Added Transnational Oil Pipeline Capacity Could Reduce Crude Oil Shipped by Rail

By U.S. Energy Information Administration

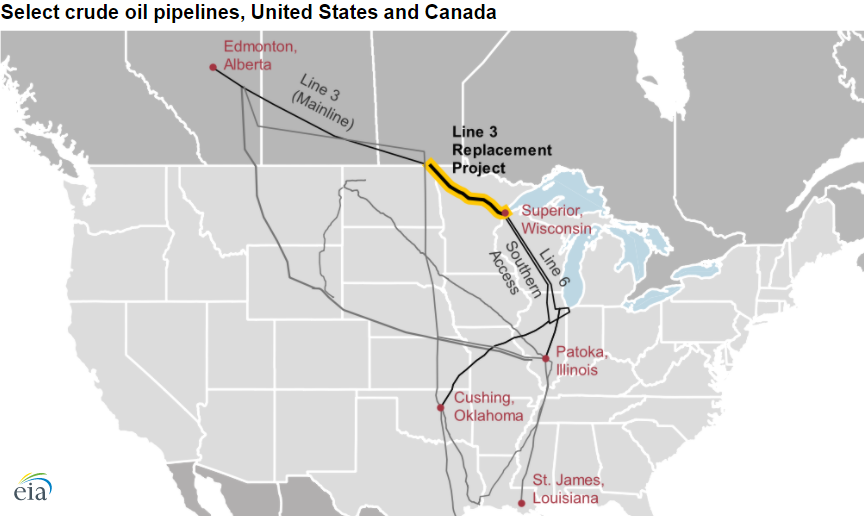

The Enbridge Line 3 replacement pipeline, which delivers crude oil from Edmonton, Alberta, in Canada to Superior, Wisconsin, became fully operational on October 1, 2021, increasing the pipeline’s capacity to 760,000 bpd. Before the replacement, Enbridge Line 3 had a capacity of about half that amount.

Because the Line 3 replacement project increases the capacity to import crude oil by pipeline from Canada, this pipeline could reduce the need to ship crude oil from Canada by other modes, especially rail.

U.S. crude oil imports from Canada have gradually increased over time and made up more than 60% of total U.S. crude oil imports in 2020. Most of this crude oil from Canada comes into the United States by pipeline. Importing crude oil from Canada by rail is often more expensive than by pipeline, but crude oil producers and shippers in Canada sometimes ship crude oil by rail because of its destination flexibility or because the pipeline capacity is insufficient to support all of the crude oil imports from Canada.

In late 2018 and early 2019, as much as 10% of Canada’s monthly crude oil exports to the United States arrived by rail. The portion of crude oil shipped by rail tends to increase when the price difference widens between crude oil in Canada and the United States.

Enbridge’s Line 3 replacement project could also lead to higher prices for the Western Canada Select (WCS) grade of crude oil that comes from Alberta relative to prices for West Texas Intermediate (WTI) crude oil priced at Cushing, Oklahoma. WCS sells at lower prices than WTI because of differences in crude oil quality and pipeline capacity constraints in Western Canada.

So far this year, WCS has been priced between $10 per barrel (b) and $18/b less than WTI. Although the price difference between these two crude oil types is affected by several factors, including refinery maintenance and crude oil inventory levels, the longer-term price difference could narrow because of the increased pipeline capacity.

Related News

Related News

- Kinder Morgan Proposes 290-Mile Gas Pipeline Expansion Spanning Three States

- Three Killed, Two Injured in Accident at LNG Construction Site in Texas

- Tallgrass to Build New Permian-to-Rockies Pipeline, Targets 2028 Startup with 2.4 Bcf Capacity

- TC Energy Approves $900 Million Northwoods Pipeline Expansion for U.S. Midwest

- U.S. Moves to Block Enterprise Products’ Exports to China Over Security Risk

- U.S. Pipeline Expansion to Add 99 Bcf/d, Mostly for LNG Export, Report Finds

- Enbridge Adds Turboexpanders at Pipeline Sites to Power Data Centers in Canada, Pennsylvania

- Great Basin Gas Expansion Draws Strong Shipper Demand in Northern Nevada

- Cheniere Seeks FERC Approval to Expand Sabine Pass LNG Facility

- Heath Consultants Exits Locate Business to Expand Methane Leak Detection Portfolio

Comments