New Pipelines Connect West Texas Natural Gas-Producing Areas to Demand Markets

By U.S. Energy Information Administration

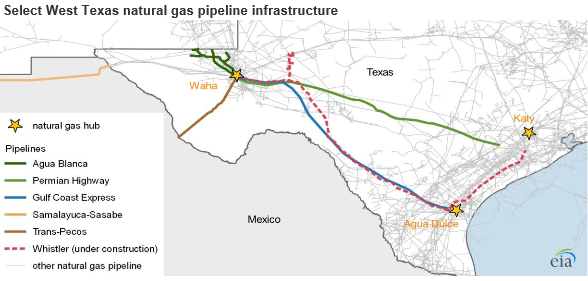

Recently completed pipeline projects in Texas and Mexico have increased natural gas transportation capacity from the Waha Hub — located near Permian Basin production activities in West Texas — to the U.S. Gulf Coast and Mexico. Since October 2020, two completed projects in Texas and two completed projects in Mexico have increased the Waha Hub’s connectivity to demand markets and, in turn, reduced the price difference between natural gas at the Waha Hub and the Henry Hub.

Recently completed projects include:

- Kinder Morgan’s 2.1 billion cubic feet per day (Bcf/d) Permian Highway Pipeline (PHP) entered service in January. It delivers natural gas from the Waha Hub to Katy, Texas, located near the Texas Gulf Coast, and also connects to Mexico.

- Whitewater/MPLX’s Agua Blanca Expansion Project entered service in late January. It connects to nearly 20 natural gas processing sites in the Delaware Basin and can move 1.8 Bcf/d of natural gas to the Waha Hub. By the third quarter of 2021, the project will likely expand to connect with the Whistler Pipeline to move an additional 2.0 Bcf/d of natural gas from the Permian Basin to the Texas Gulf Coast.

- Fermaca’s 0.9 Bcf/d Villa de Reyes-Aguascalientes-Guadalajara pipeline began commercial operations in October 2020. The pipeline, located in Central Mexico, is the final segment of the Wahalajara system, which connects the Waha Hub to Guadalajara and other population centers in west-central Mexico.

- Carso Energy’s 0.5 Bcf/d Samalayuca-Sásabe pipeline began commercial flows of natural gas in late January. The pipeline provides a more direct route for natural gas from the Permian Basin to northwest Mexico.

The additional takeaway capacity from these recently completed projects has contributed to a nearly 10% increase in U.S. pipeline exports to Mexico since last March. According to the latest Natural Gas Monthly, exports to Mexico totaled 5.9 Bcf/d in March 2021. Additional takeaway capacity has also helped increase the natural gas price at the Waha Hub, narrowing its price difference (also known as the basis) to the Henry Hub.

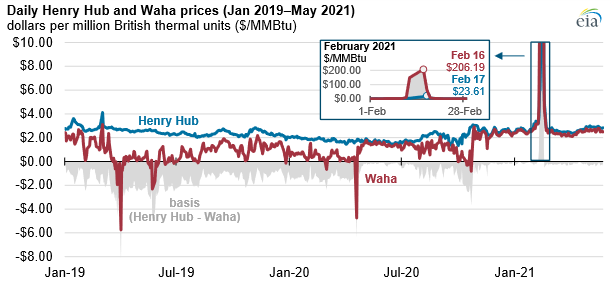

Over the past few years, constrained takeaway capacity in the Permian Basin kept Waha prices consistently at $1 per million British thermal units (MMBtu) or more below the Henry Hub price. The Waha-Henry Hub basis began narrowing in late October 2020. From March through May of this year, the Waha Hub price averaged $0.22/MMBtu less than the Henry Hub price, following a February cold snap in Texas that temporarily sent Waha prices to a record high.

Related News

Related News

- Kinder Morgan Proposes 290-Mile Gas Pipeline Expansion Spanning Three States

- Enbridge Plans 86-Mile Pipeline Expansion, Bringing 850 Workers to Northern B.C.

- Intensity, Rainbow Energy to Build 344-Mile Gas Pipeline Across North Dakota

- Tallgrass to Build New Permian-to-Rockies Pipeline, Targets 2028 Startup with 2.4 Bcf Capacity

- U.S. Moves to Block Enterprise Products’ Exports to China Over Security Risk

- U.S. Pipeline Expansion to Add 99 Bcf/d, Mostly for LNG Export, Report Finds

- A Systematic Approach To Ensuring Pipeline Integrity

- 275-Mile Texas-to-Oklahoma Gas Pipeline Enters Open Season

- LNG Canada Start-Up Fails to Lift Gas Prices Amid Supply Glut

- TC Energy’s North Baja Pipeline Expansion Brings Mexico Closer to LNG Exports

Comments