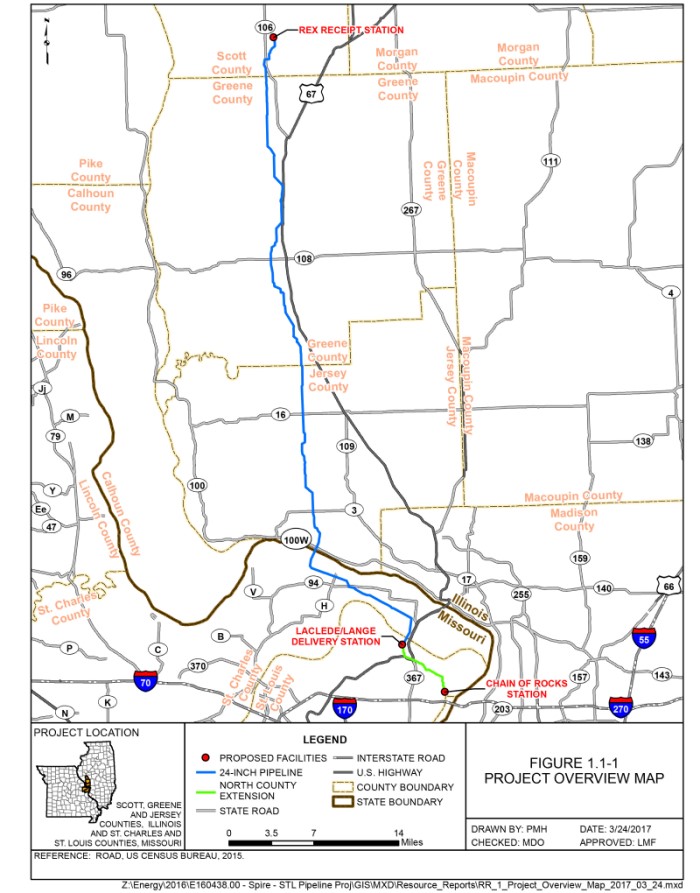

A unanimous panel of the U.S. Circuit Court of Appeals for the D.C. Circuit vacated a critical permits order for the 65-mile (105 kilometer) STL pipeline after ruling that FERC adopted an "ostrich-like approach" when it found a market need for the line despite only one gas supplier, an affiliate of the line's operator, committing to use it.

Spire is the parent company of the line's operator Spire STL and gas supplier Spire Missouri Inc, the affiliate that entered a pre-construction deal committing it to use the line.

FERC authorized the pipeline in 2018. Construction began in 2019 after the commission held up EDF's challenge.

"This is a problem of Spire STL's own making. No one has suggested that service to St. Louis customers should be compromised," Natalie Karas, EDF's senior director and lead counsel for energy markets, said.

"Customers must be protected from costs and risks associated with unnecessary infrastructure" and any temporary authorization request should be "carefully scrutinized based on facts, not fear," Karas added.

The line, designed to deliver up to 0.4 billion cubic feet of gas per day, began operating in November 2019.

Related News

Related News

- Kinder Morgan Proposes 290-Mile Gas Pipeline Expansion Spanning Three States

- Three Killed, Two Injured in Accident at LNG Construction Site in Texas

- Tallgrass to Build New Permian-to-Rockies Pipeline, Targets 2028 Startup with 2.4 Bcf Capacity

- TC Energy Approves $900 Million Northwoods Pipeline Expansion for U.S. Midwest

- U.S. Moves to Block Enterprise Products’ Exports to China Over Security Risk

- U.S. Pipeline Expansion to Add 99 Bcf/d, Mostly for LNG Export, Report Finds

- Enbridge Adds Turboexpanders at Pipeline Sites to Power Data Centers in Canada, Pennsylvania

- Great Basin Gas Expansion Draws Strong Shipper Demand in Northern Nevada

- Cheniere Seeks FERC Approval to Expand Sabine Pass LNG Facility

- Heath Consultants Exits Locate Business to Expand Methane Leak Detection Portfolio

Comments