Texas Pipeline Company Max Energy Purchases Southcross Gas Pipeline

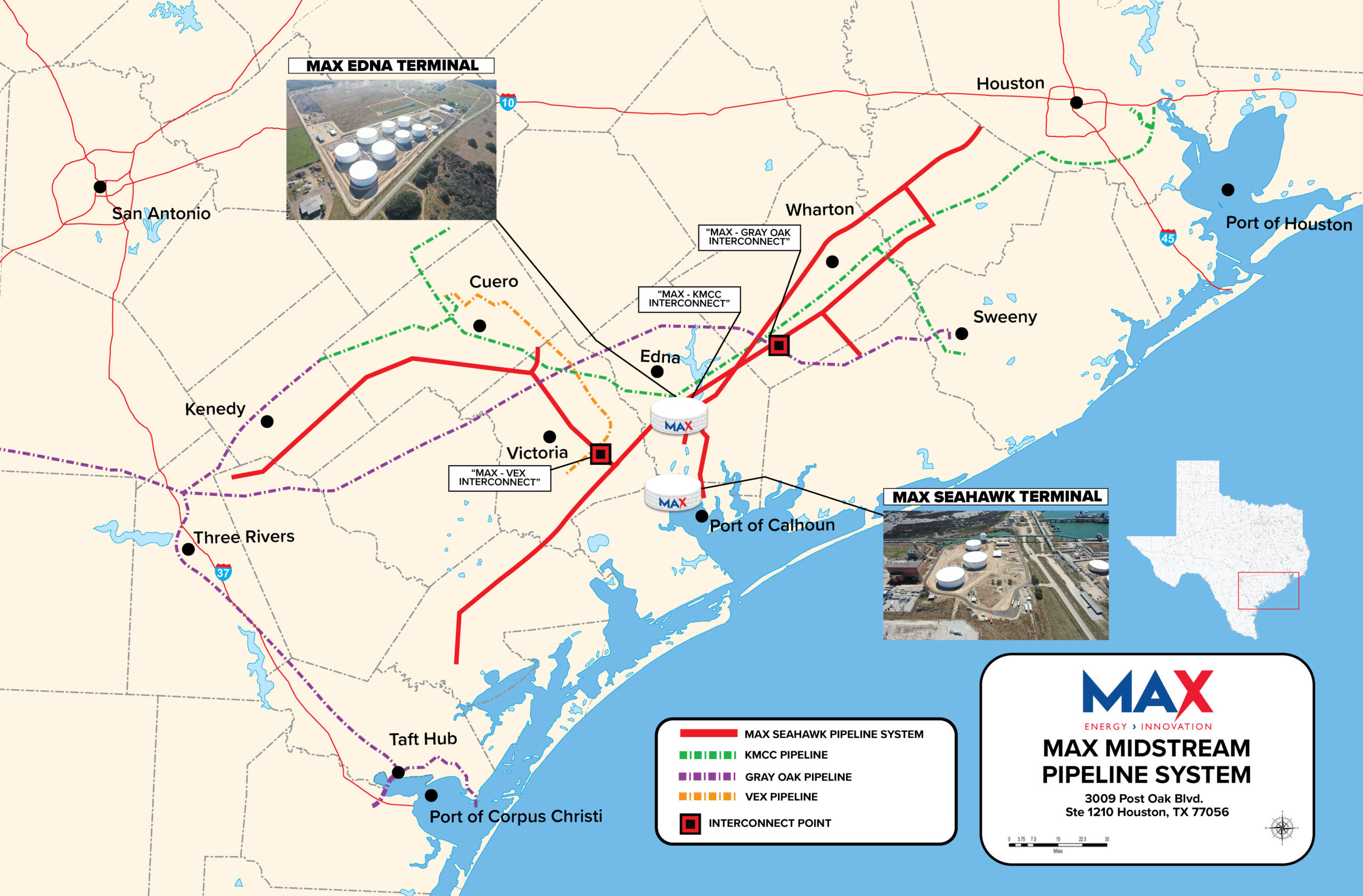

HOUSTON, TEXAS—Texas pipeline company Max Energy has purchased the Upper Gulf Coast Pipeline System from Southcross Gulf Coast Transmission Ltd., South Cross Gas Pipeline system, the company announced on Monday. This purchase will add another 328 miles of existing pipeline to the impressive collection of transportation, terminaling, and loading infrastructure Max is putting together on the Texas Gulf Coast.

“By purchasing the Southcross Gas Pipeline, Max Energy can now connect oil from all over the state to our Edna facility,” Todd Edwards, chairman at Max Energy, said. “We believe this will provide customers with alternatives to better optimize their crude oil movements and increase value throughout their supply chains.

Max Energy will immediately begin work on converting segment of the pipeline to crude operations. Before the end of the year, Max plans to have completed an interconnect with the Grey Oak Pipeline and the Victoria Express Pipeline, which will further expand access to growing crude production from the Permian and Eagle Ford basins.

Max is also developing plans to connect its growing pipeline system to both the Houston and Corpus Christi markets. This will provide customers with more options for crude movements. Ultimately, this will allow customers the ability to utilize the Port of Calhoun to better optimize their logistics compared to more congested ports. Max will be able to transport crude via pipelines between the major export ports of Houston, Corpus Christi and Calhoun including connected header systems in Edna, Three Rivers, Taft and Helena. And, Max will continue to develop all assets within the commitments of maintaining a carbon-neutral export facility.

Related News

Related News

- Kinder Morgan Proposes 290-Mile Gas Pipeline Expansion Spanning Three States

- Valero Plans to Shut California Refinery, Takes $1.1 Billion Hit

- Three Killed, Two Injured in Accident at LNG Construction Site in Texas

- Tallgrass to Build New Permian-to-Rockies Pipeline, Targets 2028 Startup with 2.4 Bcf Capacity

- TC Energy Approves $900 Million Northwoods Pipeline Expansion for U.S. Midwest

- U.S. Pipeline Expansion to Add 99 Bcf/d, Mostly for LNG Export, Report Finds

- Enbridge Adds Turboexpanders at Pipeline Sites to Power Data Centers in Canada, Pennsylvania

- Great Basin Gas Expansion Draws Strong Shipper Demand in Northern Nevada

- Cheniere Seeks FERC Approval to Expand Sabine Pass LNG Facility

- Heath Consultants Exits Locate Business to Expand Methane Leak Detection Portfolio

Comments