Low-Carbon Hydrogen Pipeline Projects Could Reach 42 Million Tons Annual Capacity

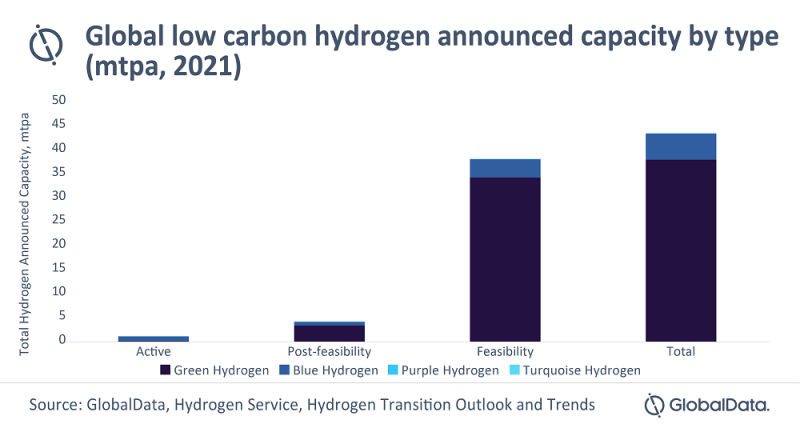

(P&GJ) — A large proportion of hydrogen pipeline projects in the feasibility phase brings the global low-carbon hydrogen project capacity to 42 million tons per annum (MMtpa), GlobalData announced.

This puts the global hydrogen energy transition market on track to becoming a major global energy source, the GlobalData report states, and positions 2022 as a crucial time for progressing final investment and construction decisions.

“Hydrogen is becoming popular as a low or zero-carbon energy source in demand segments such as energy storage, buildings, and transportation. Many countries have begun to consider a hydrogen-based economy to support decarbonization,” said Barbara Monterrubio, an energy transition analyst at GlobalData. “Green hydrogen presently has a small share in the hydrogen production mix but is poised to increase, given the ambitious targets announced by countries and companies.”

Green hydrogen is produced with renewable energy, making it climate neutral. Most active hydrogen capacity is made up of blue hydrogen, which is produced using natural gas, but most of the post-feasibility and feasibility phase projects are green hydrogen, GlobalData shows.

More than two thirds of the 42 MMtpa of upcoming capacity will come from the Former Soviet Union, Europe and Oceania, of which 87% and 12% comes from green and blue respectively, and less than 0.5% coming from purple and turquoise projects, according to GlobalData. Purple hydrogen is hydrogen produced with nuclear energy.

During the fourth quarter of 2021, 33 countries announced new low carbon hydrogen plants, with projects in Australia, Chile, and the US adding 3 MMtpa capacity to the global hydrogen pipeline.

“Countries in these regions are driving the use of hydrogen and are global leaders in hydrogen policy,” Monterrubio said. “They are also well-positioned to grow a hydrogen economy but will likely require imports to achieve their low carbon aims.”

Australia leads the upcoming capacity with more than 8 MMtpa across 90 green hydrogen hubs and projects, while North America and the Middle East lead in blue hydrogen capacity, the report states.

“This year is crucial for the sector as the first large scale projects look to reach the final investment decision (FID) stage and start construction,” Monterrubio said. “This is the case with the 2GW Saudi Neom green hydrogen project in Saudi Arabia, which has recently started engineering and procurement works, and is looking to start construction this year for completion in 2026.”

Related News

Related News

- Enbridge Plans 86-Mile Pipeline Expansion, Bringing 850 Workers to Northern B.C.

- Intensity, Rainbow Energy to Build 344-Mile Gas Pipeline Across North Dakota

- U.S. Moves to Block Enterprise Products’ Exports to China Over Security Risk

- 208-Mile Mississippi-to-Alabama Gas Pipeline Moves Into FERC Review

- Court Ruling Allows MVP’s $500 Million Southgate Pipeline Extension to Proceed

- U.S. Pipeline Expansion to Add 99 Bcf/d, Mostly for LNG Export, Report Finds

- A Systematic Approach To Ensuring Pipeline Integrity

- 275-Mile Texas-to-Oklahoma Gas Pipeline Enters Open Season

- LNG Canada Start-Up Fails to Lift Gas Prices Amid Supply Glut

- Kinder Morgan Gas Volumes Climb as Power, LNG Demand Boost Pipeline Business

Comments