New England Power Prices Jump to 4-Year High as Region Freezes

(Reuters) — United States power prices in New England for Tuesday jumped to their highest since January 2018 as homes and businesses cranked up their heaters to escape the region's coldest day of the winter.

Temperatures in Boston will only reach 16 Fahrenheit (-9 Celsius) on Tuesday before rising to a near-normal 39 F on Wednesday, according to AccuWeather.

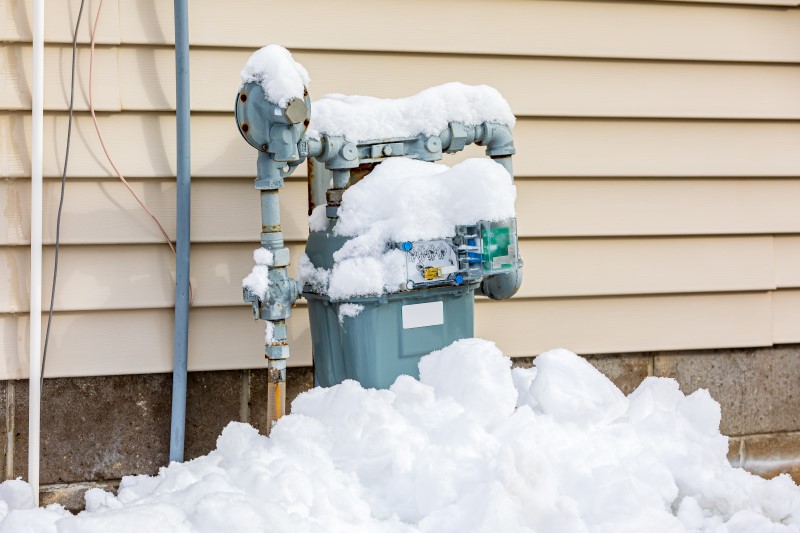

Since most New England homes and businesses use gas for heat and much of the region's electricity comes from gas-fired power plants, electric and gas prices usually soar during extremely cold weather.

Next-day power prices jumped to $186 per megawatt hour (MWh), their highest since January 2018.

That compares with $50.89 per MWh in 2021 and a five-year (2016-2020) average of $37.05.

Spot gas prices were also much higher than normal at $20.50 per million British thermal unit (MMBtu), but remained below last week's high of $24.47.

New England does not have enough gas pipeline capacity to supply all the fuel needed for both heat and power generation on the coldest days, so many gas-fired plants switch to more expensive oil and liquefied natural gas (LNG) when temperatures drop.

So far on Tuesday, the region's power generators were getting all the gas they needed and the grid operator, ISO New England, said the system was operating normally.

The ISO said it had 23,672 megawatts (MW) of power resources available to meet Tuesday's forecast peak demand of 20,200 MW.

About 42% of the power generated in New England Tuesday morning came from gas, 23% from nuclear, 16% from oil, 16% from renewables and 3% from coal.

That compares with 52% gas, 27% nuclear, 20% renewables and around 0% oil and coal on average in 2020.

During the coldest part of the winter of 2017/2018, oil generation reached 27% of the regional fuel mix.

Related News

Related News

- Kinder Morgan Proposes 290-Mile Gas Pipeline Expansion Spanning Three States

- Enbridge Plans 86-Mile Pipeline Expansion, Bringing 850 Workers to Northern B.C.

- Intensity, Rainbow Energy to Build 344-Mile Gas Pipeline Across North Dakota

- U.S. Moves to Block Enterprise Products’ Exports to China Over Security Risk

- Court Ruling Allows MVP’s $500 Million Southgate Pipeline Extension to Proceed

- U.S. Pipeline Expansion to Add 99 Bcf/d, Mostly for LNG Export, Report Finds

- A Systematic Approach To Ensuring Pipeline Integrity

- 275-Mile Texas-to-Oklahoma Gas Pipeline Enters Open Season

- LNG Canada Start-Up Fails to Lift Gas Prices Amid Supply Glut

- TC Energy’s North Baja Pipeline Expansion Brings Mexico Closer to LNG Exports

Comments