EIA: US Natural Gas Pipeline Exports to Mexico Reach Record High in May

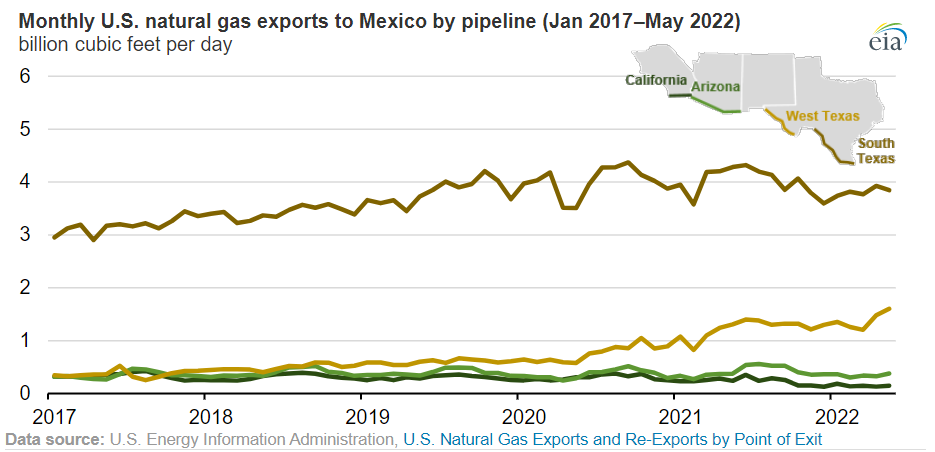

Natural gas pipeline exports from West Texas to Mexico averaged 1.6 billion cubic feet per day (Bcf/d) during May 2022—the most pipeline exports from West Texas on record, U.S. Energy Information Administration (EIA) data showed on Thursday.

Compared with 2021, U.S. pipeline exports from West Texas increased by 12% from January through May 2022 to average 1.4 Bcf/d.

U.S. natural gas pipeline exports from West Texas have grown steadily in recent years, doubling from 0.6 Bcf/d in 2019 to 1.2 Bcf/d in 2021 as more connecting pipelines in Central and Southwest Mexico have been placed in service in the past three years.

Natural gas flows from the Permian natural gas production areas in West Texas to Northwest, Central, and Southwest Mexico via the Chihuahua-to-Bajío corridor (including the Samalayuca-Sásabe pipeline system) and the Wahalajara system. The Wahalajara system connects the Waha Hub in West Texas to Guadalajara, Mexico’s second-most populous city. So far this year, exports from West Texas on the Samalayuca-Sásabe system have increased and displaced some U.S. pipeline exports from Arizona.

In Mexico, the electric power sector and (to a slightly lesser degree) the industrial sector has been leading growth in natural gas consumption in recent years. Much of this growth in natural gas consumption has been met by growth in pipeline imports from the United States.

The availability of relatively inexpensive natural gas from the United States has shifted Mexico’s natural gas supply mix. The share of Mexico’s natural gas supply met by pipeline imports from the United States grew from 61% in 2019 to 72% in 2021, but it has declined to 69% in the first seven months of this year as a result of rising U.S. natural gas spot prices, according to Wood Mackenzie.

Mexico increased its domestic natural gas production by 15% during the first seven months of 2022 compared with the same period in 2021. The recent increase in Mexico’s domestic production was driven primarily by the Quesqui and Ixachi production fields, which produce a higher proportion of dry natural gas. Recent improvements in drilling rigs’ operating efficiency have also contributed to rising natural gas production.

In addition to the decline in pipeline imports, LNG imports have fallen from over 7% of total supply in 2019 to less than 1% so far in 2022.

In the first five months of this year, U.S. natural gas pipeline exports from West Texas increased 12%, but exports from other U.S. regions declined compared with year-ago levels. Exports from South Texas decreased by 5% to average 3.8 Bcf/d, and combined exports from Arizona and California declined by 24% to average 0.5 Bcf/d. Total U.S. natural gas pipeline exports to Mexico have declined by 4% to average 5.7 Bcf/d over the same period.

Related News

Related News

- Kinder Morgan Proposes 290-Mile Gas Pipeline Expansion Spanning Three States

- Three Killed, Two Injured in Accident at LNG Construction Site in Texas

- Tallgrass to Build New Permian-to-Rockies Pipeline, Targets 2028 Startup with 2.4 Bcf Capacity

- TC Energy Approves $900 Million Northwoods Pipeline Expansion for U.S. Midwest

- U.S. Moves to Block Enterprise Products’ Exports to China Over Security Risk

- U.S. Pipeline Expansion to Add 99 Bcf/d, Mostly for LNG Export, Report Finds

- Enbridge Adds Turboexpanders at Pipeline Sites to Power Data Centers in Canada, Pennsylvania

- Great Basin Gas Expansion Draws Strong Shipper Demand in Northern Nevada

- Cheniere Seeks FERC Approval to Expand Sabine Pass LNG Facility

- Heath Consultants Exits Locate Business to Expand Methane Leak Detection Portfolio

Comments