Delfin Seeks Another Year to Build its Louisiana Floating LNG Project

(Reuters) — U.S. LNG developer Delfin LNG asked federal energy regulators for a third extension until September 2022 to bring into service the onshore facilities of its proposed floating LNG export plant off the coast of Louisiana.

The U.S. Federal Energy Regulatory Commission (FERC) in September 2017 authorized Delfin to build its project by September 2019.

In June 2019, Delfin asked FERC for an extension to finish the project until March 2023. FERC, however, only gave Delfin a one-year extension until September 2020.

In June 2020, Delfin asked and received another one-year extension from FERC to finish the project by September 2021.

In asking for this third extension, Delfin said global "economic conditions are recovering from the COVID-19 pandemic and the spot and short-term markets for LNG have significantly improved ... which will support the company to enter into long-term LNG offtake contracts."

Delfin is one of more than a dozen North American LNG export projects that have repeatedly pushed back decisions to start construction due primarily to a lack of customers signing long-term deals needed to finance the multibillion-dollar facilities.

Delfin said in its FERC filing it "is confident that it will secure commercialization in the coming year."

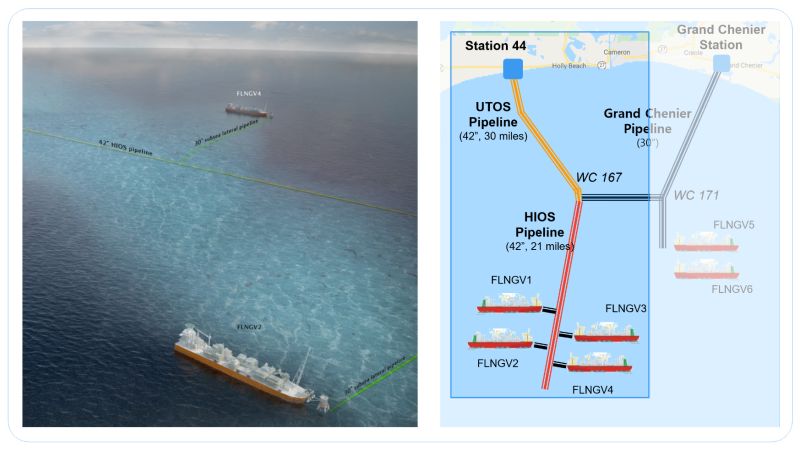

Delfin's project would use existing offshore pipelines to supply gas to up to four vessels that could produce up to 13 million tons per annum (MTPA) of LNG or 1.7 billion cubic feet per day (bcfd) of natural gas.

Related News

Related News

- Energy Transfer to Build $5.3 Billion Permian Gas Pipeline to Supply Southwest

- Enbridge Sees High Demand to Expand 593-Mile Canada-to-U.S. Gulf Oil Pipeline

- Strike Pioneers First-of-Its-Kind Pipe-in-Pipe Installation on Gulf Coast with Enbridge

- 208-Mile Mississippi-to-Alabama Gas Pipeline Moves Into FERC Review

- Chesapeake, AEP to Build $10 Million Ohio Gas Pipeline for Data-Center Power

- 275-Mile Texas-to-Oklahoma Gas Pipeline Enters Open Season

- Enbridge Sees High Demand to Expand 593-Mile Canada-to-U.S. Gulf Oil Pipeline

- LNG Canada Start-Up Fails to Lift Gas Prices Amid Supply Glut

- Strike Pioneers First-of-Its-Kind Pipe-in-Pipe Installation on Gulf Coast with Enbridge

- Trump Claims Japan, U.S. to Form Joint Venture for Alaska LNG Exports

Comments