TC Energy Hikes 416-Mile Gas Pipeline Cost 70% to Nearly $9 Billion

(Reuters) — TC Energy Corp. said it expects its Coastal GasLink pipeline project to cost C$11.2 billion ($8.72 billion), nearly 70% higher than initially budgeted.

Shares of the pipeline operator were down 1.5% at C$69.46.

The long-delayed pipeline is expected to be integral to Canada's contribution to the global liquefied natural gas (LNG) market, which has seen demand surge as Europe and Asia seek alternatives to Russian energy imports.

TC Energy also said it has settled long-running disputes with LNG Canada, a consortium led by Royal Dutch Shell, over the project, adding the pipeline is about 70% complete and is expected to be in mechanical in-service by the end of next year.

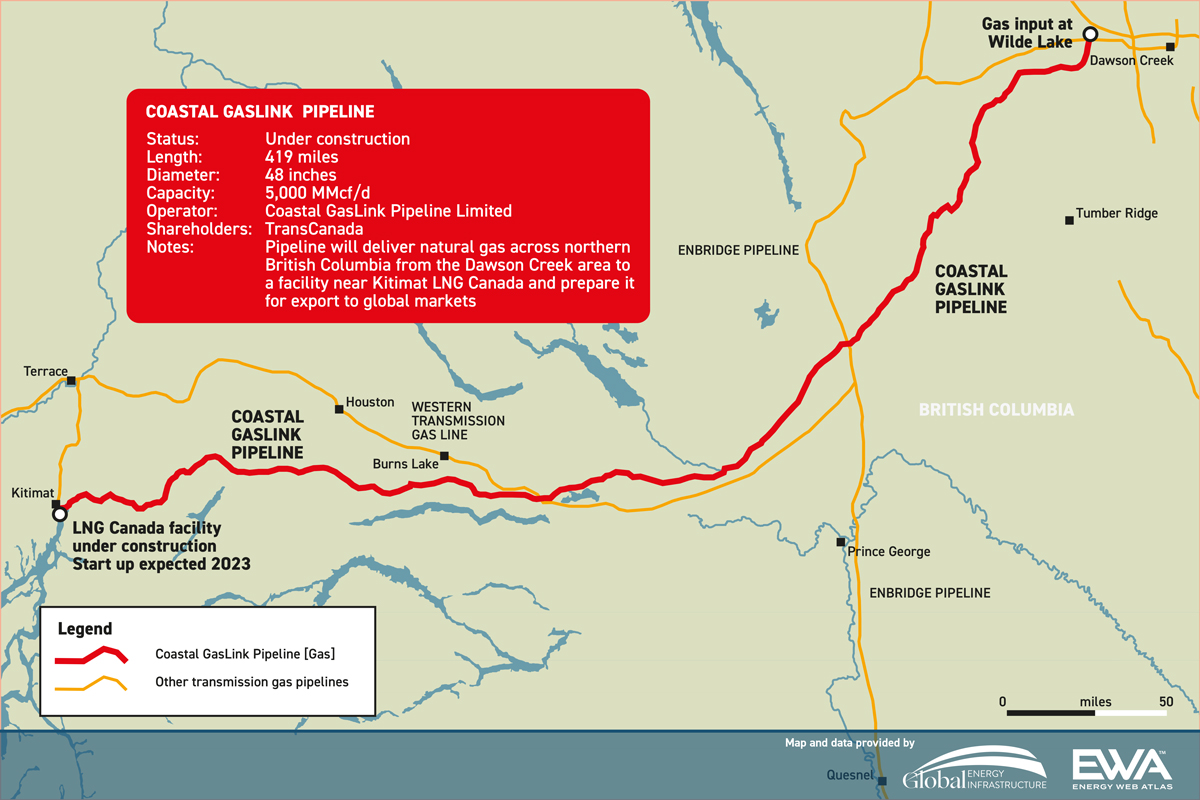

First announced in 2018, the 670-km (416-mile) Coastal GasLink pipeline is being built to transport natural gas to an LNG Canada facility at the west coast of British Columbia, Canada's first LNG export terminal.

However, the pipeline has faced COVID-19 delays as well as demonstrations from environmentalists and First Nations. TC Energy and LNG Canada have also quarreled over the project's cost and schedule.

In February, the company had said pipeline workers were attacked by masked assailants, who also damaged millions of dollars’ worth of equipment and construction trailers.

TC Energy on Thursday also raised its 2022 capital expenditures forecast to about C$8.5 billion, from a prior C$7 billion, as it will make equity contributions of about C$1.3 billion to Coastal GasLink this year.

The Calgary-based firm also said higher project costs are expected for the company's NGTL natural gas gathering and transportation system due to higher labor and materials costs.

Net income fell to C$889 million, or 90 Canadian cents a share, in the second quarter ended June 30, from C$975 million, or C$1, a year ago.

It posted comparable earnings of C$1 per share, beating estimates of 98 Canadian cents per share, according to Refinitiv data, but down from last year's C$1.06 a share.

($1 = 1.2849 Canadian dollars)

Related News

Related News

- Kinder Morgan Proposes 290-Mile Gas Pipeline Expansion Spanning Three States

- Three Killed, Two Injured in Accident at LNG Construction Site in Texas

- Tallgrass to Build New Permian-to-Rockies Pipeline, Targets 2028 Startup with 2.4 Bcf Capacity

- TC Energy Approves $900 Million Northwoods Pipeline Expansion for U.S. Midwest

- U.S. Moves to Block Enterprise Products’ Exports to China Over Security Risk

- U.S. Pipeline Expansion to Add 99 Bcf/d, Mostly for LNG Export, Report Finds

- Enbridge Adds Turboexpanders at Pipeline Sites to Power Data Centers in Canada, Pennsylvania

- Great Basin Gas Expansion Draws Strong Shipper Demand in Northern Nevada

- Cheniere Seeks FERC Approval to Expand Sabine Pass LNG Facility

- Heath Consultants Exits Locate Business to Expand Methane Leak Detection Portfolio

Comments